The Bank of England stepped up efforts to beat back the worst inflation since the 1980s by boosting interest rates half a percentage point to the highest level in 15 years.

The move surprised investors who had priced in a 40% chance of a hike of that magnitude. BOE policymakers also reiterated earlier guidance pointing to even higher rates, similar to the message Federal Reserve Chair Jerome Powell conveyed to US lawmakers this week.

Central bankers in Norway joined the BOE in accelerating their rate increases, while Switzerland dialed back its pace of hiking.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

In addition to the UK, Norway raised its benchmark rate a half point to 3.75%, while central banks in Indonesia, the Philippines, Mexico and Brazil left borrowing costs unchanged. The Swiss National Bank delivered its smallest hike since policy tightening began a year ago, while saying more action is likely.

The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years.

Europe

UK core inflation, which excludes food and energy, accelerated unexpectedly to a 31-year high of 7.1% in May, helping explain the BOE’s decision to raise interest rates a half percentage point. Separate data showed government debt now exceeds the size of the UK economy for the first time since 1961, imperiling Prime Minister Rishi Sunak’s promise to restore health to the public finances and cut inflation.

Economic momentum in the euro area almost came to a halt in June, signaling an end to the revival the bloc demonstrated since its winter downturn. A purchasing managers index compiled by S&P Global fell to a five-month low.

Germany’s rollout of ultra-cheap public transport last summer is set to reverberate through its upcoming inflation readings, causing a headache for the European Central Bank.

Asia

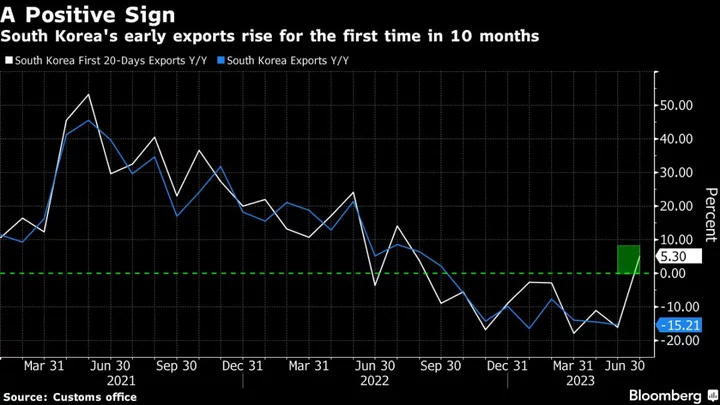

South Korean exports offered an early sign of improvement in global trade after their first year-on-year gain since last summer. Preliminary trade figures showed a 5.3% gain in exports in the first 20 days of June from a year ago for the first increase since August, a possible sign that a slowdown in world demand is starting to ease.

Singapore’s core inflation rate cooled in May to the lowest in 11 months, helped by a deceleration in transport and food prices.

US

Sales of previously owned homes barely rose in May as high mortgage rates continued to crimp demand and discourage owners from listing their properties. The median selling price declined 3.1% from a year earlier, the most since 2011, to $396,100. That’s still historically elevated for the month and reflective of limited supply.

Business activity expanded in early June at the slowest pace in three months, held back by a deeper contraction in manufacturing. Healthy demand for services stood in sharp contrast to a further deterioration at factories. The manufacturing gauge fell to a six-month low, with new orders matching the fastest rate of contraction since May 2020.

The so-called Great Retirement is looking a little less great lately, as stalled house prices and the rising cost of living push some older workers back into the labor force, new research shows.

Emerging Markets

Mexico kept borrowing costs unchanged for a second month as the central bank vows to maintain its restrictive stance over the coming months while inflation continues to show signs of cooling.

Egypt looked past a pick-up in inflation to keep interest rates unchanged for a second month, with the central bank’s next bout of monetary tightening likely hinging on the country’s ability to secure the foreign exchange needed to manage another currency devaluation.

--With assistance from Philip Aldrick, Leda Alvim, Maya Averbuch, Katia Dmitrieva, Tarek El-Tablawy, John Gittelsohn, Hooyeon Kim, Shawna Kwan, Andrew Langley, Mirette Magdy, Tom Rees, Augusta Saraiva, Michael Sasso, Jack Sidders, Kevin Varley, Alexander Weber and Natalie Wong.