Germany has been Europe’s economic engine for decades, pulling the region through one crisis after another. But that resilience is breaking down, and it spells danger for the whole continent.

Decades of flawed energy policy, the demise of combustion-engine cars and a sluggish transition to new technologies are converging to pose the most fundamental threat to the nation’s prosperity since reunification. But unlike in 1990, the political class lacks the leadership to tackle structural issues gnawing at the heart of the country’s competitiveness.

“We’ve been naïve as a society because everything seems fine,” BASF SE Chief Executive Officer Martin Brudermüller told Bloomberg. “These problems we have in Germany are accumulating. We have a period of change ahead of us; I don’t know if everyone realizes this.”

While Berlin has shown a knack for overcoming crises in the past, the question now is whether it can pursue a sustained strategy. The prospect looks remote. Chancellor Olaf Scholz’s make-shift coalition has reverted to petty infighting over everything from debt and spending to heat pumps and speed limits as soon as the risks of energy shortfalls eased.

But the warning signals are getting hard to ignore. Despite Scholz telling Bloomberg in January that Germany would ride out Russia’s energy squeeze without a recession this year, data published Thursday show that the economy has in fact been contracting since October and has only expanded twice in the past five quarters.

Read More: Germany Endures First Recession Since Covid on Consumer Weakness

Economists see German growth lagging behind the rest of the region for years to come, and the International Monetary Fund estimates Germany will be the worst-performing G-7 economy this year. Nonetheless, Scholz again sounded upbeat.

“The prospects for the German economy are very good,” he told reporters in Berlin after the latest economic data. By unlocking market forces and cutting red tape, “we are solving the challenges that face us.”

The risk is that the latest numbers aren’t a one-off, but the sign of things to come.

Germany finds itself ill-suited to sustainably serve the energy needs of its industrial base; overly dependent on old-school engineering; and lacking the political and commercial agility to pivot to faster-growing sectors. The array of structural challenges points to a cold awakening for the center of European power, which has become accustomed to uninterrupted affluence.

To its credit, industrial behemoths like Volkswagen AG, Siemens AG and Bayer AG are flanked by thousands of smaller Mittelstand companies, and the country’s conservative spending habits put it on a stronger fiscal footing than its peers to support the transformation ahead. But it has little time to waste.

The most pressing issue for Germany is getting its energy transition on track. Affordable power is a key precondition for industrial competitiveness, and even before the end of Russian gas supplies, Germany had some of the highest electricity costs in Europe. Failure to stabilize the situation could transform a trickle of manufacturers heading elsewhere into a stampede.

Berlin is responding to concerns by seeking a cap on power prices for some energy-intensive industries like chemicals through 2030 — a plan that could cost taxpayers as much as €30 billion ($32 billion). But that would be a temporary patch, and shows Germany’s desperate situation in terms of supply.

After shutting its last nuclear reactors this spring and pushing to phase out coal as soon as 2030, the country installed around 10 gigawatts of wind and solar capacity last year — half the pace it needs to hit climate targets.

Scholz’s administration aims to hook up roughly 625 million solar panels and 19,000 wind turbines by 2030, but promises to accelerate the rollout to months from years have yet to bear fruit. Meanwhile, demand is expected to surge due to the electrification of everything from heating and transportation to steelmaking and heavy industry.

“We have to think about which kinds of industries can deal with a higher energy price and which not, and then focus on the future,” Siemens Chief Executive Officer Roland Busch said in an interview with Bloomberg TV.

The bitter reality is that resources for generating that much clean power are limited in Germany by its relatively small coastline and lack of sun. In response, the country is looking to build a vast infrastructure to import hydrogen from the likes of Australia, Canada and Saudi Arabia — banking on technology that hasn’t been tested at this scale.

Read More: Hydrogen Hype Is Raging But Can’t Lure Investment to Europe

At the same time, Germany will need to speed the construction of high-voltage grids linking wind farms off the coasts in the north to power-hungry factories and cities further south. And there’s little in the way of storage to ensure the country can withstand disruptions.

“Germany needs cross-party agreement on the speed of expansion of renewable energy infrastructure,” said Claudia Kemfert, professor of energy economics at the DIW research institute in Berlin. After the next national election in 2025, “other political constellations could stall the energy transition again. That would not be good for Germany as a place of business.”

Sputtering Innovation

Europe’s powerhouse economy looks like it has a well-funded and established system to generate ideas to keep its economy on the cutting edge. Spending on research and development is the fourth-highest in the world behind only the US, China and Japan. Around a third of patents filed in Europe come from Germany, according to data from the World Patent Office.

Much of the innovation power though is embedded in big companies like Siemens and Volkswagen, and focused around well-established industries. While small manufacturers still thrive, the number of new startups is declining in Germany — in contrast to growth seen in other developed economies, according to the OECD.

The reasons include excess bureaucracy — company registrations often taking place in paper form — and a cultural aversion to risk. Financing is also an issue. Venture-capital investment in Germany totaled $11.7 billion in 2022 compared with $234.5 billion in the US, according to DealRoom. Germany also labors under a ponderous academic system and doesn’t have a single university in the top 25 of the latest Times Higher Education ranking.

Patent data shows that Germany’s ability to stay at the forefront is fading. In 2000, the country was among the top three for world-class patents in 43 of 58 key technology categories, but in 2019, it achieved that rank in fewer than half the number of areas, according to a recent study by the Bertelsmann Stiftung.

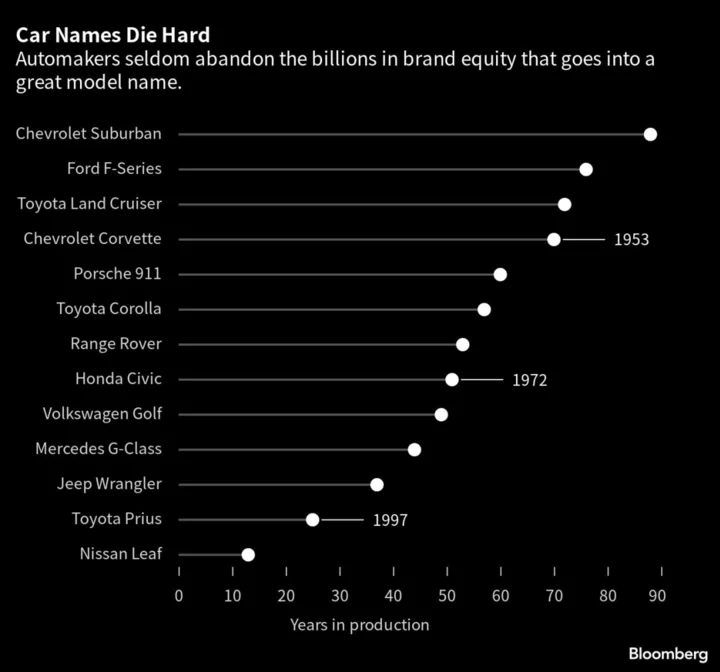

Nowhere is Germany’s disappearing technological edge more obvious than in the auto sector. While brands like Porsche and BMW defined the combustion-engine era, Germany’s electric cars have struggled. BYD Co. overtook VW to become the best-selling car brand in China last quarter. Key to its push was an electric model that costs around a third of VW’s ID3, but offers greater range and connectivity with third-party applications.

Much of Germany’s wealth and social order rest on a vibrant manufacturing sector that provides well-paid blue-collar jobs. But that strength has led to dangerous dependencies on overseas markets for orders and raw materials — above all China. Like other democracies in the aftermath of Russia’s invasion of Ukraine, Berlin is now trying to unwind its reliance on the Asian superpower, but Germany’s biggest companies aren’t paying heed.

Read More: German Bosses Defy Scholz’s Plea to Shift Away From China

There are two key areas where Germany punches well below its weight and could be ripe for broadening out its economy: finance and technology.

Much of Germans’ money is held by a network of around 360 public-sector savings banks, so-called Sparkassen. These institutions are controlled by local communities, raising potential conflicts of interest while also diluting the country’s financial muscle.

Read More: How Germany’s Little Savings Banks Threaten Big Financial Woes

Germany’s two biggest listed banks — Deutsche Bank AG and Commerzbank AG — have been mired in controversy for years, and while they’re on the mend, they’re still undersized compared to Wall Street peers. Their combined market capitalization is less than a tenth of JPMorgan Chase & Co.’s.

In technology, Germany’s biggest player is SAP SE, which dates from the 1970s and makes complex software that helps companies manage their operations. There’s little in the way of new national champions on the horizon. Digital payments company Wirecard AG briefly filled that role before collapsing in a sensational accounting scandal.

The prerequisites aren’t promising. Germany’s lack of investment is particularly acute in digital technology. Despite infrastructure that had it ranked 51st in the world for fixed-line Internet speeds, it had the fourth-lowest spending among OECD countries relative to the economy’s size.

Read More: Underground Tangle of German Wires Drags $1 Trillion Green Push

“Years of underinvestment has left Germany lagging,” Jamie Rush, chief European economist for Bloomberg Economics. “Berlin will need to spend more and make it easier for infrastructure projects to get off the ground.”

To accelerate a long-delayed rollout, Scholz’s administration unveiled a plan to overhaul the planning process for installing fiber-optic cables and mobile communication infrastructure.

Germany needs to address its issues with a long-term program, but that looks questionable. Scholz won the chancellery with the lowest level of support in the postwar era as voters ditched the tradition of handing a clear mandate to either the Social Democrats or the Christian Democrat-led conservative bloc.

With Scholz’s messy three-way coalition racked with bickering, Germany is poised for instability, and the far-right Alternative for Germany has seized on the political vacuum, vying for second in some polls.

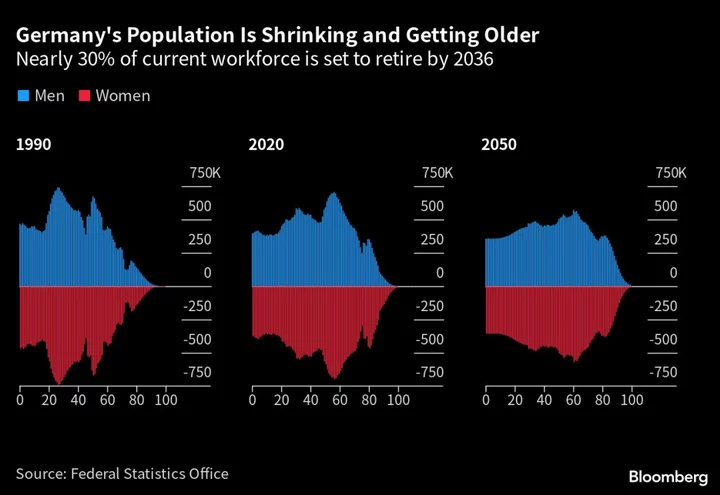

Fragmentation risks intensifying as the population ages, pitting comfortable pensioners against young people worried about their futures. The tensions have sparked disruptive protests, and authorities this week searched 15 properties across Germany in connection with an investigation against a group of climate activists.

Germany’s industrial base is already feeling the pinch of its demographic shift. Recent surveys have found 50% of firms cut output due to staffing problems, costing the economy as much as $85 billion per year.

This year, more than 1 million Germans will reach retirement age — about 320,000 more than those becoming adults. By the end of the decade, the German employment agency says the shortfall will rise to as much as 500,000 — roughly equivalent to the city of Nuremberg, adding to the strains on the economy.

Read More: Scholz Tested by Migration Influx and Mass Worker Shortage

In a recent report, the OECD put the scale of the challenges in stark terms: “No major industrialized economy has ever had the very basis of its competitiveness and resilience so systematically challenged by changing social, environmental and regulatory pressures.”

That in turn will ripple across the entire continent, according to Dana Allin, a professor at SAIS Europe. “The health of the German economy is crucial for the broader European economy, and the bloc’s harmony and solidarity,” he said.

--With assistance from Petra Sorge, Josefine Fokuhl, Iain Rogers, Michael Nienaber and Oliver Crook.