India, the world’s most polluted country after Bangladesh, has a truck-sized problem to tackle if it wants to meet its climate goals: a greener commercial fleet in order to limit emissions that account for a third of the nation’s dirty vehicle smoke.

It’s an opportunity Ashok Leyland Ltd., Asia’s fourth-largest truckmaker, is keen to pounce on.

“You will start seeing, over the next six to 12 months, the first set of our battery electric vehicles coming into the field,” Chief Technology Officer N. Saravanan said in an interview earlier this month. The company won’t have a “big bang launch that says it’s going EV,” but will roll out multiple models in small volumes, he said.

Last month, Ashok Leyland announced plans to build autonomous electric trucks for Indian ports. It’s also partnering with Adani Enterprises Ltd. and Reliance Industries Ltd. to launch hydrogen fuel cell vehicles, and is investing 12 billion rupees ($146 million) in its electrical vehicle subsidiary Switch Mobility. “You’ll see continued seeding and development of hydrogen internal combustion engines with Reliance,” Saravanan said.

India, the world’s fifth-largest economy, depends on roads to transport 70% of its goods. With increasing urbanization and growing consumer demand, the number of trucks needed is expected to more than quadruple by 2050, raising climate concerns. Yet the shift to cleaner vehicles won’t be easy — the higher price of electric versus diesel trucks and a lack of charging infrastructure are large impediments, particularly for the small fleet operators who own most of India’s trucks.

“They disproportionately contribute to climate change,” said Samhita Shiledar, manager at US-based clean energy think tank RMI’s India program. “The scale of opportunity is very high” considering the industry is the “biggest decarbonization attempt India has right now” to meet its climate goals.

India has pledged to cut emissions to net zero by 2070. It has also committed to reducing the emissions intensity of its gross domestic product by 45% by 2030. Widespread zero-emission truck adoption could reduce annual trucking carbon fumes by almost half by 2050, according to RMI.

India’s largest truckmaker, Tata Motors Ltd., which already has a small electric truck on the market, unveiled several long-range prototypes in January. China’s BYD Co. has reportedly shipped several trucks to the Adani group for its ports. Startups such as InfraPrime Logistics, Olectra Greentech Ltd., and Triton EV have all announced they are developing electric models.

On Wednesday, 15 companies including Amazon.com Inc., Nestle SA and India’s Aditya Birla Group joined forces to advance the electrification of the nation’s truck fleet, announcing several pilot projects and signaling demand for more than 7,700 e-trucks by 2030.

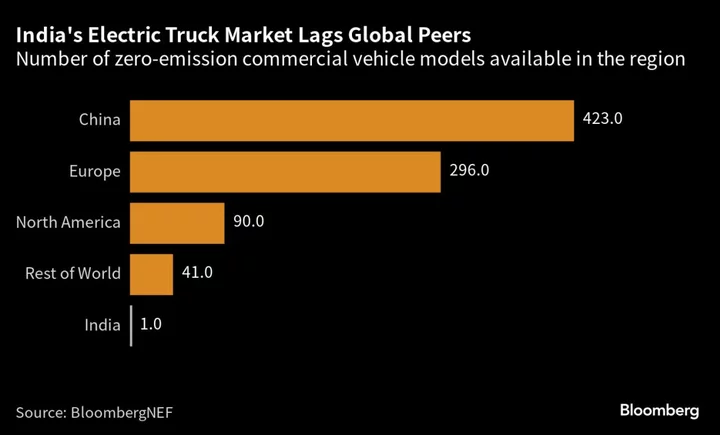

While the potential is large, the existing market is tiny. China and parts of Europe saw electric van and truck sales double in 2022 from a year earlier, according to data analysed by BNEF. India, on the other hand, has only a fraction of raw materials needed to fulfill the demand for batteries and has only recently launched a pilot project for hydrogen-based vehicles.

Moreover, the vast nation has just one charger for every 135 electric vehicles, while the global average stands at one charger around 20 EVs. With no standard charging technology and most infrastructure in India catering to two and three-wheelers, it may be some time before truckers are willing to abandon their diesel fueled vehicles.

The upfront cost of an electric truck is also higher than a diesel truck — even though operating costs are lower — another factor deterring new buyers. Manufactures may therefore need to look for new ways to sell their models.

“The market is evolving from purely ownership-based models more toward leasing and financing and looking for innovative ways of structuring the purchase,” said Rahul Mishra, partner at global consulting firm Kearney Inc.

Overcoming those hurdles needs more investment, which will only come with increased demand for electric trucks.

“It is almost like a chicken and egg problem,” said Maynie Yun Ling Yang, a commercial transport analyst at BloombergNEF. But government subsidies, regulations, and corporate sustainability mandates are key for the clean jump, she says.

India is one of the countries where sales of large trucks are forecast to increase the most globally between 2023 and 2040 according to BNEF. This has stakeholders calling for policies to boost the production of clean trucks.

And while the national government has a 100 billion rupee subsidy program to boost uptake of two- and three-wheelers, passenger cars and electric buses, and Indian states have separate EV policies, none include truck-related guidelines.

Organizations like the International Council for Clean Transportation are pushing for change.

“There is a global shift away from internal combustion engines,” said Amit Bhatt, the India head of ICCT. “But you need someone to stimulate demand.” The best agency to do so is the government, he said.

Some of his suggestions are to focus incentives on trucking operations within Delhi to maximize air quality benefits, encourage the deployment of high-powered charging infrastructure to generate interest from private businesses, and exempt these vehicles and manufacturers from some of the many taxes levied in the state.

Falling technology costs and government support point to a rapid expansion of clean truck sales in coming years.

“It’s only a matter of time before we catch up,” said Ashok Leyland’s Saravanan. “We’re not not that far behind.”

(Adds industry taskforce in ninth paragraph.)