Corporate bonds globally are on track for one of their worst weeks this year, hit by China’s escalating property crisis and rising defaults in the US as the Federal Reserve stays the course on interest rate hikes.

Yield premiums on Asian investment-grade dollar bonds are set to widen by more than 10 basis points this week, the most since the US banking turmoil in March, even as credit traders cited a smaller rise of 1 to 2 basis points Friday. Worldwide, corporate notes have lost 0.9% since the week began on a total return basis, and are headed for their worst week since May, a Bloomberg index shows.

Driving the credit selloff this week were sign of deepening housing woes in China, where a privately run giant developer risks an imminent bond default and its state-owned peers have warned of widespread losses. The hawkish message from the Fed’s latest policy meeting and growing concerns about delinquencies among weaker US firms also soured investor mood.

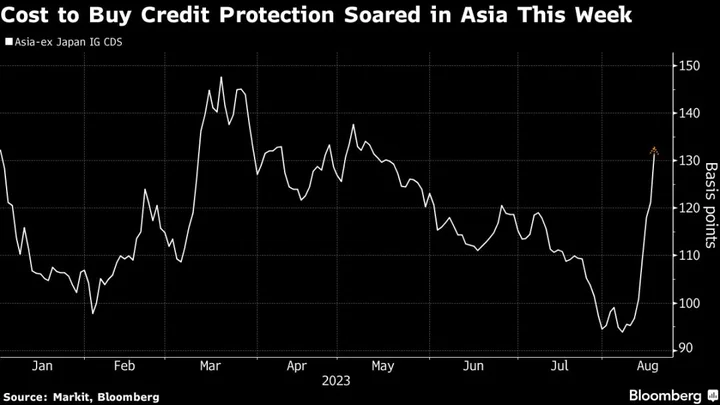

The cost to insure against default for high-grade issuers in Asia ex-Japan rose another 2 basis points Friday, according to traders, putting a Markit index on track for its seventh straight session of gains, the longest such streak since March. If the current level holds, the gauge would rise by about 33 basis points this week, the biggest such move in 11 months.

In North America, CDS tracking speculative-grade issuers are poised for their biggest blowout in eight weeks, a separate Markit index shows. Goldman Sachs Group Inc. credit strategists including Lotfi Karoui wrote in a report Thursday that the notional amounts of both defaulted debt in US high-yield bonds and leveraged loans so far this year had already exceeded 2022’s totals.