A look at the day ahead in U.S. and global markets from Mike Dolan

Last week's bond market storm calmed somewhat on Monday, but the interest rate horizon now relies heavily on evidence of more disinflation given economic activity and the labor market are holding up so well.

With Wednesday's U.S. consumer price report expected to show an almost one percentage point drop in headline inflation to just 3.1% last month, China on Monday chimed with the disinflation chorus - and maybe more than it would like, as deflation there is now a real issue.

Factory gate prices in the world's second biggest economy fell at their fastest annual rate in over seven years in June and there was no annual consumer price inflation at all - a deflationary warning that begs for some policy stimulus that's yet to show.

While that's worrying for China, it should help ease inflationary concerns elsewhere in the world.

Although Friday's June U.S. employment report showed the monthly payroll gain at its lowest in 2-1/2 year, the still-brisk 200,000 jobs gain ensured the unemployment rate fell back to just 3.6% and annual wage growth picked up to 4.4%.

While that data took the edge off the red-hot private-sector jobs readout the previous day, it left a bruised bond market still wary of further Federal Reserve interest rate rises and praying disinflation may stay its hand after one more hike later this month.

Although Treasury bond volatility backed off six-week highs on Friday, its weekly rise was the biggest since the wild swings around the banking stress in March.

Although another quarter-point Fed hike is now baked in for the July 26 meeting, futures markets dialled back expectations for another such move by November and now see less than a 50-50 chance of a second hike this year.

Two-year Treasury yields fell back below 5% on Friday and remained there first thing today. Ten-year yields held above 4%, however, and the 2-to-10 year yield curve steepened to its least inverted level in almost a month.

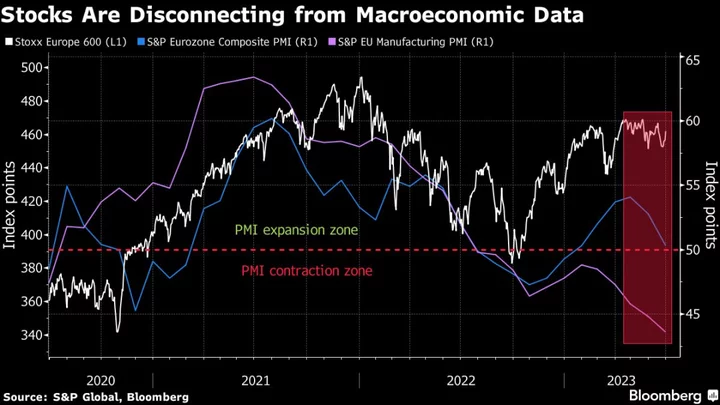

The tentative stabilisation of the bond market hasn't lifted nervy stocks, however, and the start this week of the second-quarter corporate earnings seasons - expected to show another annual contraction in aggregate S&P500 profits - adds a further risk factor.

Stock futures were in the red again ahead of Monday's open despite gains in Chinese and European bourses. The VIX index of implied equity market volatility remains elevated above 15.

The dollar recovered ground following its payrolls-related swoon on Friday. The offshore Chinese yuan edged lower.

Treasury Secretary Janet Yellen ended her China visit without any significant breakthroughs on thorny trade and industry standoffs between the two economic superpowers. President Joe Biden visited Britain ahead of this week's NATO summit in Vilnius.

British markets - where the UK government bond market selloff last week had been worse than in Treasuries - remained edgy. A bearish note from HSBC on UK real estate weighed on the sector, pushing real estate investment trusts and real estate stocks down 0.4% each.

Finance minister Jeremy Hunt is due to spell out on Monday long-awaited plans to encourage pension funds and other asset managers to invest in high-growth sectors and private equity, the Treasury said on Sunday.

Bank of England chief Andrew Bailey also speaks on Monday.

In South Korea, banking nerves went up a notch as the financial services regulator asked major commercial banks to prepare around $4 billion in financing to support a credit cooperative hit by customer withdrawals.

Events to watch for later on Monday:

* U.S. May consumer credit, June employment trends

* Federal Reserve Vice Chair for supervision Michael Barr, San Francisco Fed President Mary Daly, Cleveland Fed chief Loretta Mester and Atlanta Fed chief Raphael Bostic all speak; Bank of England Governor Andrew Bailey speaks

* U.S. President Joe Biden visits Britain ahead of NATO summit

* U.S. Treasury sells 3-, 6-month bills

(By Mike Dolan, editing by Ed Osmond, mike.dolan@thomsonreuters.com. Twitter: @reutersMikeD)