The crumbling of Austrian tycoon Rene Benko’s property empire has investors on edge.

Swiss lender Julius Baer Group Ltd. slumped the most in more than three years on Monday when it disclosed a spike in credit provisions that people familiar with the matter say was related to Benko’s Signa group of companies. Bondholders have hired advisers for discussions with the company, and some shareholders have exercised options to sell their stakes.

Benko’s sprawling property group is at the epicenter of Europe’s commercial real estate turmoil as the sector grapples with rapid increase in interest rates and lower demand for office space in the post-pandemic era. Signa revealed earlier this month that its cash reserves were drying up and appointed a restructuring adviser.

“The hunt is on for banks that have exposure” to Signa, CreditSights analysts led by Simon Adamson said in a note on Wednesday in London. “We expect a number of predominantly Austrian, Swiss and German banks to be involved.”

Signa is seeking about €500 million ($545 million) in fresh funding to meet financial obligations this year alone. For potential investors, risk from an industry in turmoil is compounded by a dearth of public disclosures.

Bloomberg has identified more than a dozen banks and insurers with exposure to Signa, based on public disclosures, people familiar with the matter and media reports. They face varying degrees of risk based on the level of collateral and their counterparty within the group of companies.

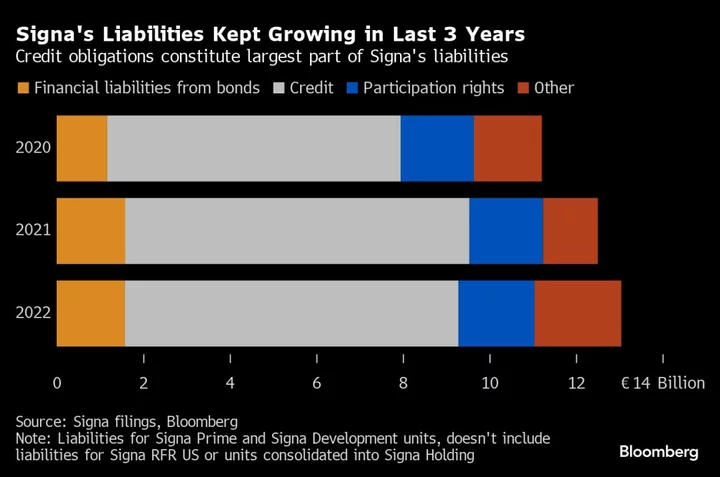

The exposure is spread out over a mix of funding types, including loans, bonds, profit participation rights and other instruments. Loans are typically backed by property assets, while the participation rights offer payouts if Signa’s profits meet certain criteria.

The list is not exhaustive and the firms generally declined to comment, citing client confidentiality policies.

- Austria’s Raiffeisen cooperative lenders have exposure via regional institutions as well as through Raiffeisen Bank International, which serves larger corporate clients, according to people familiar with the matter. RBI’s largest client exposure amounts to €755 million, according to Chief Risk Officer Hannes Moesenbacher.

- Julius Baer, Switzerland’s second-largest wealth manager, has about €600 million in outstanding loans Benko’s companies, Bloomberg reported on Tuesday. The exposure was the main reason why Baer set aside 70 million francs ($79 million) for souring debt in the first weeks of November.

- Germany’s publicly-owned Landesbanks have emerged as key creditors in that country. Helaba has an exposure in the middle of the three-digit million-euro range, while NordLB’s is at the low end, people familiar with the matter have said. BayernLB is also on the hook for an amount in the three-digit millions, according to Frankfurter Allgemeine Zeitung.

- LBBW, another Landesbank, is the agent of a syndicated loan from several banks to Signa Sports United GmbH, a spokesman said, declining to comment on any possible outstanding amounts on its books.

- DZ Bank, Germany’s largest cooperative lender, has an amount in the high double-digit millions of euros at stake, according to people familiar.

- UniCredit SpA extended loans for individual projects of the tycoon’s empire, according to a person familiar with the matter. Italy’s No. 2 lender owns Bank Austria in the alpine country and Hypovereinsbank in Germany.

- Insurers are exposed as well. In Germany, Signal Iduna is invested in several Signa projects with loans for buildings in “top locations,” according to a spokesman, who said the debt is “sufficiently secured.”

- Competitors R+V Versicherung and LVM are both shareholders in Signa Prime

- In Austria, Uniqa has said it owns €80 million of Signa bonds, while Vienna Insurance Group has confirmed a €50 million exposure

--With assistance from Libby Cherry.

Author: Nicholas Comfort, Stephan Kahl and Marton Eder