Data from China on Thursday showing falling exports fanned more fears about a slowdown in the world's second-biggest economy, which has struggled with its post-Covid recovery.

Governments and markets alike are concerned about these indicators -- the size of China's economy and its connections with the rest of the world mean any ups and downs are felt far and wide.

Here is a rundown of the problems facing China's economy, and why analysts believe Beijing is not doing enough to fix them:

Why is demand slowing?

The abandonment of tight pandemic restrictions in December set off a gradual resumption of consumer activity in China as people started dining out, shopping and using public transport more frequently.

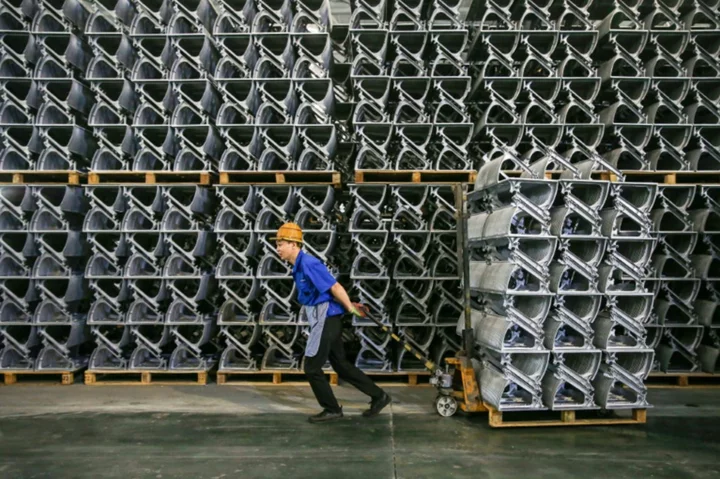

But the highly anticipated economic rebound was weaker than expected and did not reach all sectors -- industrial production, for example, is still struggling.

And a post-Covid rally has since completely run out of steam.

As many other major economies grapple with inflation, consumer prices in China fell by 0.3 percent year-on-year in July to enter deflation –- a sign of sluggish demand.

Youth unemployment rose so high in June that authorities suspended the publication of that data, while traditional growth engines such as exports, real estate and consumption remain stalled.

Analysts say these trends are increasingly pushing China's annual growth objective of around five percent out of reach.

Why the downturn?

Property development and linked industries have been a key pillar of the Chinese economy in recent years, providing a sizeable chunk of its GDP.

But the sector is in a deep crisis.

Many leading developers including Evergrande and Country Garden have come under increasing financial pressure lately, with their astronomical levels of debt bringing bankruptcy concerns to the fore.

Any implosion of these firms could have dire consequences for China's financial system, resulting in vast amounts of unfinished housing, mass layoffs, and tens of thousands of people unable to recover their funds.

And the property turmoil is fuelling doubt among potential buyers, adding further pressure to developers' budgets.

The economy is also feeling the effects of sluggish global demand, which has dragged on Chinese exports, as well as flagging domestic household spending.

What is the government doing?

Anxious to shore up finances, China has opted for prudent and targeted measures instead of a broader but costly recovery plan advocated by many economists.

Authorities unveiled steps in July aimed at stimulating the purchase of home appliances and electric vehicles.

This was followed by tax benefits for households and businesses in a bid to support consumption.

And to further boost activity, China's central bank has recently cut two reference rates, hoping to encourage commercial banks to grant more credit and on more attractive terms.

But the most important announcements -- directed at the country's flailing real estate industry -- were made last week.

Intended to reinvigorate the sector, several major cities including Beijing, Shanghai and Guangzhou relaxed the criteria to qualify for a mortgage loan.

And first-time buyers have also obtained more preferential loan rates.

Is it enough?

Many economists doubt it.

"The economy simply cannot recover until the property market improves," warns research firm Gavekal Dragonomics.

Households "are presently reluctant to borrow and purchase real estate even though mortgage rates have fallen to a 14-year low," notes analyst Arthur Budaghyan, who follows the Chinese economy for BCA Research.

A reduction in rates will not fundamentally change the situation, says Budaghyan, "because households now expect house prices to drop materially".

In recent decades, Chinese consumers have viewed purchasing property as the best way to increase one's savings.

But widespread economic uncertainty remains the main obstacle to the recovery of consumption.

Households now favour "savings rather than spending or investment", notes analyst Maggie Wei of Goldman Sachs.

Major stimulus needed?

Many economists contend that a major stimulus plan is needed to kick China's economy back into shape.

On the heels of the global financial crisis in the late 2000s, China invested four trillion yuan ($548 billion today) to help boost activity.

This expansive recovery plan enabled considerable development in the country's infrastructure, driving a building boom of roads, airports and high-speed rail.

But it also resulted in many underused projects and increased debt.

Beijing now appears wary of that strategy, as local government coffers have been drained by the pandemic.

And China's President Xi Jinping -- who has expressed opposition to Western-style "welfarism" -- is reluctant to return to a time of high spending when belts are tightening.

sbr-pfc/oho/je/qan