Japanese stocks fell for a second day as an impasse in US debt ceiling negotiations convinced some investors to take profits while benchmarks trade near their highest levels in 33 years.

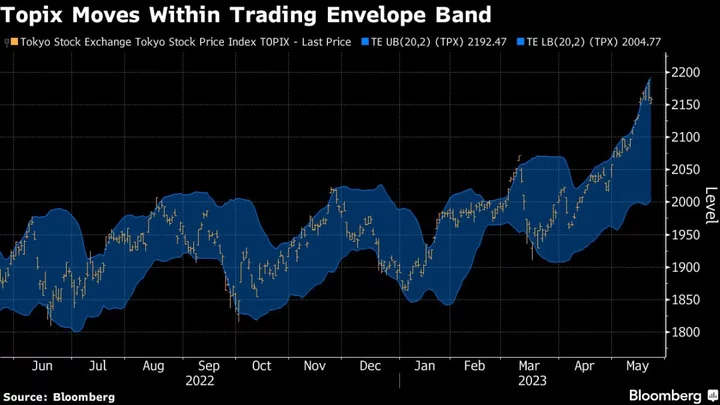

The Topix Index fell as much as 0.4%, before paring its drop to 0.1% as of 9:21 a.m. in Tokyo. Electronics makers and information firms were the heaviest drags on the gauge, while automobile companies provided support as Toyota Motor Corp. rebounded from a last-minute plunge during the previous trading session. The Nikkei 225 Stock Average slid 0.5%.

Both benchmarks are down less than 1% since climbing to levels unseen since 1990 in a rally that put Japanese equities among the world’s best performers this year. The recent gains may have been too rapid, said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management.

Read: McCarthy, Graves Signal Impasse in White House Debt Talks

“Japanese stocks, which have been suffering from short-term overheating, have been in an adjustment phase since yesterday,” Akino said. “There is a risk that the US debt ceiling negotiations will enter June without a conclusion and the market will weaken further.”

Sony Group Corp. contributed the most to the Topix’s decline, decreasing 1.4%. Meanwhile, Toyota Motor rose as much as 5.5%, after plunging 4.8% in the final minute of trading Tuesday. Out of 2,158 stocks in the Topix, 541 rose and 1,339 fell, while 278 were unchanged.