The billionaire founder of crypto’s biggest exchange Binance Holdings Ltd. sought to defend the platform following the exits of executives who had been helping the company navigate a widening regulatory crisis.

Changpeng ‘CZ’ Zhao said “we continue to BUILD, and continue to hire” in a tweet on Friday after Binance’s chief strategy officer, general counsel and a compliance official departed, stirring fresh questions about the outlook for an exchange that’s facing probes in the US, Europe and Asia Pacific.

Zhao has repeatedly had to counter what he terms “FUD” — or fear, uncertainty and doubt — amid a decline in Binance’s share of spot crypto trading volumes as officials turn up the heat. The platform has become the poster child for a drive by regulators to tighten oversight of the digital-asset sector after a $1.5 trillion rout last year and a series of bankruptcies, including at rival FTX.

Patrick Hillmann, Binance’s chief strategy officer who joined in 2021, tweeted he was leaving “on good terms.” Steven Christie, senior vice president for compliance, and Hon Ng, general counsel, have also left, a person familiar with the matter said. The new general counsel will be Eleanor Hughes, said the person, who asked not to be named discussing private information.

Binance employed nearly 600 employees in the US, according to LinkedIn. During midyear performance reviews in June, various of these staffers were asked whether they would be willing to relocate and some of those who declined were let go, the person familiar with the matter said.

Yibo Ling, chief business officer of Binance, was among the US staff that have left, according to the person familiar with the matter. Ling didn’t immediately respond to a request for comment via a LinkedIn message.

“Yes, there is turnover (at every company),” Zhao wrote in his tweet. “But the reasons dreamed up by the ‘news’ are completely wrong.” Zhao said Binance grew from 30 to 8,000 people in six years and remains the largest crypto exchange, adding “we have been able to protect our users at all times.”

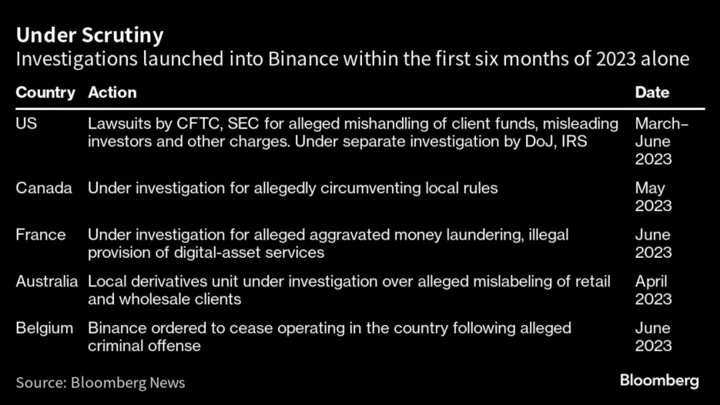

Binance faces a web of regulatory probes. The US Securities & Exchange Commission last month accused the company and Zhao of mishandling customer funds, misleading investors and regulators, and breaking securities rules.

Binance has called the SEC action “disappointing” and said that it intends to defend its platform “vigorously.” Zhao and Binance also face a lawsuit from the Commodity Futures Trading Commission. The US Justice Department has been investigating the company, Bloomberg News reported earlier.

On Tuesday, the Australian Securities and Investments Commission conducted searches at several Binance Australia locations, people with knowledge of the matter said, asking not to be identified discussing private information. The action was part of an investigation into the Australian operation’s now-defunct local derivatives business, according to the people.

Binance has also faced regulatory blowback recently in France and Belgium. The trend of heightened scrutiny has prompted some banking partners to drop Binance, making it more challenging for customers to fund transactions and withdraw fiat money.

The exchange’s share of non-derivatives trading volume fell for a fourth month, dropping 1.4% to 42% in June — the lowest since August 2022, according to a report from researcher CCData. Binance stopped offering some popular trading pairs, contributing to the decline.

BNB, the native token of Binance, fell about 1% on Friday amid broader weakness in digital assets to trade at around $218. BNB has shed some 11% this year, compared with a gain of 45% in a gauge of the biggest 100 tokens. The success of BNB and Binance are often seen as intertwined.

--With assistance from Beth Williams.

(Updates with comment from Binance’s Zhao from the first paragraph.)