The largest public offering since 2021 is here.

After a nearly two-year drought in the IPO market, UK-based chip designer Arm started trading in New York on Thursday with 95.5 million shares under the ticker 'ARM' (ARM) on the Nasdaq.

Trading opened at $56.10 a share, putting the company's potential market cap at close to $60 billion and marking the largest initial public offering this year — and the biggest since electric truck maker Rivian in 2021.

SoftBank, which acquired Arm for $32 billion in 2016, will hold on to about 90% of the company's shares.

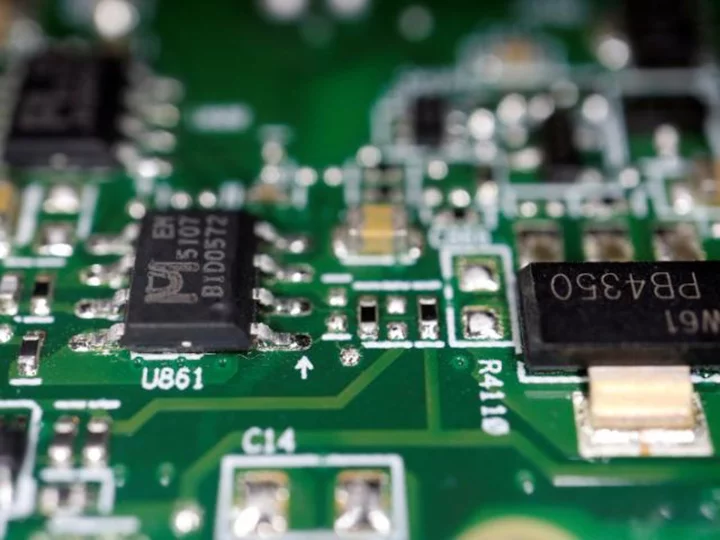

While many Americans likely haven't heard of Arm, most use the UK-based company's products daily. Apple (AAPL), Samsung, Nvidia (NVDA) and Google use Arm's designs and instructions to create their chips. The firm is essential in the production of smartphones, laptops, video games, televisions and GPS units.

Companies including Apple, Google, Nvidia, AMD, Samsung and TSMC have indicated interest in acting as cornerstone investors in the offering, according to a filing last week.

Opening the pipeline

Dealmaking has sunk to its lowest levels in over a decade as recessionary fears and high interest rates have shrunk valuations. Wall Street views Arm's listing as a weather balloon for a number of tech companies waiting to go public.

Goldman Sachs (GS) reported this summer that its investment banking revenue declined by 20% in the second quarter of 2023. Overall, profit in the quarter fell by 58% from a year ago, to $1.2 billion.

"Activity levels in many areas of investment banking hover near decade-long lows, and clients largely maintained a 'risk off' posture over the course of the quarter," said Goldman Sachs CEO David Solomon on a recent earnings call. That means clients are worried about making bets in an uncertain economic environment.

But experts say there are plenty of healthy companies waiting to make their public debut — they just don't want to be the first ones out.

A successful debut by Arm could be the big IPO that clears the pipeline for the rest.

"This is a big deal," said Dave Sekera, chief US market strategist at Morningstar Research Services. "The big takeaway here for investors, even in the public markets, is that if this IPO is successful, that opens up the floodgates for a wave of new IPOs. That would provide a positive market sentiment for the overall stock market."

Goldman Sachs is the lead underwriter in the IPO. Shares of the bank were up about 1% on Thursday morning.

This story is developing and will be updated.