A Labour-led government after the next UK election would be the best result for stocks and the pound, according to a new Bloomberg survey that shows the ruling Conservatives have failed to win back the faith of global investors a year after Liz Truss’s disastrous mini-budget.

About two-thirds of finance professionals said an outright win for Keir Starmer’s center-left party or a Labour-led coalition would be the “most market-friendly outcome,” a stinging verdict on a Tory party that’s long considered itself the natural partner of business and finance.

Despite Prime Minister Rishi Sunak’s efforts to steady the economic ship since replacing Truss last year, 80% of the 227 Markets Live Pulse survey participants — who identified themselves as portfolio managers, traders and retail investors — said confidence in UK assets hadn’t fully recovered.

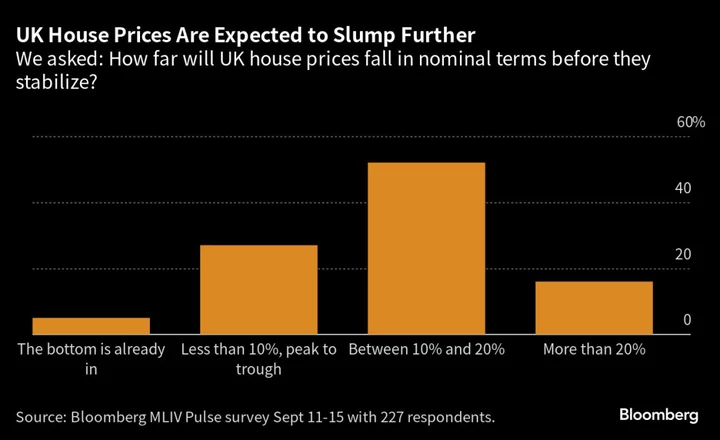

UK borrowing costs spiraled during Truss’s short-lived reign after she promised to slash taxes without cutting spending. Part of the legacy is higher mortgage rates for Britons, and most survey respondents predicted house prices would fall 10%-20% or even more. Investors also expect the country’s bond yields, which reflect its borrowing rates, to stay higher than those of US Treasuries for years.

“Markets tend to conclude that Tories are better managers of the economy but now you’ve had a situation where they’ve managed the finances pretty badly,” said George Buckley, chief European economist at Nomura.

The Conservatives’ poor poll showing is a stark contrast to the last election in 2019, when Boris Johnson won a big majority against former Labour leader Jeremy Corbyn, a hard-left socialist who backed nationalizations and worker stakes in companies. The pound and UK stocks surged as investors cheered Corbyn’s defeat.

Since then, Starmer has softened his industrial policies and courted the City of London, maneuvering Labour back toward the pro-business agenda of ex-leader Tony Blair, who won three elections from the center ground.

The Tories’ reputation for sound economic stewardship has also been damaged by Brexit, and Johnson’s blunt dismissal of business fears about the price of quitting Europe’s single market.

Sunak — a former hedge fund worker and banker at Goldman Sachs Group Inc. — has worked hard to rebuild bridges with business and the European Union, and to soothe markets with budgetary constraint. But the scars left by Truss, Brexit and Johnson run deep.

After last September’s mini-budget, sterling slumped to an all-time low against the dollar and gilt yields surged. Yields are still elevated relative to peers. While that largely reflects stickier inflation in the UK, it gives Labour an opening to attack Conservative competence.

Housing Slump

Sunak is battling a Labour lead in the election polls of up to 20 percentage points, reflecting an economy battered by Brexit trade barriers, a cost-of-living crisis and soaring rates.

The support of homeowners, often a Conservative strength, will be a key battleground in an election that’s widely expected next year. UK house prices have fallen by about 5% from a year ago, according to Nationwide data.

More than half of respondents to the Bloomberg survey expect prices to fall 10%-20% from peak to trough. That’s gloomier than most analysts. Niraj Shah at Bloomberg Economics forecasts a drop of 10%; research consultancy Capital Economics opts for 10.5%.

A strong labor market and the robust finances of many mortgaged homeowners have prevented a more drastic correction. However, the surging cost of credit has pushed transactions sharply lower and hundreds of thousands of homeowners will face a payment shock when they come to refinance their existing cheap, fixed-rate mortgages.

Labour Rebrand

Starmer, meanwhile, has been courting the business and finance elite in a campaign similar to Blair’s “prawn cocktail offensive,” named after the appetizer served at receptions for executives ahead of 1997’s landslide win.

Since replacing Corbyn, Starmer has scrapped his nationalization program. He and his pick for chancellor Rachel Reeves have schmoozed at Davos, pitched Tory donors for support and wooed private equity firms.

Reeves, a former Bank of England economist, promises a more interventionist approach from government, targeting growth in key industries such as life sciences. She’s ruled out wealth taxes and promised to cut regulations.

Andrew Cooper, an ex-Tory pollster who’s now helping Labour, said the party’s biggest risk “is the public decides their economic plans are unsustainable.” Labour are being so careful to project a message of economic competence that it’s like carrying “a Ming vase across a polished dance floor,” he added. “They’ve a huge lead but don’t want to say anything that screws it up.”

Stocks Lagging

The Bloomberg poll also found that about three-quarters of investors see the blue-chip FTSE 100 stock-market index continuing to lag the global market in 2024. “We’ve been hearing that the UK is cheap for years now,” said one respondent. “Maybe some large, mature economies just lose their mojo and will always be cheap?”

The MLIV Pulse survey of Bloomberg News readers on the terminal and online is conducted weekly by Bloomberg’s Markets Live team, which also runs the MLIV blog. Tune in this Wednesday for an Instant MLIV Pulse survey after the Federal Open Market Committee meeting.

Author: Greg Ritchie, Philip Aldrick and John Stepek