Arm Ltd. has filled out the roster of underwriters for its initial public offering, with 28 banks in all on the deal, people familiar with the matter said.

In addition to four lead banks — Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group — the offering will have 10 second-tier underwriters, including Bank of America Corp. Citigroup Inc., Deutsche Bank AG and Jefferies Financial Group Inc., the people said, asking not to be identified because the information was private.

A third-tier consists of a diverse group of 14 securities firms, such as Daiwa Securities Group Inc., HSBC Holdings Plc, Intesa Sanpaolo SpA and Societe Generale SA, they said.

A representative for Arm, which is majority owned by SoftBank Group Corp., declined to comment.

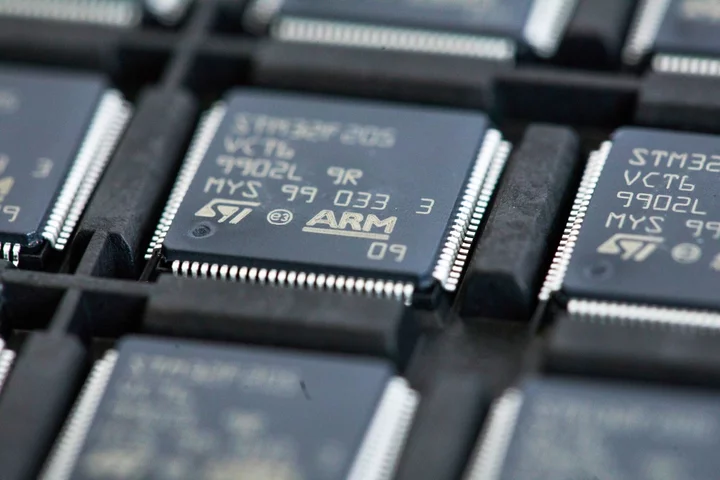

Cambridge, UK-based chipmaker Arm has been seeking to raise $8 billion to $10 billion in September in what would be the year’s biggest IPO, Bloomberg News has reported. The company is aiming to be valued in the listing at $60 billion to $70 billion.

The length of the line-up is a reflection of the global reach of Arm, which produces technology used in almost every smartphone, as well as banks’ eagerness to land roles on big-ticket IPOs. The record IPO of Saudi Arabian oil giant Aramco in 2019 also featured about 25 banks. A subdued period for new listings around the world has made securing work on large deals even more important for investment banks in 2023.

How Arm Aims to Ride AI Wave to Year’s Biggest IPO: QuickTake

(Adds context on banks, IPOs in final paragraph.)