Rakuten Group Inc. plans to issue new shares to raise ¥332.2 billion ($2.4 billion) to shore up capital depleted by its loss-churning mobile unit.

The Japanese online shopping mall said on Tuesday it will issue new shares to Cyberagent Inc., Tokyu Corp. and others, as well as conduct a public sale of new shares at an indicative discount range of 3% to 5%. The public offering price will be determined as early as May 24, it said.

Rakuten’s shares closed down 5.1% on concerns about equity dilution, with reports ahead of the announcement on the new share issue wiping out about $1.2 billion in the company’s market cap.

In contrast, the cost to insure Rakuten’s bonds against default is heading for the biggest two-day drop ever, while the company’s junk dollar notes rose by almost 2.5 cents since the share sale news, also a record. The e-commerce firm’s bonds surged by a record in the credit market.

Rakuten Bonds Jump by Record Even as Share Sale News Hurts Stock

The move indicates a sale of a minority stake in the mobile business is unlikely, according to Amir Anvarzadeh, strategist at Asymmetric Advisors. “Disappointing,” he said, adding however that if activist investors are the buyers of the new shares, they could then pressure Rakuten “to somehow get rid of the mobile assets.”

Rakuten Slides as Share Sale May Mean 30% Dilution: Street Wrap

Rakuten’s foray into Japan’s saturated mobile market has resulted in billions of dollars worth of losses, much of which it has offset by selling more debt at home and abroad. In addition to offering $450 million of dollar bonds at a yield close to 12% in January, it has also sold ¥250 billion of notes to local individual investors.

The Tokyo-based company reported its eleventh consecutive loss in the quarter just ended, dragged down by a ¥103 billion loss on its mobile arm. Its target to break even in the fourth quarter could be far-fetched, Bloomberg Intelligence’s Marvin Lo said.

Daiwa Securities Group Inc., Mizuho Securities Co., Morgan Stanley and Goldman Sachs will act as joint global coordinators of the public offering, it said.

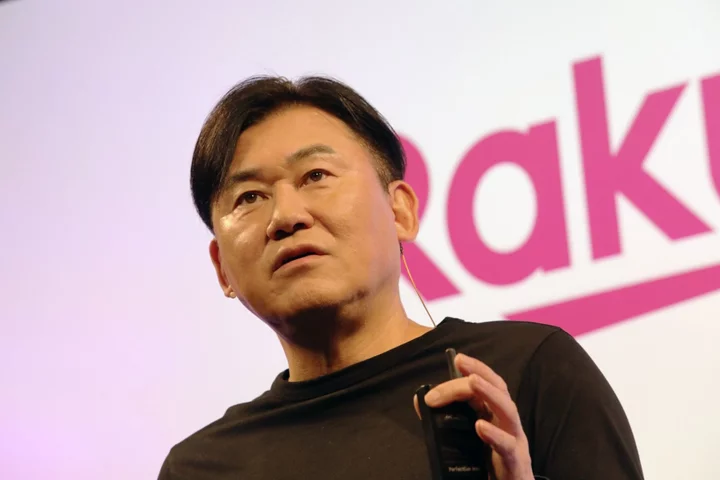

Helmed by billionaire founder Hiroshi Mikitani, Rakuten has begun cashing in on its other profitable operations, listing its banking unit on the Tokyo Stock Exchange in April. Mikitani’s also spoken of plans to list the firm’s securities arm and last week announced the sale of the conglomerate’s stake in retailer Seiyu Holdings Co.

Rakuten has cut capital spending on its carrier business, but further costs loom as it takes on far-bigger rivals NTT Docomo Inc., KDDI Corp. and SoftBank Corp. The mobile venture has yet to secure spectrum allocation best-suited for connectivity inside buildings and is facing the high cost of building out 4G base stations.

--With assistance from Finbarr Flynn, Kurt Schussler, Takahiko Hyuga and Ayai Tomisawa.

(Updates with company announcement, details on share sale, bond market reaction)