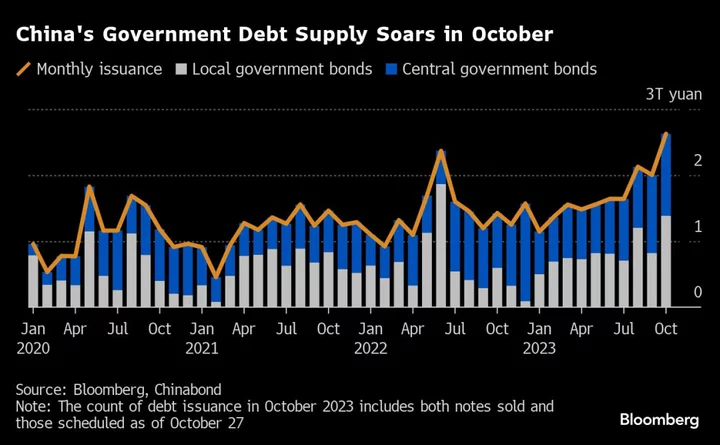

China’s central and local governments extended their borrowing spree in October to reach a new monthly high, buoyed by Beijing’s fiscal stimulus to support the economy.

The country is on track to sell 2.6 trillion yuan ($360 billion) of onshore sovereign notes and local government bonds during the month, higher than any other month this year, according to Bloomberg calculation based on Chinabond data. The October total is also 63% above the monthly issuance average in the first nine months.

The issuance hike mirrors the central government’s effort to accelerate spending, as the economy is saddled with weak business confidence and a deep property market slump. The Ministry of Finance plans to issue an additional one trillion yuan in sovereign bonds before the year-end in a rare mid-year revision to fiscal budget.

Supply pressure for the bond market will remain elevated throughout the fourth quarter, according to Citic Securities. The PBOC will possibly need to reduce reserve ratio for banks to unleash more liquidity, or even cut interest rates to guide borrowing costs lower within the year, Ming Ming, chief economist at the firm, wrote in a note.

October’s sovereign bond issuance climbed 5% to 1.24 trillion yuan from a month earlier, the most since December 2022.

Local governments, looking to boost regional investment and defuse risks in their off-balance sheet debt, are on course to sell 1.38 trillion yuan of debt in October, the most since June 2020. The total largely consists of 1.11 trillion yuan of refinancing bonds that can be used to repay financing vehicles’ debt.

Banking system liquidity has been sapped by intensive debt sales, driving up the benchmark government bond yield earlier this month to its highest since May.