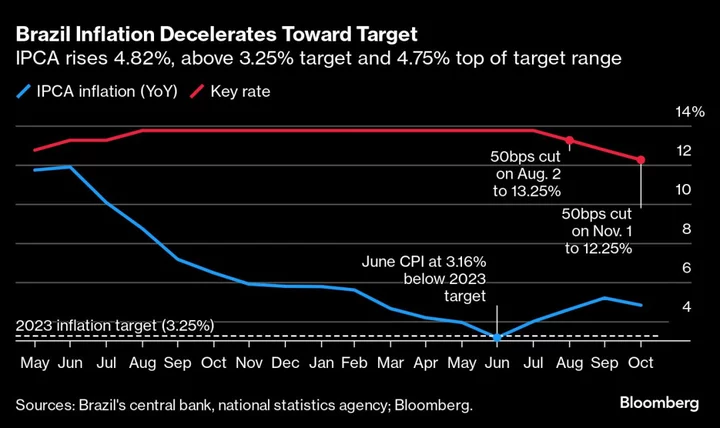

Brazil’s annual inflation rate dropped more than expected, nearing the official target range after policymakers committed to maintaining their current pace of interest rate cuts for the coming months.

Official data released Friday showed consumer prices rose 4.82% in October from a year earlier, below the 4.87% median estimate of analysts surveyed by Bloomberg. Monthly inflation hit 0.24%.

The central bank is set to deliver two more half-point cuts in as many meetings and bring the benchmark Selic to 11.25% by the end of January. Double-digit borrowing costs are starting to cool economic activity while favorable base effects and waning transportation pressures are helping rein in year-on-year inflation readings.

Read More: Brazil Central Bank Pledges Half-Point Cuts Only Through January

Swap rates on the contracts due in January 2025, which indicate market sentiment about monetary policy at the end of next year, fell five basis points in morning trading following the slower-than-expected inflation reading.

A slowdown in price increases combined with signals of weaker growth led central bankers to begin lowering the Selic from a six-year high in August to its current level of 12.25%. But some key indicators such as retail and the labor market continue to outperform economists’ forecasts.

In October, eight of the nine groups of goods and services monitored by the statistics agency became more expensive. Transportation costs gained 0.35% on higher air fares and food and beverages increased 0.31%, while communication prices dropped 0.19%.

Read more: Brazil Oct. IPCA Consumer Price Index by Component (Table)

Policymakers say progress has been made in controlling the price surge that ensued following the re-opening of Latin America’s biggest economy, though they remain concerned about pressures at home and abroad that could complicate the path of monetary easing.

Brazil President Luiz Inacio Lula da Silva is eyeing increasing public spending next year, Israel’s military offensive is raging in Gaza and US Treasury yields remain high.

Andres Abadia, chief Latin America economist at Pantheon Macroeconomics, said easing price pressures from a weaker economy could keep the disinflation trend going for up to six months.

“The main threat to this relatively benign outlook is potentially deteriorating financial conditions, on the back of increased fiscal uncertainty and geopolitical risk,” he wrote in a research note.

The annual inflation rate remains above both the 4.5% ceiling and 3% mid-point of the central bank’s 2024 and 2025 inflation target range.

--With assistance from Giovanna Serafim.

(Updates with market impact in fourth paragraph and inflation details in sixth paragraph.)