Japan bond bears are turning their attention to Friday’s inflation data, the next potential catalyst for speculation about looming monetary policy tweaks that would bump up yields.

Moves in Tokyo markets point to an emerging sense of caution about the possibility the Bank of Japan may adjust its control of government bond yields next week, in part because of rising price pressures. The 10-year bond yield has edged up toward the BOJ’s 0.5% ceiling, while the yen has pared its recent weakness against the dollar.

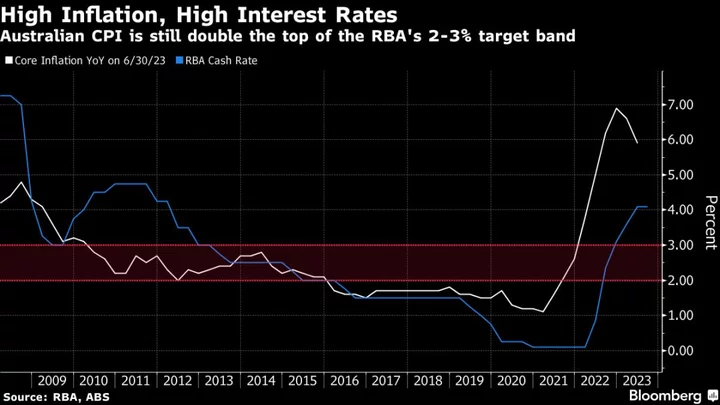

Japan’s inflation figures from June are expected to show growth in key consumer prices excluding fresh food picking up speed to 3.3% from 3.2%, largely on the impact of higher electricity prices. Stripping out energy costs as well, price gains are seen hovering close to a high of more than four decades, even after cooling for the first time since January 2022 to an expected 4.2%.

While both measures are already well above the central bank’s 2% inflation target, the BOJ has said price gains will slip below its goal in the latter half of the year ending March.

Market players remain unconvinced.

“The focal point of this CPI data is whether this will point to inflation slowing in the way the BOJ expects,” said Masato Koike, economist at Sompo Institute Plus. “If it exceeds market consensus, that would boost market expectations for yield curve control adjustments in July.”

Economists at UBS and BNP Paribas are among those flagging the meeting ending on July 28 as the most likely gathering for policy change, given that the BOJ is widely expected to raise its inflation forecast for this fiscal year from the current 1.8% projection at the same meeting.

Economic data continues to hint at an emerging cycle supporting inflation. A market gauge of long-term price expectations hit the highest since 2014 this month and one measure of base pay grew at the fastest pace since the 1990s.

BOJ Governor Kazuo Ueda has urged caution. He argues that after decades of price weakness in Japan, rushing to scythe through the green shoots of price growth now would be far more damaging than being tardy to rein in inflation.

Ueda said Monday evening that the central bank was continuing with easing on the premise that Japan was still some distance from achieving its 2% inflation goal. He said a change in that premise is needed to shift policy.

His remarks after a meeting of Group of 20 finance chiefs and central bankers in India weakened the yen and pushed Japanese bond futures modestly higher as investors interpreted them to mean no major policy change for now.

The recent consensus among BOJ watchers has been for the central bank to hold off on any major shift in policy, such as the scrapping of negative interest rates, until next year or later. But even that scenario leaves open the possibility of a near-term stop-gap measure to limit market distortions caused by yield curve control.

Ten-year yen swaps, typically used by foreigners to bet against the BOJ’s yield cap, reached a four-month high of 0.72% on Friday and the yen hit a two-month high against the dollar. But even as investors put on “just in case” hedges, speculation over a policy shift remains below levels seen earlier this year

If the BOJ moves in July it might instead argue that the change was purely a matter of making its stimulus more sustainable and had little to do with market movements since the yen is stronger and there has been no need to buy extra bonds to keep yields below 0.5%.

Some analysts argue there’s already been too much speculation about a BOJ move.

“The BOJ has a tradition of not liking to be bullied by the media or by the investor community,” said Jonathan Liang, Asia fixed-income specialist at JPMorgan Asset Management.

Still, there is mounting pressure suggesting that current policy is inappropriate, he added, indicating that change was likely in the next four quarters.

“They’re gonna have to do something,” he said. “It’s when no one’s talking about it — that’s when they make a policy change.”

--With assistance from Matthew Burgess and Brian Fowler.

(Updates with comment from BOJ Governor Ueda)