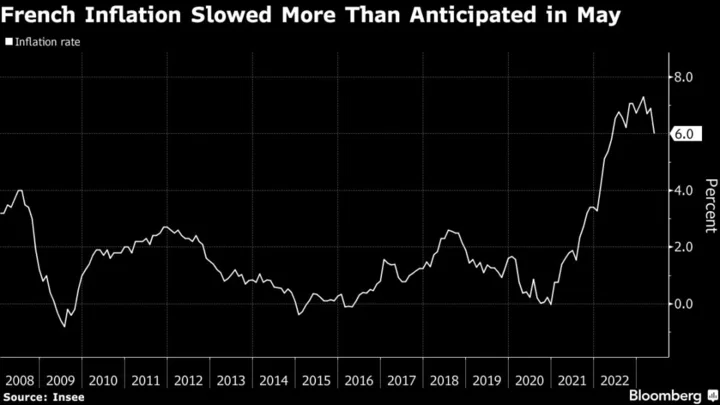

French inflation eased more than anticipated, reaching its lowest level in a year in a boost to those at the European Central Bank who say interest-rate increases can soon end.

The measure of annual consumer-price changes in the euro zone’s second-largest economy softened to 6% in May from 6.9% in April, data Wednesday showed. That’s a sharper slowdown than the 6.4% gain economists surveyed by Bloomberg had estimated.

The result reflects softening price gains across sectors, particularly in energy. Manufactured goods and services inflation, which are keenly watched by ECB officials, also moderated to 4.1% and 3%, according to the Insee statistics agency.

The data follow a larger-than-expected dip in Spanish inflation in May and are part of a raft of releases from the region’s top economies. Germany will publish its figure for this month later Wednesday, with early regional figures pointing to a similar retreat in price gains. The 20-nation euro area figures will be reported on Thursday.

Money-market traders trimmed rate bets and are no longer fully pricing another 50 basis points of hikes this year. German bonds rallied, with two- and five-year yields falling as much as 10 basis points. The euro held losses, trading near a two-month low of $1.0673 touched Tuesday.

What Bloomberg Economics Says...

“Lower-than-expected readings for France and Spain add modest downside risks to our forecast for euro-area inflation. We forecast that headline inflation will decline to 6.2% in May from 7.0% in April and core to 5.4% from 5.6%.”

—Maeva Cousin, senior euro-area economist. Click here for full REACT

While the retreat in headline price growth will be welcomed by both the ECB and France’s government, underlying pressures aren’t abating as quickly and continue to be a headache for both.

Bank of France Governor Francois Villeroy de Galhau said last week that core inflation is “showing persistence,” and services will likely become the dominant force driving prices.

Speaking after Wednesday’s data, he described the composition of price growth as encouraging, saying the downward shift means it is “probable we’ve passed the peak.”

“Part of this can doubtless be attributed to the first effects of monetary-policy transmission,” Villeroy said.

His ECB Governing Council colleague Madis Muller said there’ll probably be more than one more quarter-point hike, warning that underlying inflation “unfortunately shows no signs of slowing yet.”

ECB Vice President Luis de Guindos said the data from Spain and France are positive, but the battle isn’t won.

“I could not say that the victory is there so far,” he said in Frankfurt. “I think that we are on the correct trajectory and we have to look very carefully at the evolution of core inflation.”

In France, the rising cost of living is proving trickier for President Emmanuel Macron to alleviate than the spike in energy costs. As part of a campaign to narrow profit margins, the Finance Ministry has pressured large food companies to renegotiate prices and supermarkets.

“Retailers have stuck to their commitments,” Finance Minister Bruno Le Maire said Wednesday. “Industrial food manufacturers, who committed in my office to return to the table for commercial negotiations to translate this decrease in inflation into prices on supermarket shelves, must respect their commitments.”

In a separate release, Insee said consumer spending fell 1% in April as households cut back on food and energy outlays. Economists polled by Bloomberg had expected a 0.3% increase.

--With assistance from Joel Rinneby, Ainhoa Goyeneche, James Regan, Ott Tammik, Jana Randow and Constantine Courcoulas.

(Updates with Bank of French chief in eighth paragraph.)