The first exchange-traded fund tracking Saudi Arabian shares debuted today in Hong Kong, marking the largest of its type to trade in the city this year and underscoring efforts by the Middle Eastern country and the Asian financial hub to build closer ties.

The CSOP Saudi Arabia ETF, domiciled in Hong Kong, is Asia’s first to focus on shares listed in Riyadh. It has more than $1 billion in assets and counts Saudi Arabia’s sovereign fund as a top investor.

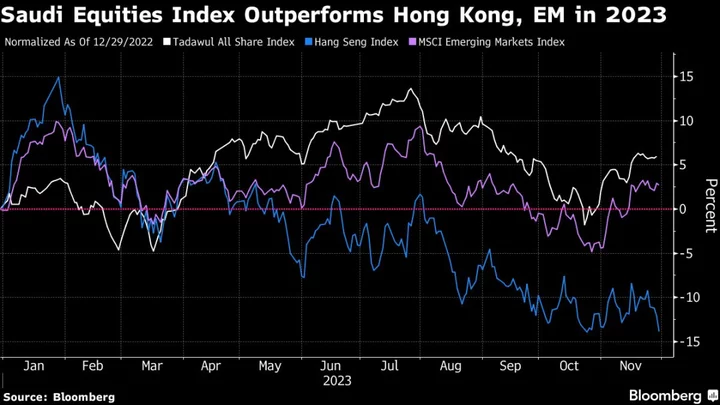

Hong Kong last month announced steps to boost investor activity to counter a slump in average trading volume. While a 14% slide puts the Hang Seng Index on course for a fourth consecutive year of losses, the volume of shares traded in Riyadh has risen and a 6% gain in its main equities gauge in 2023 is outperforming emerging market peers.

“The Saudi market is expected to more than double by 2030. There is a lot of interest in this market,” said Rebecca Sin, an analyst at Bloomberg Intelligence in Hong Kong. Apart from having oil giant Saudi Aramco as the second-biggest holding, the fund is “very financial heavy,” a group favored by Hong Kong investors, she added.

CSOP is working on a cross-listing for the fund in mainland China, the company’s Chief Executive Officer Ding Chen said in an interview with Bloomberg Television. The Public Investment Fund is “one of the leading investors” in the ETF, Chen said, without disclosing the amount. The listed fund tracks the FTSE Saudi Arabia Index.

Hong Kong Exchanges & Clearing’s CEO Nicolas Aguzin said during a visit to Saudi Arabia last month that there’s “much to do between the Middle East and Hong Kong.” He cited the potential for cross-listings between the two regions and increased capital flows. In September, the Shanghai and Saudi Arabia stock exchanges signed an accord to cooperate in areas such as cross listings, financial technology, ESG and data exchange.

Hong Kong’s leader John Lee, who visited Saudi Arabia in February as part of a broader trip to the Middle East, made it clear then that his goal is to persuade Saudi Aramco to list in the Asian hub despite competition from rivals such as New York and London. Still, there’s no indication that a dual listing is underway.

Read More: Saudi Arabia ETF Listing in Hong Kong Could Trigger China Flows