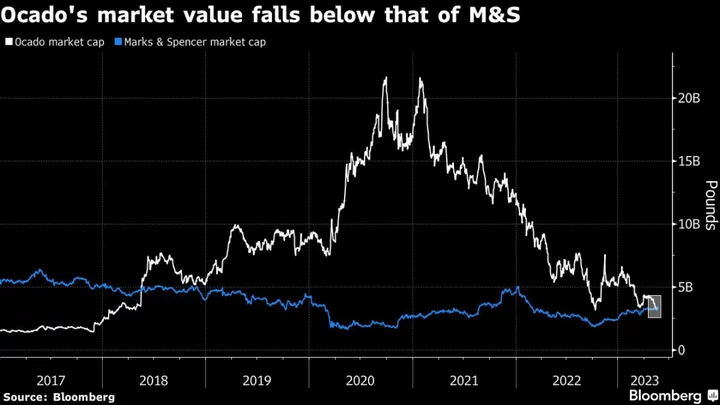

The market value of online grocer Ocado Group Plc fell below that of joint venture partner Marks & Spencer Group Plc, five years after it first overtook the UK retailer, as investors focus on profitability and as demand for robotic warehouses slows.

Marks & Spencer shares jumped 7.2% in London on Wednesday, lifting its capitalization to £3.4 billion ($4.2 billion), after the company reported better-than-expected earnings and said it plans to reinstate its dividend. Meanwhile, Ocado shares slipped 1.7%, taking their year-to-date fall to 36% and putting its market value at £3.2 billion. The drop has put the shares on track for demotion from the UK’s benchmark FTSE 100 Index.

It marks a reversal of fortunes for Ocado, whose stock soared in 2018 after a landmark deal to build robotic warehouses and license software to US supermarket chain Kroger Co. The deal boosted the online grocer’s credentials as a technology company, putting its valuation multiples squarely in line with Amazon.com Inc.

“Investors want Ocado to define a clearer route to cash-flow break-even that doesn’t rely on signing lots of deals,” said Andrew Gwynn, an analyst at BNP Paribas Exane.

The company declined to comment on the fall in its market value.

Ocado has partnerships with Sobeys Inc. in Canada, Coles Group Ltd. in Australia, Casino Guichard-Perrachon SA in France, Lotte Shopping Co. in South Korea as well as others. Even so, the UK online grocer has reported annual losses since 2018, and analysts don’t expect it to become profitable until the 2026 fiscal year, according to Bloomberg Consensus estimates.

JPMorgan recently lowered its price target on Ocado and said the shift toward more automated warehouses is likely to remain slow. “In-store picking solutions appear to be the preferred choice for established supermarkets at this point,” analyst Marcus Diebel wrote in a note earlier this month.

Ocado is making a push into other areas. This month, it agreed to buy 6 River Systems from Shopify Inc., which Morgan Stanley analysts said was designed to help the UK company’s ambitions to secure non-grocery contracts. 6 River Systems has developed a robotic product that provides automated assistance to pickers in a warehouse, and its so-called Chuck robots are currently deployed in more than 100 warehouses worldwide.

Still, it may take some time before non-grocery deals begin to materialize, putting pressure on other parts of Ocado’s business.

“Investors are losing patience with Ocado Solutions, which is meant to be the long-term powerhouse of the company,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown. “Demand for robotic warehouse solutions remains far weaker than hoped, while M&S core customers seem more resilient amid the cost-of-living crisis.”

--With assistance from Michael Msika and Jan-Patrick Barnert.