Raising a combined $6.5 billion, three of this year’s biggest US tech listings — Arm Holdings Plc, Klaviyo Inc., and Instacart — face crucial earnings tests this week after lackluster starts for their shares.

The trio will be looking to restore investor faith with their first results since going public over a one-week stretch in September. While newly-listed firms typically give reliable guidance to investment banks to help set fair valuations and leave room to impress, a miss could batter the stocks given investors’ willingness to dump perceived losers.

“If you don’t beat your expectations the first few results you’ll be put in the penalty box for quite some time,” said Greg Martin, co-founder of Rainmaker Securities. “You absolutely have to make sure you make your first — and really second — quarter expectations, otherwise you could be in a world of trouble.”

The action gets started after the bell Tuesday with results from Shopify Inc.-backed Klaviyo. Arm and Instacart — which does business as Maplebear Inc. — are due to report on Wednesday evening. After the best week for the S&P 500 in about a year last week, Klaviyo and Arm were able to pop back above their IPO price, however, they’re both down more than 20% from intraday peaks while Instacart is still roughly 9% below its offering price.

Klaviyo and Instacart shares were little changed ahead of results as Arm rose 2.1%.

While the group was expected to mark a turning point in the moribund IPO market — they account for more than a quarter of the money raised through IPOs on US exchanges this year — they’ve fizzled from strong opening days. Valuations for chip designer Arm and Klaviyo, which sells software to other businesses, were scrutinized by investors while Instacart went public at a massive discount to its last private funding round.

For Arm, the year’s biggest IPO, it must “show some early traction or tell a compelling story about how they will be a part of AI, otherwise their valuation will be questioned,” said Martin.

Analysts are looking for quarterly revenue to grow to $749 million with $445 million coming from royalties, according to the average of analyst estimates compiled by Bloomberg.

Grocery-delivery firm Instacart’s ability to expand its user base while making more money from each order will be of particular focus for Wall Street. Analysts expect quarterly gross transaction value to come in at $7.4 billion with adjusted earnings before things like interest and taxes at roughly $120 million, Bloomberg data show.

Analysts expect Klaviyo to report third-quarter revenue of $167 million, something Mizuho analyst Siti Panigrahi called conservative. He called out that the fourth quarter is seasonally Klaviyo’s strongest with expectations for management to offer revenue guidance that’s above the current Street estimate of $195 million.

While management teams typically set the table for companies to deliver results that beat expectations, it can take several quarters to regain investor confidence in the event of a miss.

“It’s absolutely the assumption that the company will hit its numbers in the first earnings report after its IPO, otherwise investors tend to lose confidence in management to set and meet future expectations,” said Matthew Kennedy, senior IPO market strategist at Renaissance Capital.

CAB Payments Holdings Ltd. is a cautionary tale of the fallout from cutting expectations quickly after an IPO. The company, which went public in London in July, erased more than three-quarters of its value in two days after slashing its forecast.

Other members of the class of 2023 IPOs will be under the microscope this week. Mediterranean restaurant chain Cava Group Inc., the US’s top performing new IPO that raised more than $200 million this year, will test its 57% rally this evening when it reports. Other newcomers including Oddity Tech Ltd., Kodiak Gas Services Inc., and Savers Value Village Inc. are expected to provide updates of their own within the next 72 hours.

Tech Chart of the Day

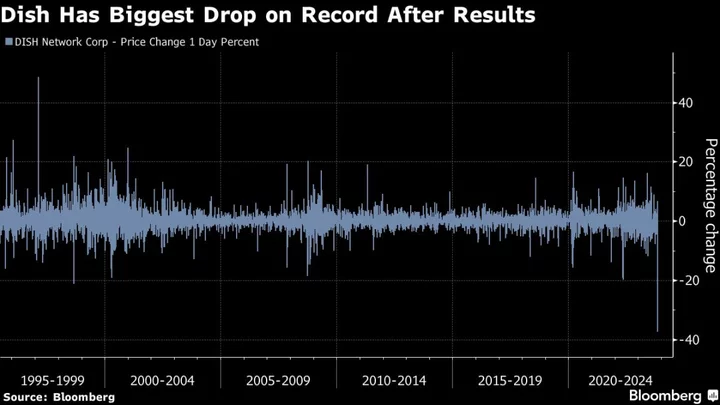

Dish Network shares plunged 37% on Monday, their biggest one-day percentage drop on record. The selloff, which took shares to their lowest close since November 1998, followed results that one analyst described as “astonishingly bad.” The stock is down more than 75% this year.

Top Tech Stories

- Tesla Inc. will raise the price of its Model Y variants in China following a refresh of the car in October, making yet another tweak to pricing in the world’s biggest and most competitive electric-vehicle market.

- PepsiCo Inc.’s Hugh Johnston will find a familiar face when he joins Walt Disney Co. next month as chief financial officer — activist investor Nelson Peltz.

- Cathie Wood’s flagship fund on Monday sold Roku Inc., which recently became its biggest holding, for the first time since August.

- A group of Alphabet Inc. contract staff working on content for Google’s support pages voted to unionize, setting up a likely contentious court battle over whether the internet company is legally their boss.

- SpaceX is on track to book revenues of about $9 billion this year across its rocket launch and Starlink businesses, according to people familiar with the matter, with sales projected to rise to around $15 billion in 2024.

Earnings on Tuesday

- Premarket

- GlobalFoundries

- Datadog

- Bentley Systems

- Gen Digital

- Novanta

- Thoughtworks

- Enfusion

- SmartRent

- Vishay Precision

- Tegna

- Madison Square Garden Entertainment

- Gogo

- Vivid Seats

- Advantage Solutions

- Consolidated Comms

- Postmarket

- Akamai

- Amdocs

- Kyndryl

- ePlus

- Corsair Gaming

- A10 Networks

- SimilarWeb

- Blend Labs

- Rackspace Technology

- ON24

- BigBear.ai

- Porch Group

- IAC Inc

- Bumble

- CarGurus

- Vtex

- Angi

- Nextdoor

--With assistance from Ryan Vlastelica and Subrat Patnaik.

(Updates share movement throughout.)