Bitcoin trading volume tumbled last month amid waning volatility and little notable price swings in a market that speculators traditionally gravitate to for its turbulence.

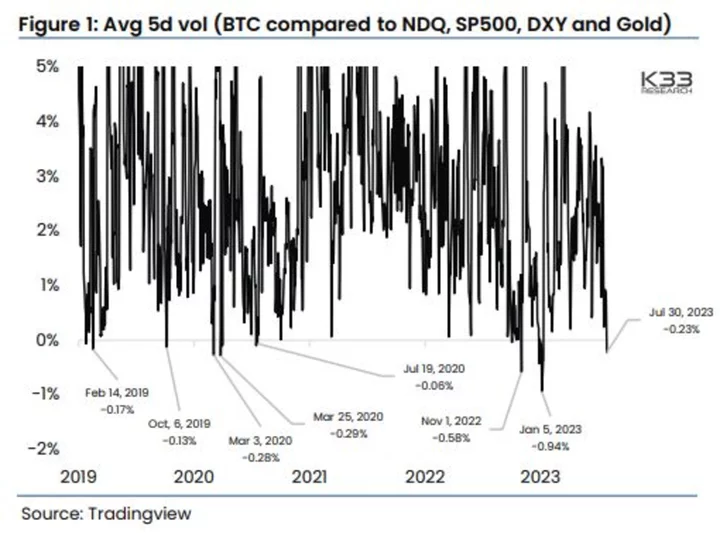

July saw the lowest monthly trade volume for Bitcoin since November 2020, according to data from K33’s Bendik Schei and Vetle Lunde. The drop-off happened as volatility also plummeted, with the digital currency’s five-day volatility sitting below that of the S&P 500, tech stocks and gold, “a rare feat that has previously foreshadowed substantial volatility eruptions in the near term,” they wrote in a Tuesday note.

Bitcoin’s 30-day volatility is, in fact, sitting near five-year lows at levels only seen on eight occasions since January 2019.

“The market is clearly in an unprecedented stable stage, which has typically acted as a massive pressure valve for volatility once it finally re-ignites,” Schei and Lunde said. “Traders should thus be vigilant.”

The largest digital coin, at around $28,800, is hovering near the bottom of a new range it carved out following excitement over BlackRock Inc.’s application to issue the first-ever spot-Bitcoin ETF in the US. Prices have declined as commotion over such a product — which other ETF issuers are also trying for — has died down, among other reasons.

“Even though the die-hard supporters keep trading it, those who are always looking for where the action in at any given time have moved on from Bitcoin,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Active traders seem to have moved on from the crypto market, at least for the time being. That’s not good for an asset that is breaking below a sideways range.”

Many market-watchers have been tracking trading volumes fastidiously given that a great number of investors had left crypto altogether following 2022’s string of scandals and company downfalls, which left mom-and-pop investors, in particular, saddled with losses. In addition, a “substantial portion” of the decline can be attributed to exchange Binance’s re-introduction of trading fees, according to K33.

Despite the tailwinds of a possible Bitcoin ETF and some recent regulatory clarity for the sector, large investors are still in no rush to enter the crypto market, says Noelle Acheson, author of the “Crypto Is Macro Now” newsletter. That could be for a few reasons, including still-ongoing uncertainties, such as potential future adverse rulings on ongoing legal cases and the unveiling of some recent DeFi vulnerabilities, among other things. As to professional investors, they tend to move in packs and aren’t yet seeing others stepping in.

“Market volumes are unlikely to increase significantly until volatility picks up — in crypto, volatility is a feature, not a bug,” she said. But, she added, “all it takes is one big announcement — a new large market participant, maybe a known hedge fund or maybe a second-tier central bank — or a favorable Grayscale ruling — to encourage some brave investors to take the first step, and then we could get a stampede.”