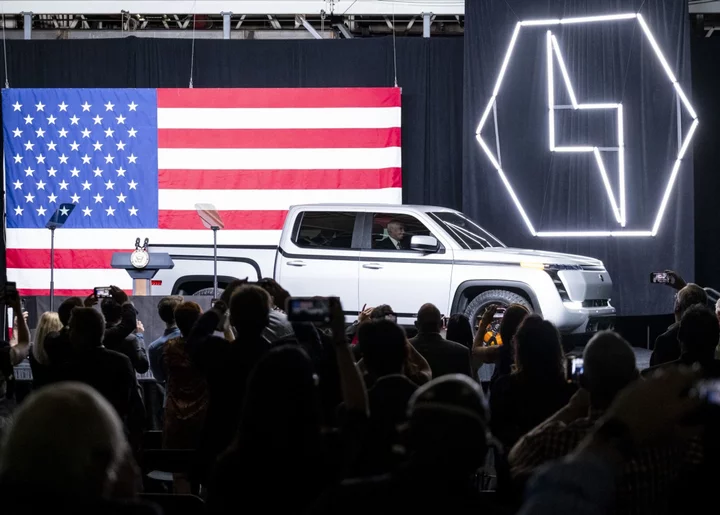

Lordstown Motors Corp. more than halved after the electric-vehicle maker, once hailed by former US President Donald Trump for saving automaking jobs, filed for bankruptcy.

The EV pickup manufacturer last month warned the company may fail if it can’t resolve a dispute with Foxconn Technology Group and its parent Hon Hai Technology Group, after the iPhone maker told the startup it’s prepared to pull out of a production partnership.

Lordstown shares declined as much as 57% in US premarket trading, after closing at $2.77 in New York Monday.

The company’s demise caps several torrid years for the maker of electric pickup trucks, part of a wave of startups whose sky-high valuations following reverse mergers fell victim to brutal corrections. In its filing, Lordstown listed as much as $500 million of both assets and liabilities with a plan for a sale including its Endurance truck.

In November, Foxconn agreed to invest as much as $170 million in Lordstown and take two board seats. The deal gave the EV maker much-needed capital while offering the Taiwanese manufacturer a firmer foothold in automotive production.

As part of the deal, Foxconn bought a former General Motors Co. factory in Lordstown, Ohio, from the company, and planned to make Lordstown’s debut vehicle under contract. But in January, Lordstown asked Foxconn to suspend production because the cost of making the Endurance exceeded the targeted sale price of $65,000 — and said it would need another partner beyond Foxconn to share costs.

The bankruptcy filing follows the company going through several crises, including fighting off short-seller claims and a Securities and Exchange Commission inquiry about inflated vehicle pre-orders, before signing the deal with Foxconn in a bid to raise much-needed cash.

A Foxconn representative couldn’t provide immediate comments when contacted by Bloomberg about the case.

--With assistance from Allison McNeely, Sean O'Kane, Janine Phakdeetham and Debby Wu.