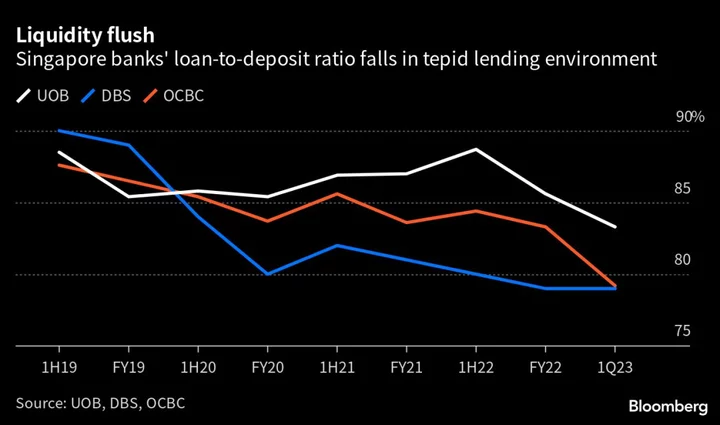

Singapore banks are flushed with deposits with few options to deploy them amid a tepid lending environment. The city-state’s central bank is one avenue.

The issue was highlighted in May when DBS Group Holdings Ltd. Chief Executive Officer Piyush Gupta said during an analyst call that the bank had lent the Monetary Authority of Singapore S$30 billion ($22.3 billion) as it is “not finding enough opportunities to put the money to work.”

The liquidity surplus underscores how Singapore has been a beneficiary as Asia’s wealthy shift their money to a perceived safe haven, even as customers in the city-state have flocked to lock in high interest rates on fixed deposits. Local lenders meanwhile have signaled a softer outlook for loan growth amid global economic uncertainty.

Elsewhere in the region, Japan banks are sitting on trillions of dollars of surplus liquidity, which have pushed them to seek higher-yielding investments though some have turned cautious lately. Indian banks by contrast are trying to keep up with a decade-high demand for loans by hoovering up deposits.

“Banks do not actively gather customer deposits just to park them at the central bank as a business strategy,” said Willie Tanoto, a director in Fitch Ratings’ financial institutions team. It’s likely that some banks have seen more deposit inflows than they can immediately deploy to suitable risk-adjusted asset opportunities, he added.

From a yield perspective, lending to customers would usually be more rewarding than keeping funds with central banks, Tanoto said. MAS’ standing facility accepts overnight deposits at a yield between 2.7% to 4% year-to-date, while a loan can range from high-3% for a mortgage to over 27% on credit cards.

DBS holds MAS bills, government treasury bills and lends short-term surplus funds to MAS in the normal course of business, a spokesperson said in response to queries from Bloomberg News, declining to comment specifically on the S$30 billion loan to MAS.

Southeast Asia’s biggest lender said deposits have been lifted by its digital capabilities and flight to safety in recent years, particularly during the Covid-19 pandemic. DBS’ total deposits climbed 31% to S$529 billion between December 2019 and March 2023, surpassing the 16% rise in total loans to S$417 billion, according to the spokesperson.

At rival United Overseas Bank Ltd., lending to MAS is one of the bank’s deployment options for surplus cash. Its non-restricted balances with central banks jumped 40% year-on-year to S$42.3 billion last year. Oversea-Chinese Banking Corp.’s money market placements and reverse repos with central banks was S$28.4 billion in 2022, up from S$20.3 billion a year ago.

In the first quarter, Singapore banks chalked up the largest “excess” since 2020 as deposit growth continues to outstrip loan growth, Fitch Ratings’ Tanoto said.

Strong capital ratios and a conservative regulatory environment in Singapore had contributed to the surge in flight-to-safety inflows, said Thilan Wickramasinghe, head of research at Maybank Securities Singapore.

The city-state’s interest rates — and hence bank deposit rates — have also been more sensitive to the Fed’s hikes compared to some regional markets that did not see rates rise as much, he added.

Lenders in Singapore have been dangling attractive rates in a fierce race for funds. This has caused fixed deposits in the country to surge over 70% to S$837 billion in the first quarter from a year ago, MAS data show, though banks now face mounting pressure on funding costs as cash continues to pour in.

This trend is expected to persist through 2023 with depositors seeking safe-haven alternatives, Bloomberg Intelligence analyst Sarah Jane Mahmud said in a note. OCBC and UOB, with higher fixed-deposit bases, could be more vulnerable, she said.

--With assistance from Chanyaporn Chanjaroen, Taiga Uranaka, Alice Truong and Kevin Dharmawan.