China’s manufacturing contracted in July, rippling through factories across Asia and signaling any turnaround in the region could still be far off.

The Caixin manufacturing purchasing managers index declined to a six-month low of 49.2 in July from 50.5 in June, below the key 50 level that marks a contraction, a private survey showed Tuesday. The official manufacturing PMI released Monday also showed a decline in China’s factory activity last month.

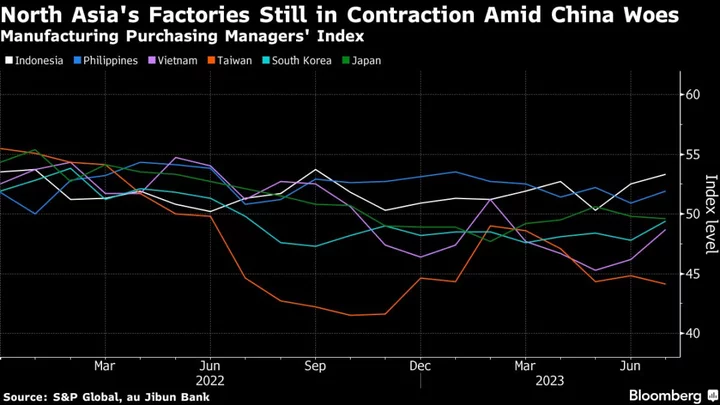

China’s faltering recovery weighed on Asian manufacturing powerhouses, especially in North Asia. Taiwan’s PMI slid to an eight-month low of 44.1, while Japan’s dipped slightly to 49.6, according to S&P Global and au Jibun Bank.

The PMI readings cloud the outlook for Asia, which was banking on a manufacturing revival to help drive economic growth after the easing of pandemic restrictions and supply chain bottlenecks. A disappointing rebound in China, combined with sticky inflation in the US and Europe, are sapping demand for the region’s goods.

The Caixin survey covers mainly smaller and export-oriented businesses compared with the official PMI. Manufacturers reported muted foreign demand as a key factor weighing on total sales, with new export orders down noticeably in July.

The data offers fresh evidence that China’s economic momentum weakened further in July. Consumer spending remains subdued, while the property market shows no signs of a turnaround.

Investors, though, have turned optimistic in recent days over potential policy stimulus after China’s top leaders promised to boost the capital market and signaled more support for the housing sector. However, Beijing has stopped short of providing direct cash support to consumers and providing any major fiscal or monetary stimulus.

In Taiwan, “declines in output, new orders and export sales all gathered pace, with firms blaming weaker global economic conditions and high inventory levels at clients,” said Annabel Fiddes, an economist at S&P Global Market Intelligence.

South Korea’s PMI improved slightly to 49.4 in July, but was still below the 50 mark that signals a contraction. It was its softest decline in a year, nudging manufacturers to increase staffing and purchasing.

Domestic demand partly helped insulate Southeast Asia, with new business and steady production propelling factory activity to expand to a region’s best 53.3 in Indonesia and 51.9 in the Philippines. The downturn in manufacturing hub Vietnam, meanwhile, eased to 48.7 from 46.2 amid subdued demand in its export markets.

(Updates with more details throughout.)