By Ankur Banerjee

SINGAPORE Asian shares climbed to fresh two-month highs on Tuesday, boosted by a rally on Wall Street while the dollar languished near its lowest in two-and-a-half months on expectations the U.S. Federal Reserve is likely done with interest rate hikes.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.91% higher at 509.82 having touched 510.42, the highest since Sept. 18. The index is up 7% for the month and on course for its biggest monthly gain since January.

Japan's Nikkei eased 0.15% after hitting highs not seen since 1990 on Monday. The index is up roughly 28% this year, making it the best performing stock market in Asia.

China's blue-chip CSI300 Index was 0.66% higher, while Hong Kong's Hang Seng Index gained 1.25% as easing U.S.-Sino tensions lifted sentiment.

On Monday, Wall Street's three major stock averages rose with Nasdaq's 1% rally leading the charge as heavyweight Microsoft hit a record high after it hired Sam Altman, who headed OpenAI until he was ousted late last week. [.N]

Investor focus on Tuesday will firmly be on earnings from Nvidia and also minutes of the Federal Reserve's last meeting to gauge which way rates are headed.

Stock markets have broadly rebounded in November as a flurry of data that showed U.S. inflation might be easing has spurred bets that the Fed is done with monetary tightening and rate cuts may be on the way next year.

Traders have nearly fully priced in the likelihood that the Fed will keep interest rates unchanged in December, and some have started pricing in rate cuts as soon as March, according to the CME Group's FedWatch tool.

Some remain cautious as economic data could change the monetary policy outlook.

"It only takes another strong inflation print or more consumer/labour market strength, and rates would head higher again," said Ben Bennett, APAC investment strategist for Legal and General Investment Management.

"My main concern is ... that we'll see some disappointing data around the turn of the year, which will focus attention on the risk of recession."

Trading is expected to be muted for much of the week ahead of Thursday's U.S. Thanksgiving holiday and a sparse data calendar for the week.

Rob Carnell, ING's regional head of research for Asia-Pacific, said the markets seem to have run out of internal momentum at the moment and may need an external stimulus to power the next move.

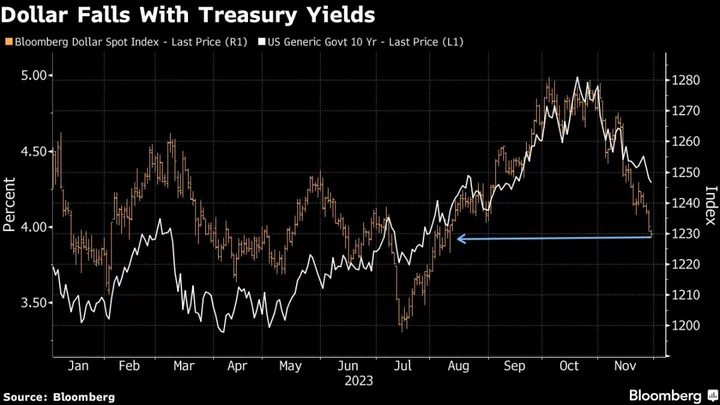

Treasury yields were lower in the wake of solid bidding in the $16-billion sale of 20-year Treasury bonds on Monday that suggested the market still anticipates inflation will decelerate and the Fed will cut rates next year. [US/]

The yield on 10-year Treasury notes was down 1.2 basis points at 4.410%, while the yield on the 30-year Treasury bond fell 2.1 basis points to 4.554%.

Lower yields kept the dollar on the back foot, with the dollar index, which measures the U.S. currency against a basket of six major currencies, down 0.058% at 103.37.

The Japanese yen strengthened 0.22% to 148.03 per dollar, having touched a seven-week low of 147.86. [FRX/]

The Australian dollar, often seen as a barometer of risk appetite, touched a three-month high of $0.65775 earlier in the session. The head of Australia's central bank said on Tuesday inflation will remain a crucial challenge over the next one to two years, in comments made two weeks after policymakers raised interest rates to a 12-year high earlier to tame high prices.

Oil prices eased, reversing the previous day's rally, as concerns over a slowing global economy outweighed the prospect of deepening supply cuts by OPEC and its allies such as Russia.

U.S. crude fell 0.05% to $77.79 per barrel and Brent was at $82.23, down 0.11% on the day. [O/R]

The oil market has dropped almost 20% since late September as crude output in the U.S., the world's top producer, held at record highs, while the market was concerned about demand growth, especially from China, the No. 1 importer of oil.

(Reporting by Ankur Banerjee; Editing by Jacqueline Wong)