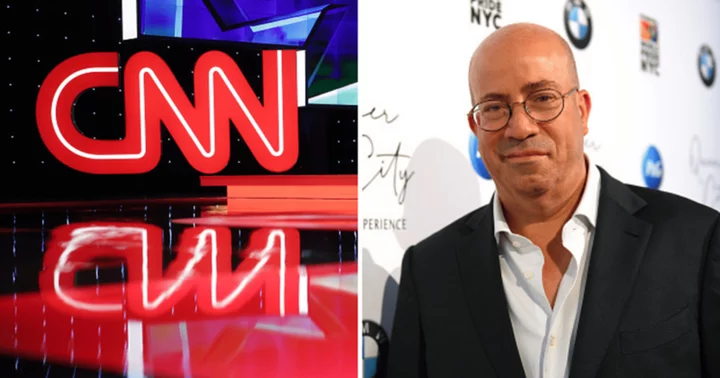

NEW YORK CITY, NEW YORK: One industry expert has cautioned that a rumored sale of CNN to its former CEO, Jeff Zucker might result in foreign control over the struggling network as a significant amount of funds could come from the United Arab Emirates. The assertion was made after growing speculations that Warner Bros Discovery might sell CNN in the upcoming year, with Zucker emerging as a potential buyer.

After 15 years of employment, the 58-year-old Zucker was ousted from CNN more than a year ago over his alleged secret romance with former CNN shill Allison Gollust. He is now reportedly prepared to take the lead once more by investing billions in the floundering news network after the unexpected dismissal of his replacement, former ‘Late Show’ chief Chris Light. But Ivan Schlager of Kirkland & Ellis believes that such a deal couple could be proved detrimental as a large portion of Zucker's funds may really be covert investments from the Middle Eastern nation, according to Daily Mail.

Also Read: How did Meg Johnson die? 'Emmerdale' co-stars lead tributes as actress dies aged 86

What is Jeff Zucker's net worth?

Because of his high-profile career, the father of four apparently has a net worth of an estimated $60 million, according to The Sun. The outlet listed his annual salary at $6.3 million and reported that he received a nearly $40 million payout from Comcast after leaving his position as president at NBC. Following reports that Zucker is interested in taking over CNN, Schlager expressed concerns to the news site Semafor, pointing out that more and more of these high-profile purchases have involved money from either the Saudis or the Qataris, sometimes with little or no attention.

Furthermore, Schlager pointed out that the UAE government already funds Al Jazeera, a full-fledged worldwide news network, which may be a portent of things to come if CNN sells to Zucker for a sizable sum of money. He lamented the possibility of "another Al Jazeera" while telling Semafor that there was still hope if Congress rejected the agreement due to worries about foreign funding. The expert mentioned how similar political issues prevented a sale of Forbes to the Indian investment group Sun Group from going through for months. A foreign-backed offer for CNN in this instance, according to Schlager, might result in "the mother of all Committee on Foreign Investment [CFIUS] reviews," putting the potential sale in a similar conceptual limbo as Forbes.

Also Read: Who was Duane Tabinski? NASCAR contractor electrocuted to death while setting up Chicago street race

Is Congress going to review the deal?

The media expert stated that he expects Congress to review the transaction appropriately if the UAE's overall investment represents more than 25 per cent of the total. A legal review, he added, would also be likely, if the foreign parent - in this case, Zucker's private equity firm RedBird IMI - is not truly passive. He even cited the media mogul’s most recent partnership with International Media Investments as an example of ostensibly silent partners surreptitiously controlling events behind closed doors. Schlager did not offer any evidence to support that assertion, but it comes around a year and a half after Zucker formalized plans for a partnership with the Abu Dhabi-based International Media Investments and his private equity firm RedBird Capital Partners.

More from MEAWW

Who is Bishop James Dixon? Houston church congregation burns 'demonic statue' found on premises