Shell Plc will increase its dividend 15% and boost natural gas production as new Chief Executive Officer Wael Sawan refocuses on the fossil fuels that drove record profits last year.

It’s part of a pivot by the European oil major to expand the most profitable parts of its business, even if they are carbon intensive, while scaling back ventures that don’t make high enough returns. The company reiterated its pledge to achieve net-zero emissions by 2050.

“We will invest in the models that work — those with the highest returns that play to our strengths,” Sawan said in a statement. The CEO and his management team will lay out more details of the plan to shareholders at a presentation in New York later on Wednesday.

Shell has been gradually building back its dividend since former CEO Ben van Beurden cut it during the depths of the pandemic. While the latest increase will still leave the payout about 30% below the pre-Covid level, the move may help convince investors that the company can be a reliable source of cash, like its more highly valued American peers.

As well as the dividend increase, which will take effect this quarter, Shell committed to buying back at least $5 billion of shares in the second half. The company will reduce capital spending to $22 billion to $25 billion a year for 2024 and 2025, down from an expectation of $23 billion to $27 billion this year.

Key to achieving higher returns will be the oil and gas business that drives the majority of Shell’s profits. The company will no longer seek to cut oil production by 1% to 2% annually, having achieved its initial output-reduction plan — announced in 2021 amid a focus on cutting carbon emissions — faster than anticipated.

Shell will now seek to grow its integrated gas business and will stabilize oil output to 2030. That follows in the footsteps of BP Plc, which also rolled back its plans to cut oil production earlier this year. Investors rewarded that move with a 15% jump in BP’s share price.

Shell shares fell as much as 0.5% before paring losses to trade 0.2% lower at 2290.5 pence as of 8:08 a.m. in London.

“One area of initial disappointment may be on the dividend,” RBC analyst Biraj Borkhataria said in a note. “From our conversations into the event, we believe market consensus was for around a 20% increase.”

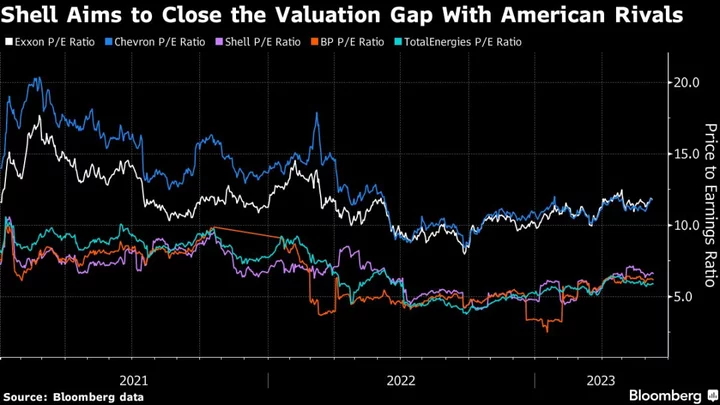

Put together, the shift in strategy of the European majors is another sign that the American vision for Big Oil is winning out. As Shell and BP pivoted to low-carbon in recent years, Exxon Mobil Corp. and Chevron Corp stuck unapologetically to their fossil-fuel cores. That helped contribute to a valuation gap as fossil fuel investors flocked to the clear-cut Americans while the Europeans were still too involved in oil and gas to attract low-carbon purists.

While many of the details of Shell’s plan will come later on Wednesday, the initial outline puts oil and gas front and center while giving lower-return, low-carbon efforts a smaller supporting role. That’s a stark difference from the company’s strategy update about two years ago, when Shell said its oil production was in decline and named electricity and low-carbon hydrogen as its key sources of growth.

Today, Shell said it will invest “selectively” in power, focusing on markets where it can add value with its traders. Investments in hydrogen and carbon capture technology will be made “in a disciplined manner to create options for the future.”

(Updates with share price in eighth paragraph.)