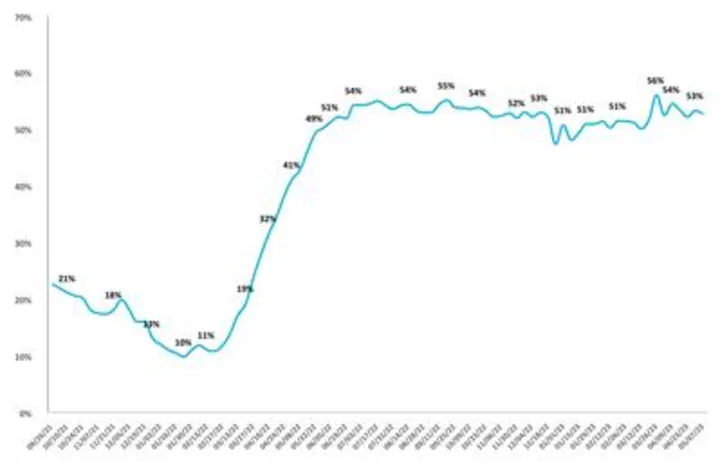

In a pivotal meeting that could shift the direction of the US economy, the Federal Reserve is expected to announce Wednesday that it will hold interest rates steady after increasing them 10 straight times to bring down historically high inflation.

However, that doesn't mean the Fed is done hiking altogether: Officials have characterized their expected move as a "skip" rather than a "pause." That could give the economy a little more time for the central bank's aggressive rate-hiking campaign to filter through — and allow Fed officials to determine whether higher rates are bringing down inflation as expected or if they need to keep their foot on the gas.

Research shows that it takes at least a year for rising interest rates to broadly affect the real economy, typically by slowing down employment and consumers' purchases. The Fed began lifting rates in March 2022.

Inflation as measured by the Consumer Price Index slowed last month to its slowest annual pace since March 2021, the Bureau of Labor Statistics reported on Tuesday. Prices are still rising twice as fast as the Fed would like, but hiking rates too much, too quickly, could tip the economy into a recession. So this week's good news on inflation, released as Fed officials started their two-day policy meeting, likely underscores the consensus that it's time for the central bank to pull back.

The rationale for suspending rate increases

Inflation isn't the only gauge suggesting officials may have already pulled the economy's reins enough to justify a skip.

Interest-rate sensitive parts of the economy, such as housing and finance, have slowed somewhat, and the broader economy is likely to catch up sometime soon, economists say.

Credit conditions are tighter after the collapses of three regional banks. Economists say keeping the benchmark federal funds rate at a range of 5-5.25% might be a prudent policy move for a banking sector that is still under pressure.

Regional bank stresses at the moment "aren't getting worse but they're probably not getting a lot better either," noted Michael Gapen, managing director and head of US economics at BofA Global Research.

The Fed's emergency lending has come down only slightly in recent weeks, and regional banks continue to grapple with low profitability, higher cost of capital, commercial real estate issues, forthcoming regulation, and maturity issues on Treasuries.

Banks are expected to continue to toughen their lending standards as the economy slows further and US consumers chip away at their savings, rack up debt, and eventually tap out after a striking recovery from the pandemic's economic toll.

Watch for signs of a hike in July

The Fed may be taking a breather this month, but Fed Chair Jerome Powell will likely clarify in his news conference at 2:30 p.m. ET on Wednesday that a rate hike in July is still in play.

While inflation has cooled from 9.1% last June to 4% last month, it's still punishingly high for US consumers.

"Employment growth is still strong, inflation is pretty sticky, so there is a case for more hikes," said Michael Feroli, chief US economist at JPMorgan Chase.

That decision, of course, largely depends on what economic data shows in the coming weeks. If job gains and wage growth soften, and inflation continues to slow, then the Fed might just hold rates steady again, Feroli said. And the inverse would likely elicit a hike.

Some Fed officials have said they still believe more rate hikes are necessary to successfully bring down inflation to the central bank's 2% target, including the Fed's most hawkish voice, Federal Reserve Bank of St. Louis President James Bullard (who is not a voting member this year). Even Federal Reserve Bank of Dallas President Lorie Logan, who's more toward the center, said in a speech last month that she's not yet convinced inflation is on a certain path to the 2% target.

The Fed is also set to release its latest Summary of Economic Projections on Wednesday, a set of forecasts from Fed officials for various economic indicators. The quarterly update will reflect the likely path of interest rates. The latest set of projections showed that most officials expected the benchmark lending rate to reach a range of 5.13-5.37% in 2023 — indicating rates could hold steady for the rest of this year. If predictions show the benchmark lending rate going higher this year, that could indicate an additional rate hike is coming soon.

The impact of the labor market and services inflation

The labor market's trajectory remains in focus for officials because of its stubborn impact on inflation. Ben Bernanke, a former Fed chair who steered the central bank during the Great Recession, argued in a recent paper that the tight labor market has had a minor but growing impact on inflation that could only be remedied by an economic slowdown.

The current job market has contributed to stubbornly high inflation: The US economy is services-based and employers in that sector continue to struggle to hire. That means businesses need to pay workers more to hold on to the staff they have — and to attract new talent. That boosts wage growth, according to Gapen.

"The Fed really has to wait until the labor market cools before it can even consider rate cuts," said Ira Jersey, chief rates strategist at Bloomberg Intelligence.