VinFast Auto Ltd. soared on its first day in the public markets, boosting the fortune of its billionaire founder.

The electric automaker’s shares surged 255% Tuesday, adding $39 billion to the net worth of chairman Pham Nhat Vuong and pushing the company’s market capitalization above that of industry giants General Motors Co. and Mercedes-Benz Group AG. The fortune of Vietnam’s richest man now stands at $44.3 billion, according to the Bloomberg Billionaires Index.

The index hasn’t previously included Vuong’s stake in the carmaker, which he founded. He directly and indirectly controls 99% of the company’s outstanding shares, mostly through his conglomerate, Vingroup JSC. That large stake limits the shares available for other investors to trade, meaning the stock is prone to large swings.

VinFast scrapped its plans for a normal initial public offering and opted for a SPAC listing after investor appetite for money-losing startups waned over the past year. Instead, it agreed to merge with blank-check company Black Spade Acquisition Co., founded by casino mogul Lawrence Ho.

To be sure, other recent SPAC deals have experienced eye-popping rallies that ended a few trading sessions after their merger closed, as traders look to make a quick profit on companies with limited shares — meaning the jump in Vuong’s fortune may be short-lived.

The automaker was established by Vuong in 2017, and forecasts sales will reach 45,000 to 50,000 this year. It began building a factory in North Carolina last month. Vuong and his relatives have invested at least $300 million into the firm.

Vuong moved to Ukraine in the early 1990s after studying geo-economic engineering in Russia. He started a business making instant noodles which was sold to Nestle SA in 2010, nine years after he had returned to Vietnam.

By that time, he’d already established publicly-traded Vingroup JSC, focused on real estate, resorts, schools, shopping malls and more. The Hanoi-based firm booked revenue of $4.4 billion last year, and remains a major shareholder in VinFast.

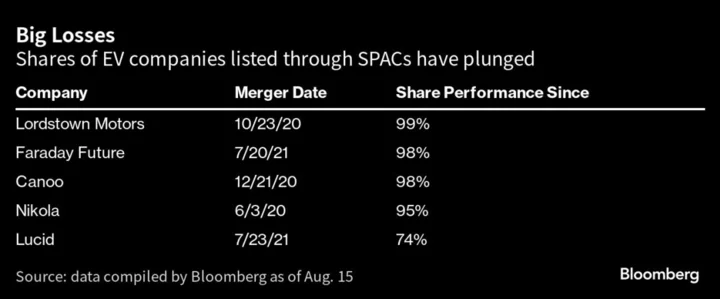

If VinFast can hold onto its gains, it will be in a somewhat unique position given the dismal performance of other electric automakers taken public via SPACs, including Lordstown Motors Corp., Nikola Corp. and Faraday Future Intelligent Electric Inc., all of which lost more than 90% of their market value since their mergers.

(Updates with closing share price in second graph, and adds additional context on SPAC moves in fourth paragraph.)