Israeli assets declined Tuesday as investors mulled a law passed in parliament that will weaken the power of judges and prompted hundreds of thousands of Israelis to protest in the streets.

The shekel slipped for a fourth day, dropping 1.7% to 3.7208 per dollar as of 12:52 p.m. in Tel Aviv, the biggest loss among some 150 currencies tracked by Bloomberg.

The benchmark stock index was down 1.6% on Tuesday, also the poorest performance in the world among primary indexes monitored by Bloomberg. The nation’s local currency bonds dropped, weakening by the most since February as of Monday’s close.

On Monday, Prime Minister Benjamin Netanyahu’s right-wing coalition scrapped a law that allowed judges to void ministerial decisions they considered “unreasonable,” effectively removing judicial oversight over elected politicians’ decisions.

The government says the reasonableness law is just the first step. It also wants to increase the ability of politicians to select judges and make it harder for the Supreme Court to overturn legislation. Opponents say such legislation undermines Israel’s democracy and could imperil its status as a magnet for tech investments.

Israel in ‘Twilight Zone’ as Investors Fret Over Judicial Law

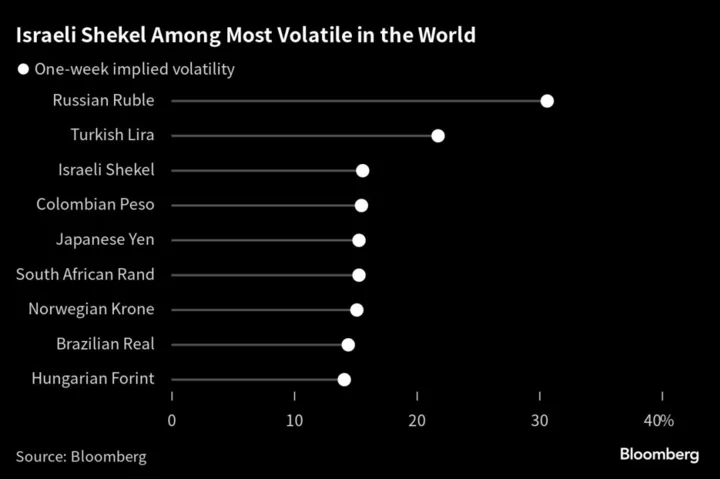

The shekel’s one-month implied volatility has jumped by the most in over a year in the past two sessions, rising to the highest since April 17. The one-week measure has spiked to make it among the top three in the world behind Russia’s ruble and Turkey’s lira.

Eimear Daly, a London based emerging-markets strategist at NatWest Markets, said that while investors were concerned about the potential for further moves by the coalition, the shekel may gain a reprieve because of the parliamentary recess beginning at the end of July. “Without any further tangible moves to further constrain the judiciary’s power, the shekel selloff will be limited,” she said.

Given its historically weak levels against the dollar, the shekel could stage a short-term recovery during the parliamentary break. But “further judicial reform likely means further ILS weakness,” Daly said.

(Adds comment from NatWest Markets strategist.)