The Bank of Japan further loosened its grip on government bond yields while remaining the last of its peers to cling to a negative interest rate in a decision that prompted a retreat in the yen.

The BOJ said it will take a more flexible approach to controlling yields on 10-year government debt, saying the 1% level was now a reference point, according to its statement Tuesday. That marks a shift from a previous pledge of daily bond purchases at 1%, a stance that effectively drew a clear line in the sand there.

Though the central bank also raised its inflation forecasts, it emphasized the need to keep policy easy as it waits for more signs of sustainable wage and price growth. The BOJ remains in a tough spot, caught between a weakening yen and rising yields that are putting pressure on its stimulus framework.

The decision disappointed investors expecting a clearer sign of policy normalization that could have stabilized the currency. It also left others confused about the central bank’s intentions.

“The BOJ couldn’t sit around doing nothing given the market speculation that inaction would trigger a further slide in the yen and risk causing more trouble for the government,” said Yasunari Ueno, chief market economist at Mizuho Securities. He noted that the bank stopped short of raising the fixed rate of its daily bond buying operations.

“This decision was the product of compromise for a BOJ in dilemma. Traders probably sensed it and that’s partly why the yen weakened even after the tweak,” he said.

The yen had strengthened overnight after the Nikkei first reported a move to allow yields edge higher was in the offing, but the Japanese currency quickly weakened beyond the 150 mark against the dollar after the actual decision. That suggests market players still see the BOJ very much committed to a stimulus stance that marks it as an outlier among global central banks.

Earlier Japan’s 10-year yield jumped at the start of trading to a fresh decade high of 0.955% before paring gains.

The decision comes amid a new global central bank mantra of elevated interest rates for longer. While the European Central Bank kept rates steady at its meeting last week and the Federal Reserve is expected to hold policy unchanged on Wednesday, both have indicated that high rates will remain in place for some time to come.

The BOJ remains the only major monetary authority sticking doggedly to negative interest rates as it seeks to spur inflation, while its peers look to suppress price pressures with tighter policy. That’s helping drive the yen down.

While Japan’s central bank is edging closer to a policy pivot, with economists flagging next spring as a likely timing, the latest move suggests pockets of caution remain internally.

Before the decision, three quarters of the 45 economists surveyed by Bloomberg forecast no policy change in a survey that closed just over a week ago. Further moves in bond and currency markets and inflation readouts after that poll helped fuel speculation that tweaks were more likely to come.

If the shift was partly aimed at boosting the yen, it appeared to fail in that respect.

Japan’s government had to intervene on three different days last year to prop up the currency. Policy makers at the finance ministry would likely have welcomed a firmer move that helped push the yen away from intervention territory.

The decision to allow yields to inch up also has implications for Japanese Prime Minister Fumio Kishida as he struggles to find ways to pay for ramped up spending on defense and childcare, while also promising tax cuts to help cushion the blow of inflation. Higher yields on government debt mean that financing spending through bonds and rolling over debt will become more expensive.

Still, in terms of keeping YCC in operation before a more meaningful change in policy in the coming months, the move may have bought the BOJ some time.

“BOJ is still inching towards policy normalization, but the step in terms of YCC tweak falls short of speculation of bolder change,” according to Moh Siong Sim, FX strategist at Bank of Singapore. “We think there will be scope for the yen to significantly outperform in 2024 when we expect the Fed to cut rates and the BOJ to speed up normalizing policy. Focus shifts back to currency intervention watch for now.”

Governor Kazuo Ueda has indicated the importance of sticking with ultra-easy policy to nurture the economic recovery as the bank steadily approaches its long-sought inflation goal. In particular he has cited the importance of strong wage growth to support a positive inflation cycle before pivoting on policy. Economists expect that move to come early next year.

What Bloomberg Economics Says...

“We think this is designed to relieve pressure on the framework — not a fundamental pivot from the BOJ’s dovish policy stance. The central bank also said it might increase the amount of its JGB buying operations.”

— Taro Kimura, economist

For the full report, click here

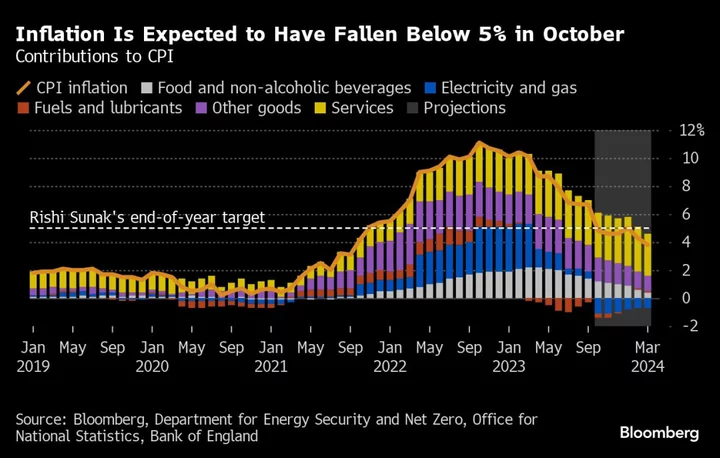

The BOJ upgraded its inflation projections, saying it now expects a key price gauge to stay well above its 2% target for three consecutive years through fiscal 2024. The nation hasn’t seen such steady price growth since 1992.

The new forecast projects 2023 price growth at 2.8%, in stark contrast to the BOJ’s initial 1.1% projection issued soon after Russia invaded Ukraine last year. The bank expects the same pace of price growth in the following year, too. But in the final year of the projection period it sees inflation weakening below 2%, a factor that it may use to justify continued caution on changing policy.

The upgraded price forecasts left a strong impression on Mizuho’s Ueno.

“It’s as if they are waiting to shout ‘bingo’ before scrapping negative rates,” Ueno said. “I see there is a good chance for the end of negative rate in April, but Ueda’s BOJ moves when it can, so I can’t rule out a chance of that happening in March or even before.”

--With assistance from Yoshiaki Nohara and David Finnerty.

(Adds analyst comments and more details from release)