Global government bond yields extended their climb to the highest levels since the financial crisis as resilient economic data dashed speculation central banks are about to halt or start reversing interest-rate hikes.

US 10-year yields climbed to 4.31% Thursday, only just below last October’s peak, which was the highest since 2007. The equivalent yield on UK gilts jumped to a 15-year high, while its German counterpart rose close to the highest since 2011.

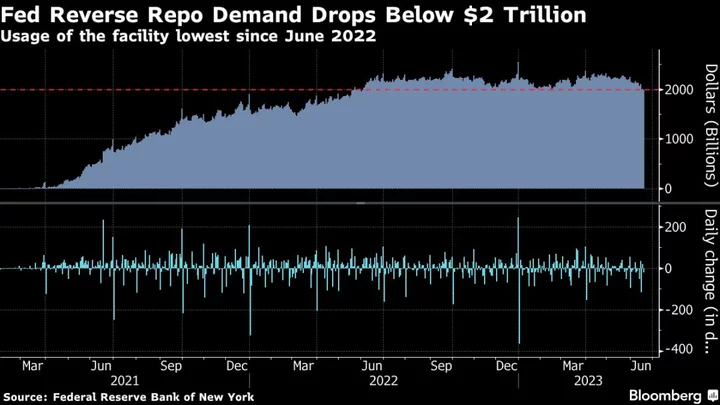

Treasuries have been a key driver of the global debt selloff as resilience in the US economy defies expectations that more than five percentage points of Federal Reserve interest-rate hikes would bring on a recession. Officials at the last policy meeting remained concerned that inflation would fail to recede and that further rate increases would be needed, minutes of the meeting showed.

“Recent data has been firmer, fueling expectations that central banks have a little more work to do,” said Prashant Newnaha, a macro strategist at TD Securities Inc. in Singapore. “The current selloff is being led by the longer end, underscoring concerns about supply and liquidity.”

Contributing to the selloff in the asset class, Japan — which has the developed world’s lowest interest rates thanks to its ultra-easy monetary policy — saw weak investor interest when selling 20-year notes Thursday.

The yield on a Bloomberg index for total returns on global sovereign debt rose to 3.3% Wednesday, the highest since August 2008. Sovereign bonds worldwide have handed investors a loss of 1.2% this year, making the asset class the worst performer across Bloomberg’s major debt indexes.

It’s a reversal from the start of the year, when optimism that rate hikes were close to ending sent global bonds soaring, with the Bloomberg Global Aggregate benchmark jumping more than 3% in January for its best opening month to a year on record. The gauge slid Wednesday to be down 0.1% for the year.

Investors Pile In

The higher yields in the US continue to draw in buyers. Investors pumped $127 billion this year into funds that invest in Treasuries, on pace for a record year, Bank of America Corp. said last week, citing data from EPFR Global.

Asset managers boosted long positions in Treasury futures to a record in the week to Aug. 8, according to Commodity Futures Trading Commission data. JPMorgan Chase & Co.’s client survey showed long positions in the week to Aug. 14 matched the peak set in 2019, which was the highest since the financial crisis.

Global bonds in particular are looking attractive given that yields worldwide are being lifted by the US at a time when numerous economies are showing weakness, said Steven Major, global head of fixed-income research at HSBC Holdings Plc.

“Much of the bear case for bonds is cyclical and local to the US,” Major wrote in a note Wednesday. “It therefore misses the global backdrop, along with longer-run structural drivers. The fact that some emerging-market central banks are already easing tells us that inflation is falling fast or that they have cyclical and structural headwinds.”

Global bonds are positioned to outperform within six to 12 months because central banks are getting close to the end of their rate-hike cycles, Western Asset Management said this week.

But Treasuries have also been under pressure by expectations the US government will issue more bonds in the coming quarter to plug widening federal deficits. US 10-year yields have jumped more than 30 basis points in August, set for the biggest monthly increase since February.

The Treasury is likely to boost auction sizes in November and February, according to Michael Cudzil, a fund manager at Pacific Investment Management Co. That may pressure yields higher again unless inflation comes back down, he said.

--With assistance from Liz Capo McCormick, James Hirai, Nicholas Reynolds and Neil Chatterjee.

(Updates with context throughout.)