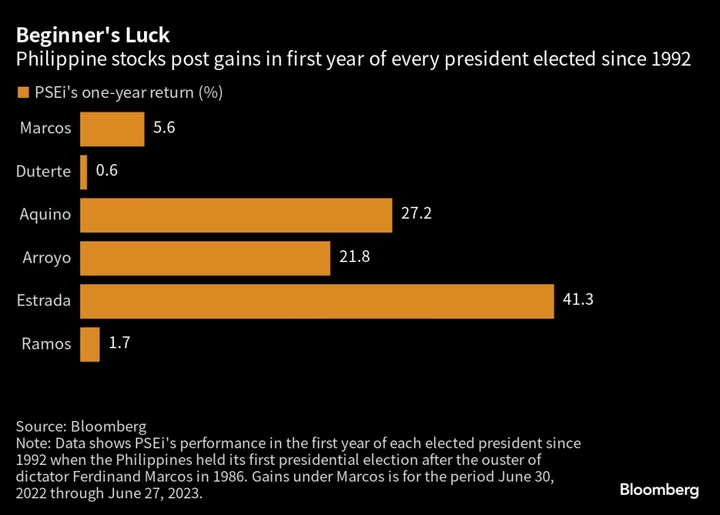

Philippine President Ferdinand Marcos Jr.’s market-friendly policies helped boost local shares in his first year in office, leading to gains of more than 5% since June 2022. The Southeast Asian nation’s aggressive growth targets and careful planning by the central bank in terms of when to hike rates helped the economy expand at a faster-than-expected pace in the first quarter.

The Philippines, which is considered a bright spot with its interest rates recently on hold while many central banks are still tightening, has also seen its diplomatic and economic ties with other nations including the US improve. The stock gains under Marcos Jr. far outpace performance in the first year of former President Rodrigo Duerte.

To sustain gains, the president will need to focus on lowering inflation and interest rates as well as ramping up investments in infrastructure, said Fritz Ocampo, chief investment officer at BDO Unibank Inc.

(Updates throughout)