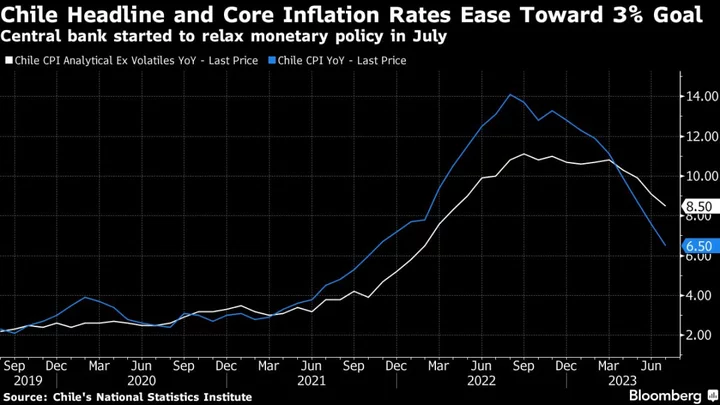

Chile’s annual inflation eased broadly in line with forecasts in July, a month that ended with the central bank delivering a larger-than-expected interest rate cut and indicating more big reductions to come.

Consumer prices rose 6.5% from a year prior, just above the 6.4% median estimate of analysts in a Bloomberg survey. Monthly inflation stood at 0.4%, the national statistics institute reported on Tuesday. A closely-watched price gauge that excludes volatile items increased 8.5% in 12 months and 0.3% from June.

Price-growth is heading toward the 3% target after policymakers held borrowing costs at an over two-decade high for nearly a year. In a statement with last month’s rate decision, central bankers wrote both headline and core inflation have eased faster than expected. Still, in recent days the peso has weakened and gasoline prices have started to tick up, stoking import costs.

What Bloomberg Economics Says

“Slower headline and core inflation in July add evidence that upward pressure on prices from supply shocks and excess domestic demand are easing in Chile. The results support the central bank’s 100-basis-point rate cut in July and our expectation for policymakers to continue quickly cutting rates and move toward less-tight monetary conditions.

— Felipe Hernandez, Latin America economist

— Click here for full report

Read more: Chile Delivers Jumbo Rate Cut as Latin America Pivots to Easing

Food and non-alcoholic beverages rose 1.2% on the month while recreation and culture costs gained 1.9%, representing two of the top price drivers in July, according to the national statistics institute. On the other hand, household items fell by 0.7% and transportation dipped by 0.2%.

While the July report “doesn’t change the trend of inflationary stabilization,” the continued decline in the peso could affect the pace of the consumer price slowdown, according to Jorge Selaive, chief economist at Scotiabank Chile. The peso has fallen over 7% against the dollar since the start of July.

Meanwhile, demand in one of Latin America’s richest nations continues to cool after billions of dollars of early pension withdrawals and government cash transfers propelled record economic growth in 2021. Activity rose in June, according to the latest central bank data, though a jump in the volatile mining sector masked declines in other areas such as commerce and services.

Swaps are now pricing a key rate cut of about 75 basis points to 9.5% in September, with borrowing costs seen at 5% in 12 months.

Chile’s central bank forecasts annual inflation will hit the target next year.

--With assistance from Rafael Gayol.

(Updates with economist comments and details from the inflation report starting in fourth paragraph)