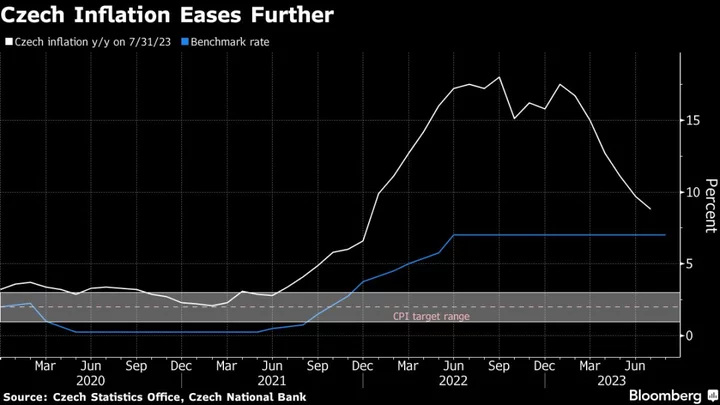

Czech inflation eased further in July, boosting arguments for the central bank to start discussions about the timing and pace of monetary easing.

Consumer prices rose 8.8% from a year earlier, the lowest reading in 19 months, according to data published by the statistics office. The figure was in line with market consensus and slightly below the central bank’s projection for the month.

The Czech National Bank also said Thursday that core inflation, a measure of underlying domestic price trends, slowed to 6.8% in July and was below its 6.9% forecast. Weak household demand is preventing producers, retailers and service providers from further increasing their profit margins, it said.

“The observed price developments bear out the expectations of the summer forecast that inflation will continue to fall sharply during summer,” the bank said on its website. “The downward trend in annual inflation will temporarily halt in October, but only as a result of the statistical effect of the energy savings tariff introduced at the end of last year. After its fade-out, inflation will fall sharply to close to the CNB’s 2% target early next year.”

Easing Debate

The Czech Republic is recovering from the worst cost-of-living crisis in three decades as lower energy costs, improving global supply chains and depressed household consumption curb growth in prices of goods and services. The central bank expects inflation to ease to its 2% target next year, although policymakers say that domestic and foreign risks still warrant a cautious approach to rates.

The bank’s fresh forecast implies policy easing starting in the third quarter, and Governor Ales Michl said the debate about lowering borrowing costs may begin this fall. But he also warned that rate cuts may come later and proceed at a slower pace than most investors expect.

Money-market prices indicate bets on about 100 basis points of cuts this year, starting as soon as September, although several officials have said that such wagers appeared overdone.

“Slowing inflation and still-weak household consumption in the domestic economy are overall factors that should open the debate about potential rate cuts,” said Radomir Jac, chief economist at Generali Investments CEE. “A drop in borrowing costs before the end of the year remains a possibility.”

(Updates with core inflation, central bank comments from third paragraph.)