By Kevin Buckland

TOKYO Treasury yields and the dollar hovered above multi-week lows on Wednesday as markets grappled with the possibility of another U.S. interest rate hike while waiting on comments from Federal Reserve Chair Jerome Powell for a steer on the policy outlook.

Crude oil sank to a three-month low after data showed a steep build in U.S. stockpiles, while worries about the Chinese economy weighed on the outlook for demand.

Equities were mixed in Asia, with gains for tech stocks offset by slumping commodity shares. Wall Street futures pointed slightly lower following gains across the big three indexes overnight, led by a 0.9% rally for the tech-heavy Nasdaq.

Expectations have been building in recent days that U.S. policy rates have peaked and cuts could begin as early as May, following a softening in key monthly jobs data at the end of last week and a tempering in the Fed's hawkish stance. However, investors remain sensitive to the possibility of more hikes amid guarded remarks from Fed officials.

Fed Governor Christopher Waller said on Tuesday that the economy bears watching after "blowout" third-quarter GDP figures, while fellow governor Michelle Bowman said she still expects higher rates will be needed. Powell speaks on Wednesday and Thursday.

U.S. 10-year Treasury yields were little changed at 4.5789%, finding a floor after dipping as low as 4.484% on Friday for the first time since Sept. 26. They reached a 16-year high of 5.021% last month.

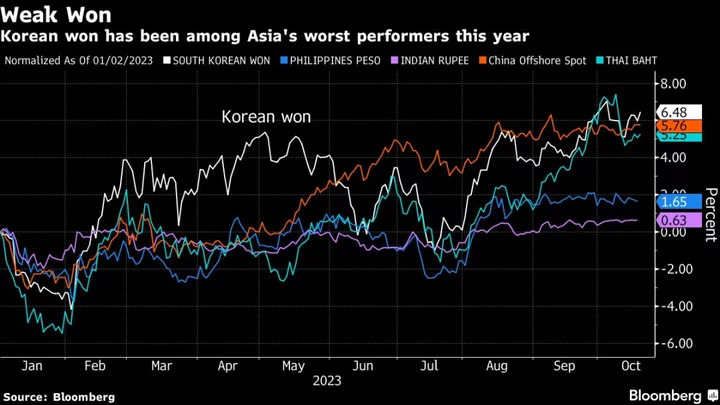

The dollar index, which measures the currency against six major peers, was largely flat at 105.55, above the more than six-week low of 104.84 reached on Monday, but well back from the high at the start of this month at 107.11.

"The markets are repositioning for a moderation in U.S. growth," pushing down long-term yields and the dollar, said Kyle Rodda, a senior markets analyst at Capital.com.

"The drop in oil prices is delivering a similar signal," he added. "The sell-off is coming on demand fears: There's a lot of fear about China's recovery in that, but also that after exceptional resilience, the U.S. economy is slowing."

Brent crude futures dropped 25 cents to $81.36 a barrel on Wednesday, while U.S. crude futures fell 35 cents to $77.02 a barrel. Both declined to the lowest since July 24 in early Asia trade.

Declines in commodity shares amid lower energy prices were offset by a climb in growth stocks, amid expectations for lower borrowing costs.

A case in point was Japan's tech-heavy Nikkei 225, which rose 0.13% while the broader Topix sank 0.66%.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.3%, aided by gains for Chinese markets after some bullish comments from the People's Bank of China governor.

Hong Kong's Hang Seng rose 0.22%, while an index of mainland blue chips added 0.1%.

(Reporting by Kevin Buckland; Editing by Shri Navaratnam)