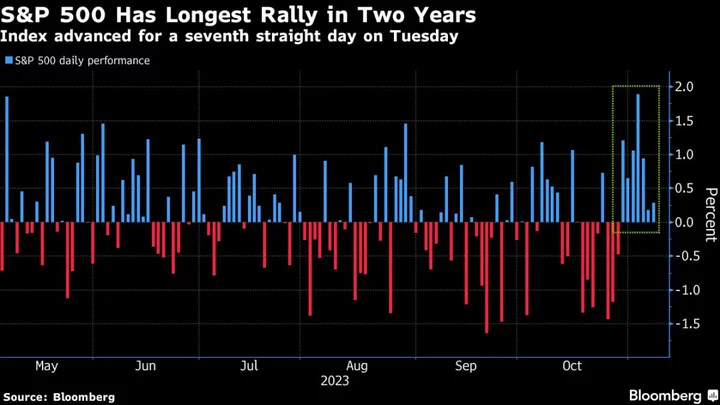

Stocks in Asia are set for a mixed open after a rally in big tech saw the S&P 500 notch up its longest streak of gains in two years, with investors shrugging off the latest attempts from Federal Reserve speakers to tone down Wall Street’s optimism.

Australia’s equity benchmark was little changed in early Asia trading, while futures for Japan advanced and those for Hong Kong were flat after the S&P 500 gained for a seventh day. Bets on a Fed pivot next year sent bond rates sharply down, with the 10-year yield dropping below 4.6%. Oil fell the most in more than three months following weak trade data from China.

Australia’s 10-year yield declined for a fifth session, a day after the central bank lifted its cash rate to a 12-year high, while signaling a higher hurdle to further policy tightening that pushed the local currency lower.

Global equities are poised for a double-digit rally in 2024 if the Fed pivots its monetary policy and allows the economy to avoid a recession, according to HSBC Holdings Plc strategists. The S&P 500 rose in price an average 13% in the nine months after the last rate hike in the past three decades, said Sam Stovall, chief investment strategist at CFRA and author of “The Seven Rules of Wall Street.”

“The recent move in stocks is consistent with our view that investor pessimism had been overdone,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management. “While we continue to see near-term headwinds for equities, we believe conditions are in place for positive total returns over the next six to 12 months.”

US equities advanced even after some central bank officials emphasized that bringing inflation fully down to the 2% goal is their main focus. Fed Bank of Minneapolis President Neel Kashkari said policymakers have yet to win the fight against inflation and they will consider more tightening if needed. His Chicago counterpart Austan Goolsbee said officials don’t want to “pre-commit” decisions on rates.

Several of the US central bank’s more hawkish policymakers signaled that the cumulative tightening of financial conditions since July — with yields on 10-year Treasury bonds up more than 100 basis points — could have a dampening effect on the economy, though they want more time to see if it will last.

Fed Governor Christopher Waller called the run-up in yields an “earthquake” for the bond market, while Governor Michelle Bowman said it was too soon for officials to know what the full effects of the recent rise will be.

“We’ll be especially attentive to policymakers’ thoughts around the recent shifts in financial conditions and what a nearly 50 basis-point drop in 10-year yields and a strong rebound in equity valuations could mean for the path of monetary policy,” said Ian Lyngen, head of US rates strategy at BMO Capital Markets.

The US dollar strengthened for a second day on Tuesday, making commodities priced in the greenback less attractive for international buyers. Oil slipped in early trade on Wednesday, after dropping the most in more than three months to settle near its lowest since July. Gold was little changed after dropping to a two-week low.

Key events this week:

- Eurozone retail sales, Wednesday

- Germany CPI, Wednesday

- BOE Governor Andrew Bailey speaks, Wednesday

- US wholesale inventories, Wednesday

- New York Fed President John Williams speaks, Wednesday

- Bank of Japan issues October summary of opinions, Thursday

- BOE chief economist Huw Pill speaks on the economy, Thursday

- US initial jobless claims, Thursday

- Fed Chair Jerome Powell participates in panel on monetary policy challenges at the IMF’s annual research conference in Washington, Thursday

- Atlanta Fed President Raphael Bostic and his Richmond counterpart Tom Barkin speak, Thursday

- UK industrial production, GDP, Friday

- ECB President Christine Lagarde participates in fireside chat, Friday

- US University of Michigan consumer sentiment, Friday

- Dallas Fed President Lorie Logan and her Atlanta counterpart Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:18 a.m. Tokyo time. The S&P 500 rose 0.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.9%

- Hang Seng futures were little changed

- Australia’s S&P/ASX 200 was little changed

- Nikkei 225 futures rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was little changed at $1.0696

- The Japanese yen was unchanged at 150.37 per dollar

- The offshore yuan was little changed at 7.2790 per dollar

Cryptocurrencies

- Bitcoin fell 0.3% to $35,400.96

- Ether fell 0.6% to $1,882.39

Bonds

- The yield on 10-year Treasuries declined eight basis points to 4.57%

- Australia’s 10-year yield declined 10 basis points to 4.60%

Commodities

- West Texas Intermediate crude fell 0.3% to $77.12 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.