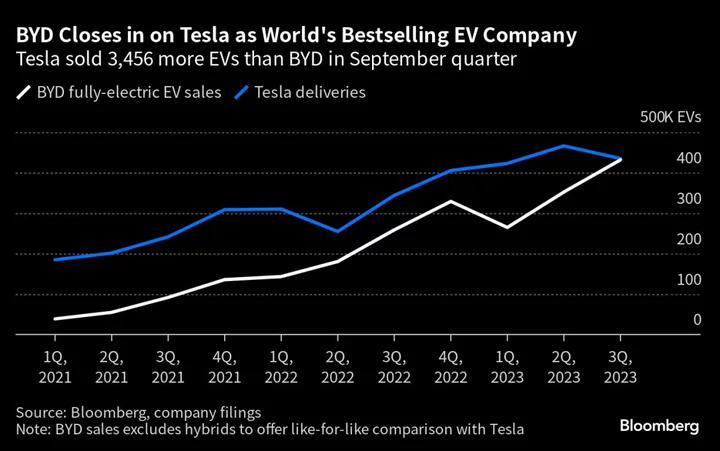

BYD Co. is poised to overtake Tesla Inc. as the world’s biggest seller of electric vehicles as the Chinese automaker’s global sales push gains greater traction.

China’s best-selling car brand came within a whisker of toppling Tesla last quarter after factory downtime led to the US automaker’s first delivery decline in more than a year.

BYD sold 431,603 fully-electric vehicles in the three months ended Sept. 30, up 23% from the second quarter. Tesla shipped 435,059 cars globally in the quarter — with the 3,456 gap between the two the narrowest yet.

“BYD will sell more fully electric passenger vehicles than Tesla in the fourth quarter,” said Taylor Ogan, chief executive officer of Shenzhen-based hedge fund Snow Bull Capital, which owns shares in both automakers.

Shares in BYD fell as much as 3.6% in Hong Kong on Tuesday morning, mirroring broader declines in the Hang Seng Index, which hit its lowest intraday level since November 2022. Other Chinese EV makers like Li Auto Inc. and Geely Automobile Holdings Ltd. also declined.

Including hybrids, Shenzhen-based BYD sold a total 822,094 vehicles for another record quarter, helping it cement its lead as China’s best-selling car brand.

Known for selling affordable cars to the masses, BYD has made progress in broadening its appeal, aiding its sales surge. The company has added two luxury EV brands, Yangwang and Fang Cheng Bao, to penetrate the 1 million-yuan ($137,000) price category, more than double some of its earlier higher-end vehicles. It also pushed two cheaper models, the Seagull and Dolphin, to undercut its rivals.

Growing exports are also aiding the company, which also makes its own batteries and semiconductor chips, as it eyes a larger chunk of overseas sales to supplement its dominance in China.

Exports accounted for 9% of BYD’s third-quarter sales, up from 5% the previous quarter, according to Bloomberg Intelligence analyst Joanne Chen.

“This will be a key volume driver next year as BYD expands its global presence with more new EVs,” she said.

Both BYD and Tesla, however, are under scrutiny from European officials, who have launched an investigation into Chinese subsidies for EVs, which they claim put European automakers at a disadvantage.

Tesla’s deliveries missed estimates by around 20,000 units as it prepared its factories to make a refreshed Model 3 sedan and the yet-to-be-released Cybertruck. Still, Elon Musk’s company affirmed its annual target to sell 1.8 million vehicles. BYD remains on track to sell around 3 million vehicles, including hybrids.

The automaker also reintroduced its base Model Y crossover sport utility vehicle with rear wheel drive in the US market at a lower price, after it fell short of Wall Street delivery estimates. Tesla also made some tweaks to its Model Y in China, though left the price unchanged.

(Adds analyst comment in fourth paragraph.)