Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

US employers tempered the pace of hiring while worker pay accelerated unexpectedly, illustrating a healthy yet moderating labor market that keeps the Federal Reserve on track to raise borrowing costs this month.

A decline in Germany’s industrial output suggested sustained manufacturing weakness in Europe’s largest economy. Inflation expectations remained elevated in the UK and services activity in China grew at a slower pace.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

US job gains moderated and wage growth remained firm in June. The 209,000 increase in payrolls was the smallest since the end of 2020, marking the first time in 15 months that employment growth fell short of estimates. A look beneath the still-healthy headline numbers shows some cracks are starting to form.

The US service sector expanded in June at the fastest pace in four months as business activity and orders quickened. The manufacturing report, out earlier this week, showed factory activity contracted at the fastest pace in more than three years.

Europe

German industrial production unexpectedly fell in May, casting a shadow over the recovery in Europe’s largest economy from its recent recession. In contrast with a separate report this week that showed a rebound in factory orders, the output data pointed to signs of continuing deterioration that chime with a recent litany of dire news from German businesses.

UK companies are expecting inflation to be running at almost double the Bank of England’s target three years from now, a survey showed as traders ramped up bets on higher interest rates.

Asia

Expansion in China’s services industry slowed in June from the previous month, according to a private survey, providing more evidence that the key driver of the country’s post-Covid recovery is cooling. The data will likely spur more calls for the government to ramp up measures to support growth.

Japanese workers’ wages jumped by more than twice the pace expected by economists as annual pay hikes fed into monthly data, offering the central bank a sign that upward momentum in pay may be strengthening. The unexpectedly strong figure could strengthen the view that the BOJ might consider a policy adjustment in the near future without waiting to see the results of next year’s wage negotiations.

Emerging Markets

Mexico’s inflation slowed slightly less than expected in June, as Banxico has sought to maintain its restrictive monetary policy stance. While inflation has been slowing, the central bank has yet to declare victory as prices continue rising above its target of 3% a year, plus or minus 1 percentage point.

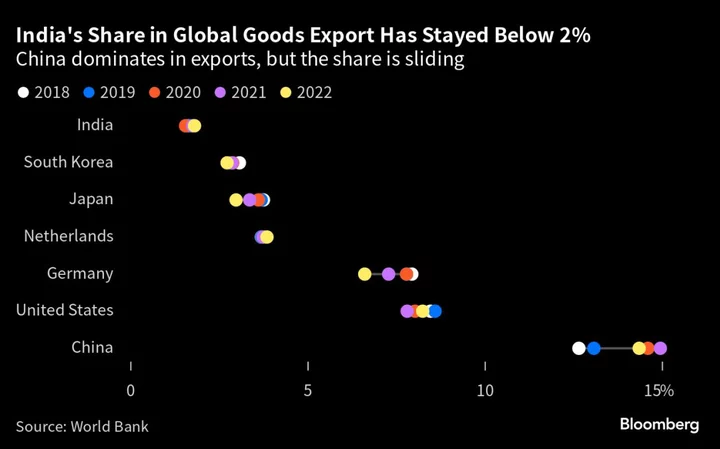

India’s year-old campaign to boost the rupee’s role in cross-border payments has made little headway, according to people familiar with the matter, underscoring the challenges for countries trying to reduce their dependence on the dollar.

World

Sri Lanka cut its benchmark rate for a second consecutive meeting. Australia kept rates on hold but left the door open to future hikes, while Malaysia, Kazakhstan and Poland also left interest rates unchanged.

--With assistance from Leda Alvim, Maya Averbuch, John Liu, Ana Monteiro, Tom Rees, Anup Roy, Reade Pickert, Augusta Saraiva, Subhadip Sircar, Fran Wang, Alexander Weber, Sonja Wind and Erica Yokoyama.