Broadcom Inc., one of the world’s biggest chipmakers, predicted that sales tied to artificial intelligence are on track to double this year, helping offset a broader slowdown in technology spending.

Chip revenue from companies building out their AI capabilities could grow to $1 billion per quarter, Chief Executive Officer Hock Tan said during a conference call Thursday that followed Broadcom’s quarterly earnings release. AI-related chip sales could be more than 20% of the company’s total soon, he said.

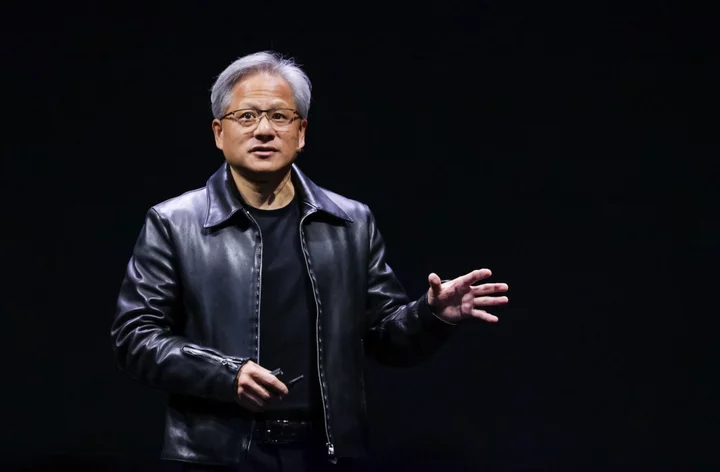

The outlook suggests that Nvidia Corp. isn’t the only chipmaker benefiting from the AI frenzy. Broadcom’s networking components help direct traffic between computers in giant data centers, and it makes custom chips for some of the biggest cloud computing providers. Those customers have been racing to add more capacity to handle demand for AI services — a trend that helped send Nvidia near the $1 trillion valuation threshold this week.

Tan’s remarks helped Broadcom’s stock pare its losses after a decline of more than 3%. They were down about 1.5% as of 5:37 p.m. New York time.

The shares had closed at $789.95 in New York, leaving them up 41% this year. That makes them one of the best-performing semiconductor stocks in 2023.

Broadcom is still contending with a industrywide slump in tech demand, and its overall sales growth has decelerated sharply since a pandemic-fueled surge in recent years.

Revenue in the fiscal third quarter will be about $8.85 billion, up 4.6% from a year earlier, the company said in an earlier statement Thursday. Though that tops the analyst estimate of $8.76 billion, it would represent Broadcom’s slowest growth in years.

Tan had warned analysts and investors that pandemic boom times wouldn’t last. The shortages of the past few years have given way to an inventory glut in some areas, prompting customers to put off new orders.

In touting Broadcom’s AI gains, Tan is using a now-common tactic for tech companies. But, like others, he hasn’t yet matched the dramatic increase that his counterpart Jensen Huang at Nvidia is seeing. Broadcom may be growing in a weakening overall market, but Nvidia predicted a jump in sales of more than 60%.

Broadcom’s chips go into smartphones and home networking — in addition to data centers — making it a bellwether for a wide swath of tech spending. The company had previously said it would have full order books for the rest of the fiscal year, which ends in October.

In the second quarter, which ended April 30, Broadcom’s profit was $10.32 a share, excluding some items. Revenue rose 7.8% to $8.73 billion, marking the first time the growth has been below 10% since 2020. Analysts had predicted earnings of $10.15 a share and sales of $8.72 billion.

Broadcom’s chip business had sales of $6.81 billion in the quarter, a gain of 9% from a year ago. Infrastructure software rose 3% to $1.93 billion.

Broadcom supplies semiconductors to Apple Inc. for the iPhone that provide short-range connectivity. The chipmaker had warned earlier that wireless sales would slow in the second quarter.

Broadcom, based in San Jose, California, also has branched out into enterprise software by acquiring security and mainframe capabilities. A planned purchase of cloud software maker VMware Inc., though, is facing regulatory scrutiny and has taken longer than expected to close. That company also posted quarterly results after the close on Thursday, reporting sales and earnings missed estimates.

Broadcom said it’s making good progress clearing regulatory hurdles and still expects the VMware deal to close in fiscal 2023.