The debt ceiling debate and possibility that the United States could default on its financial obligations have hung over the heads of investors for nearly six months now. But Wall Street appears to be largely shrugging off the ongoing negotiations as noise, opting instead to focus on a better-than-expected first quarter earnings season.

What's happening: There are just three trading days left until Treasury Secretary Janet Yellen's June 1 estimate of when the United States needs to raise the debt ceiling or risk being unable to pay some of its bills. Meanwhile, negotiations between President Joe Biden and Republican House Speaker Kevin McCarthy remain deadlocked.

Economists have warned that a default would be a catastrophic event: Growth could be squashed, the dollar could lose its status as the global reserve currency and markets could go haywire.

But investors chose to celebrate a strong earnings report by semiconductor company Nvidia on Thursday instead of worrying over the debt ceiling. The tech-heavy Nasdaq Composite gained 1.7% after the company, which makes chips used in artificial intelligence, saw its shares soar nearly 25% as it beat earnings expectations and posted strong guidance for the year ahead.

The surge in share price means that Nvidia is now just a hair away from reaching $1 trillion in market capitalization.

Other chip makers benefited from Nvidia's climb. AMD and Taiwan Semiconductor rose 11% and 12% on Thursday respectively. The VanEck Semiconductor ETF gained 8.6%.

"All that matters for markets is the trajectory of corporate profits," said David Bahnsen, chief investment officer at The Bahnsen Group, in a note.

"Our main message to investors is to ignore the debt ceiling noise and pursue investments that provide growing cash flows," he added.

Nearly every S&P 500 company has reported first quarter earnings at this point and about 78% of them have had earnings-per-share come in higher than analyst estimates, according to Factset data. S&P 500 companies are on track to record their best performance relative to analyst expectations since the fourth quarter of 2021.

Very few executives are discussing the debt ceiling as a potential headwind on earnings calls, reported FactSet. The term "debt ceiling" had been cited on the calls of just 13 companies in the S&P 500 between March 15 and May 18.

"Solid earnings results compared with expectations have helped keep stocks afloat in recent weeks amid debt ceiling jitters, regional bank concerns, and louder calls for recession," said Jeffrey Buchbinder, chief equity strategist for LPL Financial.

The bottom line: Yesterday, we reported about a "market vibe shift" where investors were waking up to the serious consequences of a possible default on US debt. And while there is more stock market volatility because of the brinkmanship in Washington, traders still seem to be prioritizing company fundamentals over political events. At least for now.

The bond market is more rattled

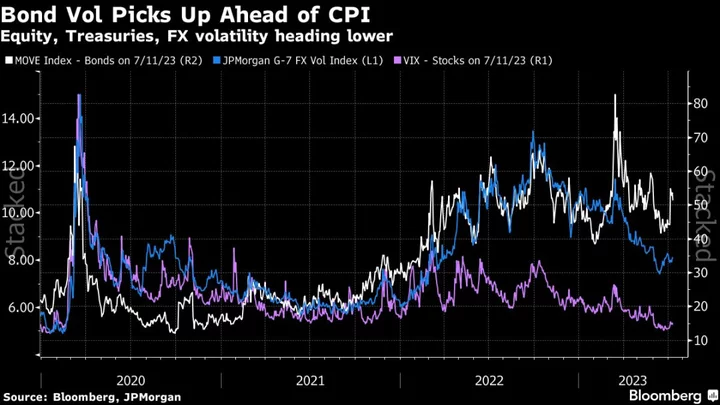

While US equities have been somewhat resilient to the debt ceiling drama, bonds haven't had the same luck.

Treasury yields, which move in the opposite direction to prices, have been on the rise as concerns over the US debt ceiling grow more serious.

The yield on the one-month Treasury bill, which is particularly sensitive to the debt ceiling crisis, rose past 6% on Thursday, and in the past week yields on 2- and 10-year Treasury notes hit their highest levels since March.

"If there were an actual payment default, based just on the size and the scale of the amount of US Treasuries that are outstanding, I do think that this could be something that could hit the markets pretty hard," said Dave Sekera, chief US market strategist at Morningstar.

So what should an investor do? Sit tight, said Sekera.

"For investors that do own US Treasuries, I don't think you're going to end up suffering any loss of principal, and I fully expect that once the debt ceiling gets raised, you will get your principal and interest," he said. "I could even see the US government paying you any extra interest until you get that principal payment back."

Still, Sekera cautioned, "there's really no way to know exactly what would happen, and I don't think anyone really can understand the full ramifications of it right now."

JPMorgan is cutting about 1,000 First Republic Bank jobs

JPMorgan Chase informed about 1,000 First Republic Bank employees on Thursday that they will no longer have jobs, reports my colleague Matt Egan.

JPMorgan acquired most of First Republic's assets earlier this month after the San Francisco-based regional bank was seized by the government. It marked the second-biggest bank failure in US history.

A JPMorgan spokesperson told CNN that the bank updated all First Republic employees on Thursday about their future employment status and the vast majority — or nearly 85% — have been offered a transitional or full-time role.

That leaves 15%, or about 1,000, First Republic employees who are not receiving an employment offer.

JPMorgan said the company's May 1 deal with the Federal Deposit Insurance Corporation to buy most of First Republic did not include all of the company's employees.

"We've been transparent with their employees and kept our promise to update them on their employment status within 30 days," JPMorgan said in a statement. "We recognize that they have been under stress and uncertainty since March and hope that today will bring clarity and closure."