Why France's Emmanuel Macron is courting Central Asia

Uranium is of interest to Paris, unsure about its supply of the fuel after a coup in Niger in July.

2023-11-02 02:45

3 stars the 76ers should pursue after the James Harden trade

The Philadelphia 76ers now have the assets available to them to acquire a third star to pair with Joel Embiid and Tyrese Maxey after the James Harden trade.

2023-11-02 02:15

Davante Adams gets an even bigger gift after Raiders oust McDaniels

Las Vegas Raiders wide receiver Davante Adams had been vocal about his lack of targets this season under head coach Josh McDaniels. With Jimmy Garoppolo as the

2023-11-02 01:50

Ukraine war: Russia hits most settlements in one day, says Kyiv

Some 118 towns and villages were struck in 24 hours, the most this year, Kyiv's interior minister says.

2023-11-02 01:45

Vogue magazine owner Conde Nast to trim about 5% of staff

Vogue magazine owner Conde Nast will trim about 5% of its staff, CEO Roger Lynch said on Wednesday,

2023-11-02 01:25

How many MLB teams have overcome a 3-1 World Series deficit?

A look at the teams who've overcome a 3-1 deficit to win the World Series.

2023-11-02 01:21

How Harry Kane can replicate Jude Bellingham's Clasico impact in Der Klassiker

How Bayern Munich's Harry Kane can emulate the game-winning influence of his England teammate Jude Bellingham for Real Madrid against Barcelona ahead of a Bundesliga meeting with Borussia Dortmund

2023-11-02 00:57

Bears already making Montez Sweat trade look like a massive mistake

Ryan Poles once again demonstrated he has no earthly idea how make a trade in the NFL. What the Chicago Bears gave up for Washington Commanders edge rusher Montez Sweat was absolutely lunacy.

2023-11-02 00:49

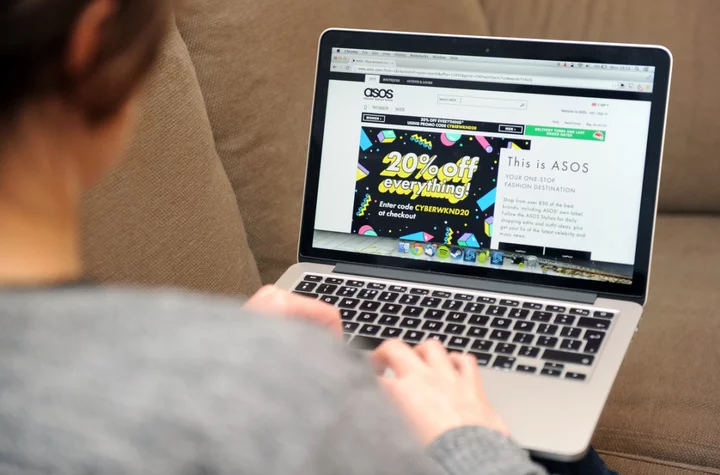

Fast fashion retailer ASOS struggles to engage customers as losses balloon

We’ve all been there. A friend’s wedding is three days away and you don’t have anything to wear. The last thing you want to do is drag yourself around high-street shops, so it inevitably you turn to ASOS. After all, the company is known for its next day delivery and simple free returns service. Though many of us are reliant on the online fast fashion retailer for last-minute holiday purchases or big seasonal shops, a new report shows that ASOS’s pre-tax losses ballooned to almost £300m in the year to 3 September, compared with £31m the previous year, according to the results published on Wednesday (1 November). Despite its huge popularity, the once undisputed queen of online retailers now faces stiff competition from abroad, challenging economic headwinds, and a maturing clientele potentially seeking a more tailored experience. Leading some to ask, is ASOS in SOS? When ASOS was launched in 2000, the online retailer was considered revolutionary. It was like a supersize department store at your fingertips and became the first online retailer that UK customers could visit and find hundreds of dresses for £30 all in one place. But, in recent years, the company has been cutting its stock as it faces severe profit and revenue losses. In July and August, the retailer said it was hit by wet during the summer months, forcing the retailer to cut its stock by 30 per cent. Some experts now say that the holes within ASOS’s business model are becoming apparent. Rick Smith, Managing Director of business recovery firm Forbes Burton tells The Independent that ASOS’s business model of allowing large numbers of free returns makes the company susceptible to financial losses during challenging economic conditions. “The buying culture within their target demographic sees several items returned for each order placed, which can make for slim profit margins,” Smith explains. “ASOS has enjoyed a stratospheric rise since their inception, but have perhaps reached their ceiling now and need to cut their cloth accordingly, especially given the amount of economic headwinds [such as as the cost of living crisis] in play at the moment.” The buying habits of consumers have also shifted in the 23 years since ASOS launched. Smith says that sifting through hundreds of products has become a painstaking and often unenjoyable task for its customers. “Once large online retailers get to a certain size, it can become laborious for customers to scour their whole catalogue,” Smith explains. “The online fashion landscape is evolving now to a point that customers are looking for a more tailored service from websites.” With the rise of shopping on social media, too, young people are increasingly buying individual items from retailers on Instagram and TikTok or instead shopping directly from the brands that ASOS stocks, such as Pull and Bear, Stüssy and Bershka, which all have their own websites. “ASOS’s busy 20-something [target] market doesn’t necessarily have the time to sift through dozens of item pages,” adds Smith. “So curated collections and recommendations based on user input may be one of the changes they eventually look at.” ASOS, which originally stood for As Seen On Screen, initially started trading with the tagline “Buy what you see on film and TV” as it exclusively sold imitations of clothing worn by celebrities. That business model quickly expanded away from the world of replica products: ASOS now offers 850 affordable to mid-range high-street brands and ships to 196 countries. But the company is also now tackling a debt issue, with net debt including leases now at £648.5m, up from £533m the year before. Analysts predict that the online fashion site may need to raise quick cash soon – potentially through the rumoured sale of its Topshop brand, which ASOS acquired when the Arcadia Group went bust in 2021 and closed Topshop’s bricks and mortar stores. Despite the profit slump and predicted future losses, José Antonio Ramos Calamonte, ASOS’s chief executive, said in the report that the company has made “good progress” in “a very challenging environment” and would continue to invest in its brand and stock more fashionable lines of clothing. The company plans to spend £30m more on marketing and said it was going “back to fashion” with its products “geared around fashion and excitement”. As ASOS faces huge losses, it was reported this week that the Chinese-founded retailer Shein has acquired UK company Missguided, with plans to “reignite” the online retailer that was only bought out of administration by Mike Ashley’s Frasers Group a year and a half ago. Despite calls for boycotts from anti-fashion campaigners, Shein is currently valued at around £53bn, having expanded globally and bought many of its rival brands. In 2022, it was the most-googled fashion brand in the world and made a reported £18.9bn in revenue, suggesting that fast fashion is not falling out of favour with consumers who want to find entire outfits on a budget. Read More The funniest and most unique celebrity Halloween costumes of 2023 Kim Kardashian’s ‘power-nipple’ bra isn’t empowering – it’s the stuff of nightmares It’s ‘Phoebe Philo’ day – here’s why fashion fans are so excited The funniest and most unique celebrity Halloween costumes of 2023 Kim Kardashian’s ‘power-nipple’ bra isn’t empowering – it’s the stuff of nightmares It’s ‘Phoebe Philo’ day – here’s why fashion fans are so excited

2023-11-01 23:57

Newcastle injuries: Latest Isak, Tonali & Botman news and potential return dates

The potential return dates for Newcastle's currently injured stars, including Alexander Isak.

2023-11-01 23:54

US pilot charged for allegedly threatening captain

The man is accused of telling a colleague he would shoot them if the flight they were on was diverted.

2023-11-01 23:45

The 15 best assisting seasons in Premier League history

For some players making an assist is as good as scoring a goal and with the stats that some of these Premier League players have, you can see why. Here are the 15 best assisting seasons in Premier League history.

2023-11-01 23:18