The Bank of England warned that UK households renewing their mortgage deals will probably have to pay almost £3,000 a year more after the benchmark lending rate surged to a 15-year high.

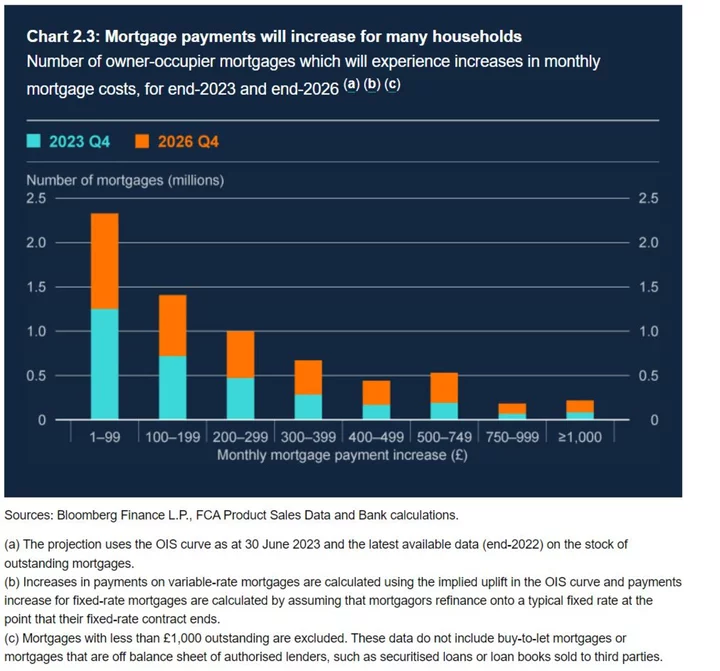

The assessment in the central bank’s Financial Stability Report showed that more than 4 million mortgage holders will face higher rates when they renew their deals by the end of 2026.

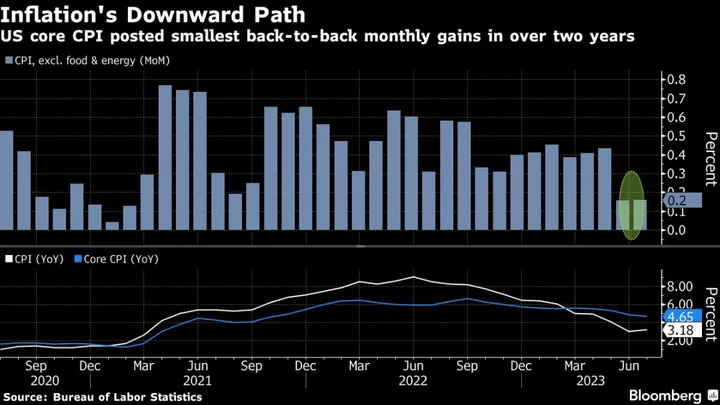

The figures underscore the strain on households that the BOE has delivered in its quickest series of rate rises in three decades. The action is meant to slow the economy and rein in inflation that at 8.7% remains more than four times higher than the BOE’s target, but it means real pain for consumers already coping with the tightest squeeze in living standards in generations.

The BOE said that a typical household rolling off a fixed-rate deal in the second half of 2023 face a £220 per month increase in their mortgage costs based on current rates — equivalent to £2,640 a year.

By the end of 2026, about 1 million households will have seen their payment go up by more than £500 a month. This assumes they refinance at the same maturity, but about 15% of mortgagees have extended the length of their loans. Some are repaying using their savings, which reduces the quantity of mortgages they are refinancing.

The warning comes after Moneyfacts revealed that the average rate for fixed two-year home loans rose to 6.66%, the highest since August 2008. The pain for homeowners could get even worse as the BOE is forced to ramp up interest rates to stamp out inflation that has proven surprisingly sticky.

While mortgage arrears remain low by historical standards, the BOE’s Financial Policy Committee said they are increasing and that it will “take time for the full impact of higher interest rates to come through.”

The BOE said that around half of mortgage holders — around 4.5 million — have already rolled onto new deals since the start of its hiking cycle in December 2021. Those remaining will face even higher rates are the recent surge.

The BOE also warned that an exodus of buy-to-let landlords facing higher mortgage costs threatens to hit house prices.

“Falling profitability could, in principle, cause landlords to sell their property investments and exit the buy-to-let market,” the Financial Stability Report said. “If this were to happen in large enough volumes, it could put downward pressure on house prices.”

Read more:

- Largest UK Lenders Pass Latest Bank of England Stress Tests

--With assistance from Philip Aldrick.