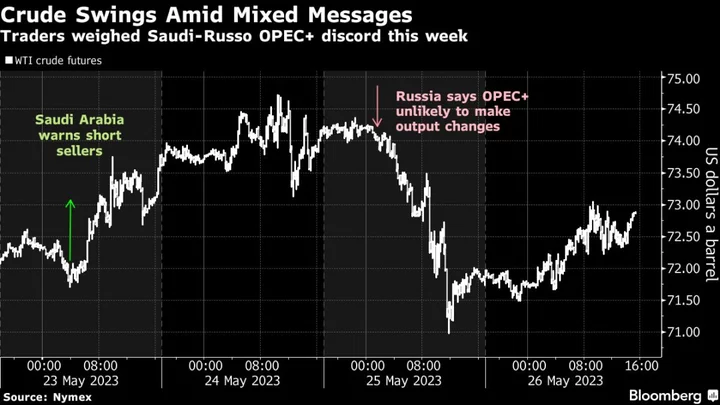

Oil headed for a fourth weekly loss after sinking into a bear market as signs of healthy supplies and rising stockpiles offset attempts by OPEC+ leaders Saudi Arabia and Russia to keep declines in check.

West Texas Intermediate traded near $73 a barrel after dropping more than 20% from a high in September. Global benchmark Brent plunged almost 5% on Thursday. The declines followed a build in US crude inventories, and were likely amplified by automated selling programs.

Crude’s run of four straight weekly declines — the longest losing streak since May — has come despite collective and voluntary supply cuts by the Organization of Petroleum Exporting Countries and its allies. The losses have also been abetted by the evaporation of an Israel-Hamas war risk premium as fears the conflict would expand and disrupt oil supplies have so far not eventuated.

Terminal users can click here for more on the Israel-Hamas War.

The International Energy Agency said earlier this week that production growth means the global market won’t be as tight as had been expected this quarter, adding pressure on OPEC+ ahead of a meeting on its supply policy on Nov. 26.

“We believe that OPEC will ensure that Brent oil prices end up in a $80-to-$100 range in 2024 by ensuring a moderate deficit and leveraging its pricing power,” Goldman Sachs Group Inc. analysts including Daan Struyven said in a note. The latest selloff was driven by non-OPEC supply topping expectations, they said.

Data midweek showed nationwide US crude stockpiles expanded for a fourth week to hit the highest level since August. Some of that increase came at the key hub in Cushing, Oklahoma, where holdings expanded by more than 8%.

There have also been some clouds on the demand horizon. Figures from China, the world’s largest importer of crude, showed that refiners cut daily processing rates in October as apparent oil demand fell from a month earlier. Meanwhile, US unemployment benefits rose to the highest level in almost two years, signaling a slowdown in the world’s biggest crude consumer.

“The string of weak macro data, coupled with rising US crude stockpiles, triggered the sell-down in oil,” said Han Zhong Liang, investment strategist at Standard Chartered Plc. WTI prices are likely to be sluggish on the back of a slowing global economy, he added.

Pricing patterns along the futures curve point to looser conditions. The spread between Brent’s two nearest contracts was 12 cents a barrel in contango — where near-term prices are below longer-dated ones. That compares with more than $1 a barrel in backwardation a month ago.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

--With assistance from Matthew Burgess.