The finance and central bank chiefs of the world’s largest economies will debate the risks of Russia’s prolonged war in Ukraine and yet another shift to resuming interest rate hikes in meetings next week in Gandhinagar, India.

The discussions among the Group of 20 nations come as the war drags on for nearly 17 months, slowing the global economy and keeping policymakers on edge over resurgent inflation and stuttering growth. G-20 chiefs are also examining regulations for cryptocurrencies and ways to access more climate financing.

There will be demands on the World Bank and the International Monetary Fund to shore up their balance sheets and address the impact of climate change and future pandemics. The G-20 meetings will build on discussions in Paris last month involving 40 world leaders who made commitments for easier access to cash for poorer countries facing debt stress.

Here are the major themes at play for the key meetings next Monday and Tuesday:

War Language

As the G-20 president this year, India struggled to get countries to agree to language around the war and is trying to achieve a chair summary at the end of next week’s meetings. That’s a tall order given India failed to secure a statement in the last finance ministers’ meeting in April.

READ: Geopolitical Wrangling Seen Shadowing India’s G-20 Finance Meet

China and Russia had objected to language describing the conflict even as Western leaders condemned Moscow and pledged further support for Ukraine. It’s expected it will remain tough for India to negotiate language that is palatable to all the G-20 members ahead of the leaders’ summit in September.

“On all items in core agenda, common ground was found, except for the impact of war between Russia and Ukraine on the world economy,” India’s Economic Affairs Secretary Ajay Seth said on Thursday.

Interest Rate Conundrum

Global monetary policymakers are increasingly diverging on policy stances, particularly when it comes to inflation. While elevated price gains are keeping US and European central banks in tightening mode, the prospect of deflation is compelling China to consider further easing.

Central bankers will also discuss threats posed by the banking sector turmoil that shook investors worldwide earlier this year. The failure of two mid-sized US lenders and a near-collapse of European banking giant Credit Suisse Group raised fears of a contagion, complicating the growth trajectory for the world that’s also dealing with the after-effects of the war in Europe.

Multilateral Reforms

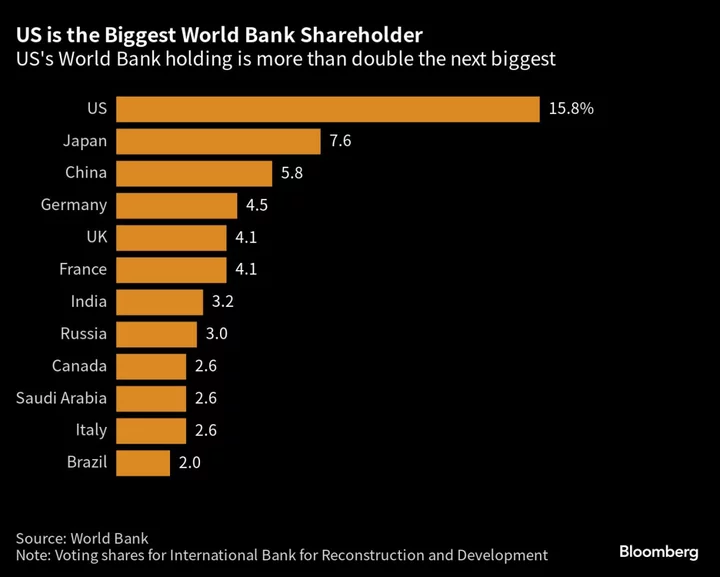

An overhaul of the World Bank and the IMF will be on the table with Treasury Secretary Janet Yellen leading the charge. She has urged the development lenders to work harder to mobilize private capital as global challenges mount.

READ: Yellen Sees Urgency in Boosting IMF Poverty-Fighting Arsenal

An expert panel headed by economists Lawrence Summers and NK Singh suggested both lenders ramp up annual loans to developing countries while tapping sovereign donors and the private sector for further funds, according to people familiar with the matter.

The panel has also advocated boosting market-linked financing to $300 billion annually by 2030, they said. In comparison, the volume of financing resources committed by multilateral organization stood at $162 billion in 2016, according to an Organisation for Economic Cooperation Development report.

A spokesperson for India’s finance ministry didn’t respond to requests for comment.

The G-20 countries are also exploring ways for the lenders to deliver loans with special provisions to protect developing nations from climate risk.

Debt Distress

The proportion of countries in debt distress, or at high risk of one, has doubled to 60% from 2015 levels, according to International Monetary Fund data. However, there are tentative signs of debt breakthroughs.

Countries like Zambia, which has been waiting for debt resolution for years, secured a deal with official creditors, including China under the G-20’s Common Framework.

The development could lead the way for other nations such as Ghana, Sri Lanka and Ethiopia, which are locked in negotiations with creditors and bondholders to restructure debt.

READ: Zambia’s Debt Deal Is Promising But Unfinished: Editorial

Crypto Regulations

Bankrupt FTX Trading Ltd. and other high-profile failures in crypto-asset markets over the past year have pushed regulators including the Financial Stability Board and the IMF to find ways to implement global standards.

“We must avoid a globally fragmented system of regulation that would allow crypto-asset activities to flow to the areas where regulation is less stringent,” said FSB Chair Klaas Knot in a letter to G-20 Finance Ministers ahead of the meeting. “This will require a further strengthening of cross-border cooperation and information sharing.”

Digital currencies issued by central banks are gaining more traction as global trade expands after the pandemic.

More than half of the world’s central banks are exploring or developing digital currencies, according to the IMF. India’s Central Bank Digital Currency has 1.3 million customers since its launch and is aiming for a million transactions a day by end-2023.

--With assistance from Erica Yokoyama, Michelle Jamrisko and Anup Roy.