By Herbert Lash and Nell Mackenzie

NEW YORK/LONDON (Reuters) -The dollar eased and global equities rebounded on Friday as Wall Street rallied on doubts that interest rates will go higher even after Federal Reserve Chair Jerome Powell cautioned that tighter monetary policy might be needed to tame inflation.

Powell's remarks on Thursday that the fight to restore price stability "had a long way to go" at first roiled markets. But a softer labor market as seen in last week's unemployment report and speculation that next week's consumer prices index (CPI) will show slower inflation spurred bulls into action.

"Even with Powell's commentary yesterday, for the most part that's been shrugged off as sounding too hawkish. People are not really convinced that the Fed is going to be raising rates going forward," said Michael James, managing director of equity trading at Wedbush Securities in Los Angeles.

"Too many people were far too over their skis on the short side, both of equities and bonds, and you've seen that reverse in a huge way in the course of the last week."

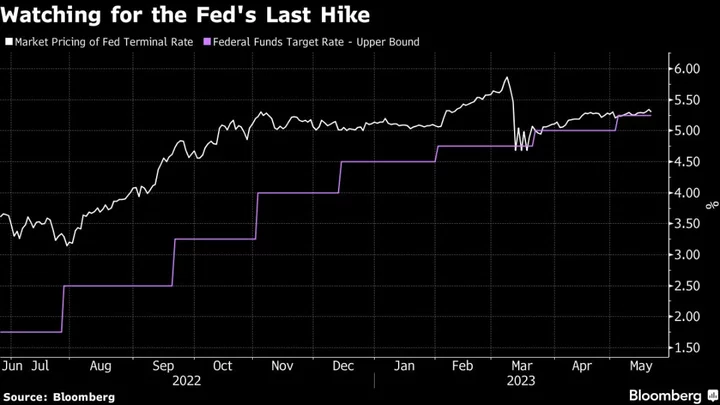

Many investors embraced the notion that U.S. rates have peaked after the Fed kept its overnight lending rate steady last week, a move that bolstered speculation the tightening cycle was over and spurred a rally in risky assets until Thursday.

Thierry Wizman, global FX and interest rates strategist at Macquarie in New York, said with the decline in gasoline prices the CPI data could surprise to the downside.

"We could also see some downside surprises in the core components of rents, for example, air fares, new cars, etc," he said. "If we were to get a low CPI next week, yields can come down around that number and we may get some weakening in the dollar."

Core CPI month-over-month is expected to have risen 0.3% in October, with a year-over-year increase of 4.1%, a Reuters poll showed. Both estimated gains are the same as in September.

But U.S. consumer sentiment fell for a fourth straight month in November and households' expectations for inflation rose again, with their medium-term outlook for price pressures at the highest in more than a dozen years, the University of Michigan's preliminary reading of consumer sentiment showed on Friday.

MSCI's gauge of global equity performance closed up 0.76%, while Wall Street's main indices surged 1% or more. The Dow Jones Industrial Average rose 1.15%, the S&P 500 gained 1.56% and the Nasdaq Composite added 2.05%, its biggest percentage jump since May.

For the week, the Dow rose 0.7%, the S&P 500 gained 1.3% and the Nasdaq advanced 2.4%.

Earlier in Europe, the pan-regional STOXX 600 index closed down 1.0%.

U.S. Treasury yields rose sharply on Thursday after a weak 30-year bond auction. The extra yield needed to get the issue sold was the largest in several years as was the amount dealers were forced to absorb, said Dec Mullarkey, managing director for investment strategy and asset allocation at SLC Management in Boston.

"The market continues to struggle with what is the right premium or clearing level to fund the large pipeline of government debt issuance," he said.

"Investors are worried about the prospects of higher rates for longer and the price volatility that may invoke," he said, reflecting a variance of views between bond and equity investors about rates.

The two-year Treasury yield, which reflects interest rate expectations, rose 3.2 basis points to 5.054%, while the benchmark 10-year yield slid 0.6 basis points at 4.624%.

Futures show about a 35% probability the Fed will cut its overnight lending rate by 25 basis points by next May, according to the CME's FedWatch tool, but the market expects that rate to stay above 5% through June.

Asian stocks closed the day down as worries over China, the world's second-biggest economy, resurfaced after data on Thursday showed Chinese consumer prices dipped again.

Tapas Strickland, head of market economics at NAB, said the data keeps the pressure on Beijing to continue with its incremental easing in monetary and fiscal policy.

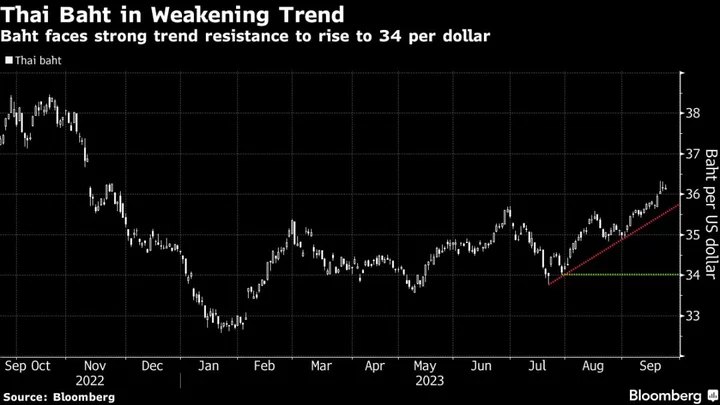

In currency markets, the dollar index fell 0.11% to 105.79, with the euro up 0.16% to $1.0683.

The Japanese yen weakened as traders remained on watch for possible intervention to shore up the struggling currency. The yen weakened 0.12% at 151.51 per dollar.

The dollar touched one-week highs against the Australian and New Zealand dollars. [FRX/]

Oil prices gained almost 2% as some speculators kept taking profits on short positions, but remained on track for a third week of losses on signs of slowing demand.

U.S. crude rose $1.43 to settle at $77.17 a barrel, while Brent settled up $1.42 at $81.43 a barrel.

Gold fell more than 1%, heading for a second straight weekly decline, as safe-haven demand eased.

U.S. gold futures settled down 1.6% at $1,937.70 an ounce.

(Reporting by Nell Mackenzie in London; Editing by Dhara Ranasignhe, Tomasz Janowski and Richard Chang)