UK household spending is holding up better than expected partly because returns on savings are rising faster than the cost of mortgages.

Analysis of Bank of England data by Bloomberg may help explain why Governor Andrew Bailey and his colleagues are struggling to tame the highest inflation rate among Group of Seven economies. Households are in aggregate around £10 billion ($12.7 billion) a year better off as a result of higher rates.

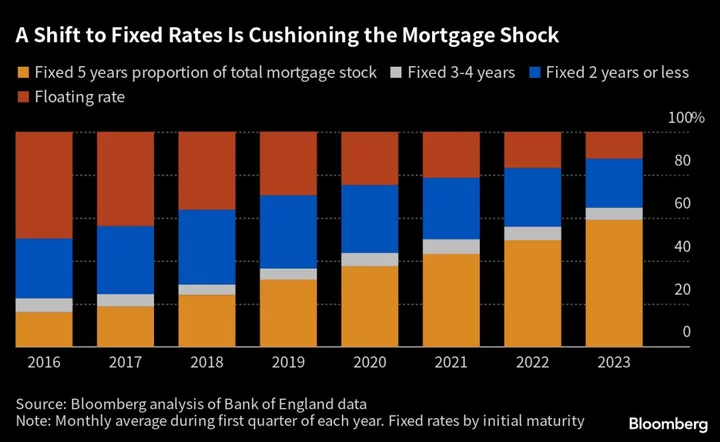

The dynamic may be complicating the transmission of monetary policy, which works largely by suppressing household spending power. The impact of rate rises on homeowners is being delayed because so many are on fixed rates that have yet to expire.

“The effective interest rate on the stock of bank deposits has risen more quickly than the effective rate on the stock of debt, because over 85% of the stock of mortgages is fixed-rate,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

At current interest rates, savers collectively are earning £24 billion more a year than in November 2021, a month before the BOE began the most aggressive rate-hiking cycle since the late 1980s. Mortgage borrowers are paying £14 billion more in debt interest.

Anecdotal evidence also suggests that in aggregate consumers are net beneficiaries at the moment. Respondents to GfK’s June consumer confidence barometer said their personal finance situation had improved sharply last month, despite the surge in mortgage rates.

However, the reprieve for homeowners will be short lived. Resolution Foundation, a think tank, has warned of a £5 billion mortgage crunch next year as around 1.5 million fixed deals come to an end.

The data suggests interest rates may not be as effective a monetary policy tool as they were in 2008, when the stock of mortgage debt was considerably larger than bank deposits. Now the reverse is true after savers added around £200 billion to their accounts during the pandemic when opportunities to spend were limited.

“The income effect over the next year is probably positive,” said Simon Ward, economic adviser to Janus Henderson Investors. While some households will be in financial distress due to rate rises, others - including the wealthy and many pensioners — will be better off.

Ward added that higher rates also discourage spending by promoting saving, and that overall spending could still be lower as the impact on borrowers tends to be larger than on savers. Savers on the best deals cannot access their cash for a fixed period but may be willing to spend other income due to the wealth effect of better returns.

‘Pitiful’

The average mortgage rate on the stock of loans has risen from 2% in December 2021 to 2.82%. However, new 2-year fixed mortgage deals can cost over 6%. Fixed rates on savings have risen from under 1% to over 3%.

Martin Lewis, the consumer champion and MoneySavingExpert.com founder, has attacked banks for ripping off customers by failing to pass on rate rises to easy access accounts.

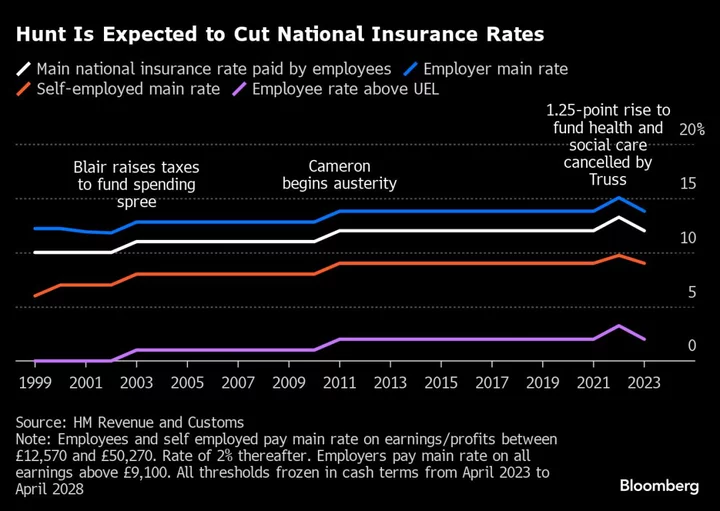

“Some big banks pay under a pitiful 1% while most people should be earning at least 4%,” he said last week. Chancellor Jeremy Hunt has now ordered banks to pass on rates to instant access savers.

Separate analysis by Deutsche Bank shows that British households have barely dipped into the savings they tucked away during Covid lockdowns. While households in most of the developed world have been running down excess savings — the amount over and above pre-pandemic levels — those in Britain have maintained theirs and are now generating bigger returns on their stockpiles.

UK excess savings climbed to over 11% of GDP by the end of last year. By contrast, households in the US have completely depleted their stockpiles.

--With assistance from Andrew Atkinson.