My goodness it’s warm around here. Temperatures are soaring, both physically and politically. Sadly, the only thing that doesn’t seem to be running hot is the economy, especially in China. Here’s what the thermometer reads in Asia this week.

The big divide. It’s that time when the world wonders (again) if the US government would really trash its own economy (and maybe everyone else’s) because of partisan politics. The answer is no, (I hope). As we wait for President Biden to return from Japan, what sort of deal might emerge to keep the government funded?

The big data. Chinese banks will probably keep their loan prime rates unchanged at the May 22 fixing, after the People's Bank of China held its one-year rate steady on May 15. Still, the PBOC may not stay on hold for long. The economy’s slowing recovery shows it needs more policy support and the PBOC may deliver a 10 basis-point cut as early as June. On Wednesday, odds are that New Zealand will hike rates by a quarter point, while Indonesia will hold the next day.

The big burn. The heatwave scorching Asia has produced one clear beneficiary — Russia. As countries across the region scramble to make sure they have enough coal, gas and oil to keep fans and air-conditioners going, Russian supplies shunned by the West look increasingly attractive.

The big meeting. When is the G-7 not the G-7? Well basically always, since the EU tagged along. But this time, the summit in Japan has been eclipsed by invitees who aren’t part of the formal group. While the G-7’s communique was largely what was expected, here are some of the supporting cast...

The big mission. Ukrainian President Volodymyr Zelenskiy flew some 9,000 km to Hiroshima on Saturday to meet leaders from countries such as Brazil and India who have taken a more neutral stance over Russia’s invasion. He met with India’s Narendra Modi on Saturday for the first time since Russia’s invasion. But Brazil’s Lula didn’t seem so keen.

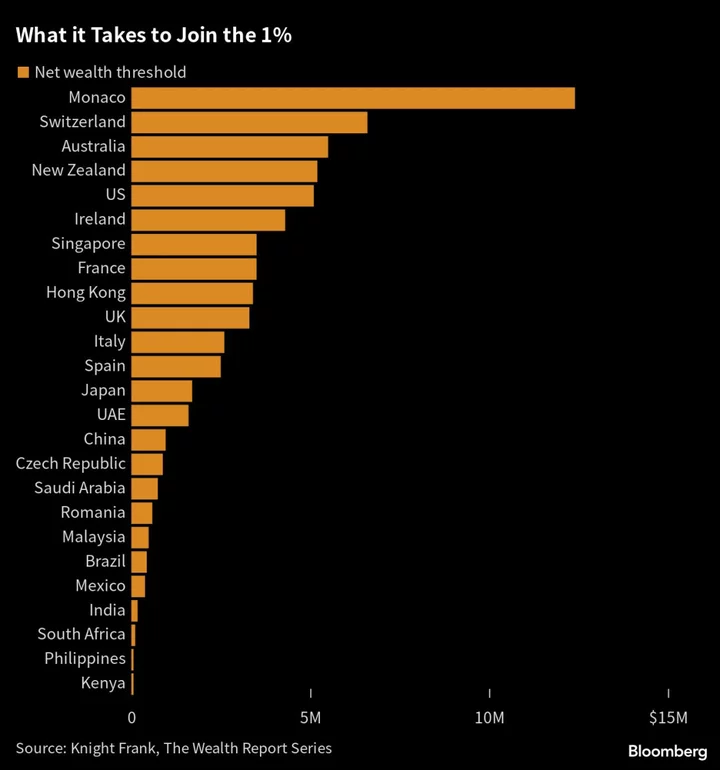

The big snapshot. China misses a beat, Japan grows faster than expected, the US pushes back its recession. Plus your target to join the 1%. Here’s the global economy right now in 13 charts.

The big results. The tail end of earnings season brings a smattering of reports from some China tech companies, including NetEase, Xiaomi, Lenovo and Meituan that may signal a return to favor after a bruising two years of regulatory crackdowns, Covid-induced disruptions and geopolitical interference.

And finally, the storm clouds of a looming recession seem to be finally casting a cloud on the art auctions, allowing a canny collector to scoop up a cut-price Koons for a couple of million.

Have a chill week.