Employers in the US probably tempered their pace of hiring this month after beefing up payrolls by the most since the start of the year, consistent with a sturdy labor market that’s powering economic expansion.

Government data on Friday are projected to show payrolls in the world’s largest economy increased by about 190,000 in October, still-solid job growth that follows sizable advances in the previous three months.

Hourly earnings are seen rising at the slowest annual pace in more than two years, partly a reflection of increased labor force participation. Moderating pay gains help explain why Federal Reserve policymakers are projected to again hold interest rates steady on Wednesday following their two-day meeting.

Read More: Fed to Weigh How Much Fuel Consumers Have Left After Rate Hikes

The resilient labor market has been instrumental in keeping consumers spending and the economy growing as inflationary pressures gradually wane. Steady hiring is also a reason economists are more sanguine about the outlook, with recession odds having eased since June.

Economists will also watch a report on third-quarter employment costs on Tuesday for signs of cooler wage growth. Labor costs are the biggest expense for employers, and any acceleration risks keeping inflation elevated. The government’s latest reading on productivity will also give an indication of how successful firms are in mitigating some of those increased costs.

The gradual loosening of tight labor conditions may be reflected in a separate report in the coming week. Job openings in September are seen declining from the prior month toward levels not seen since March 2021.

What Bloomberg Economics Says:

“Wage growth is a more accurate signal of labor-market conditions. Both the Fed’s preferred Employment Cost Index and average hourly earnings (part of the nonfarm-payrolls report) likely decelerated in recent months. That should give the Fed cover to keep rates on an extended pause. However, if those indicators signal that underlying labor-market conditions are deteriorating swiftly, it would open up new worries for policymakers.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full analysis, click here

A busy calendar for the week also includes October surveys of manufacturers and service providers.

In Canada, fresh jobs data for October will reveal whether the labor market continues to ease, while gross domestic product data for August is expected to show little growth as rate increases weigh on households and restrict spending.

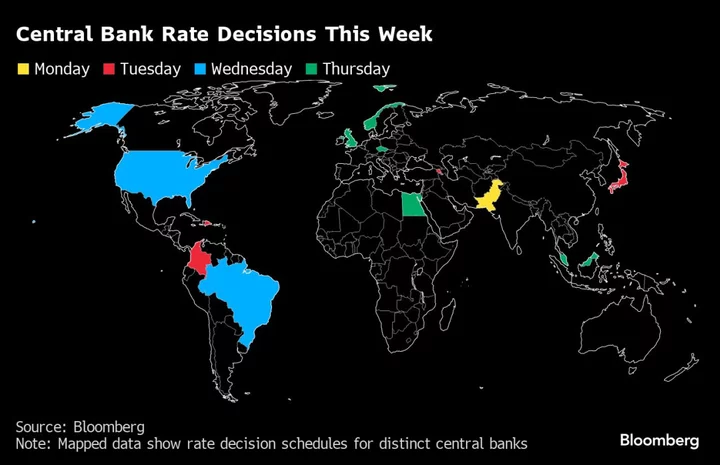

Elsewhere, a closely watched central-bank decision in Japan with a risk of a policy shift, no-change rate outcomes expected from in the UK and Norway, and possible rate cuts in Brazil and the Czech Republic will keep investors busy. In the euro zone, data may show stalling growth and slowing inflation.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Asia

A gathering of Group of Seven trade ministers in Osaka, Japan, this weekend criticized some nations for exploiting the commercial vulnerabilities of others to pursue policy objectives, without specifying any culprit.

EU Trade Commissioner Valdis Dombrovskis and Australia’s Trade Minister Don Farrell will meet following the G-7 talks for a critical round of free trade talks, with both sides warning that a failure to strike a deal now could delay any potential agreement by months or even years.

Meanwhile, China is hosting its first Xiangshan Forum since 2019.

A highlight for the week is the Bank of Japan’s policy meeting that wraps up on Tuesday. Most economists expect no change, but many flag the risk of a policy adjustment with the yen hovering around 150 to the dollar, long-term yields continuing to rise, and most recently, data showing Tokyo inflation unexpectedly quickened.

Japan will also report on its currency intervention data for the October period in the evening that day, together with a host of other data in the morning. Prime Minister Fumio Kishida is also set to unveil details of his latest economic package on Thursday.

Reserve Bank of India Deputy Governor T. Rabi Sankar will give a speech on Monday, with Governor Shaktikanta Das set to speak the following day.

Malaysia’s central bank gives its rate decision on Thursday, while PMI data will be released across the region during the week, including from China.

Elsewhere, Vietnam, Thailand, South Korea and Australia report trade data through the week, giving the latest snapshot on the state of global demand, while Indonesia and South Korea will also release inflation figures.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

While the Fed decision takes center stage, Europe will also await the outcomes of a trio of central bank meetings closer to home on Thursday.

- Most prominently, the Bank of England is expected to keep rates unchanged for a second successive meeting, while keeping the door open to further hikes if needed to tame inflation. Investors are likely to hone in on the vote breakdown within the nine-member Monetary Policy Committee, with perhaps a minority favoring another increase.

- In Norway, policymakers led by central bank Governor Ida Wolden Bache are expected to keep borrowing costs on hold for the first time since January, yet are likely to reiterate a plan for the final quarter-point key rate increase in December.

- The Czech central bank faces what’s looking like a close call given lingering inflation risks, with a majority of economists anticipating a quarter-point cut and the rest no change.

Turning to the euro region, key data on Tuesday may show the economy stalled or even shrank in the third quarter under the cumulative weight of rate hikes.

Only four of 29 economists surveyed by Bloomberg predict that the brief spurt of expansion seen during the three months through June continued into the autumn.

Contraction in Germany, whose own GDP report is due on Monday, is seen weighing on the region, while France and Italy the next day are expected to have eked out expansion.

Providing some comfort to the European Central Bank, inflation data the same day may show marked slowing. Headline price growth is expected to have weakened to 3.1%, far closer than before to the ECB’s 2% goal.

A changing of the guard in Rome and Frankfurt may draw some attentio as Bank of Italy Governor Ignazio Visco retires this week. He’ll be succeeded by ECB Executive Board member Fabio Panetta, who in turn will be replaced by Piero Cipollone, a senior official at the Italian central bank.

In Switzerland, nine-month earnings from the Swiss National Bank on Tuesday will be followed by a speech from its president, Thomas Jordan, two days later. Inflation data are also set to be published on Thursday.

South African Finance Minister Enoch Godongwana will deliver a budget on Wednesday, which investors will watch to see how government finances will be stabilized as revenue shortfalls and higher spending swell its deficit and debt.

The next day, a conference begins on US preferential trade access for Africa, with expectations that an agreement set to end in 2025 will be extended.

In Egypt on Thursday, investors will watch to see if the central bank raises rates to counter inflation that’s at a record high or holds for a second straight meeting. The decision has implications for the Egyptian pound, which is under pressure amid a dire shortage of foreign currency.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

In the region’s main event, Brazil’s central bank is locked in on delivering a third straight 50 basis-point rate cut that will take the Selic down to 12.25%.

Inflation expectations for 2023 are now back in the bank’s target range, though they remain above the actual goal throughout the survey horizon.

Three of Latin America’s big economies post September unemployment reports. The labor market is tight in Brazil, tightening in Colombia and showing increasing slack in Chile.

Mexico on Tuesday becomes the first of the region’s big economies to report third-quarter output. Analysts look for some deceleration in both the quarter-on-quarter and year-on-year readings from the 0.8% and 3.6% prints for the three months through June.

Brazil’s September manufacturing PMI suggests that industrial output data for the same month reported this week will fall into the red as well. Inflation in Peru likely slowed for a ninth month in September, coming in just below 5%.

In Colombia, the pace of disinflation is too slow, and inflation expectations are too elevated and sticky, likely persuading Banco de la República to keep the key rate at 13.25% for a fourth meeting.

Most analysts expect to see the bank soon begin a slow, multi-year unwind of its record 2021-2023 tightening cycle.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Laura Dhillon Kane, Robert Jameson, Piotr Skolimowski, Monique Vanek, Paul Wallace, Ott Ummelas and Yuko Takeo.

(Updates with Fed tout after third paragraph)