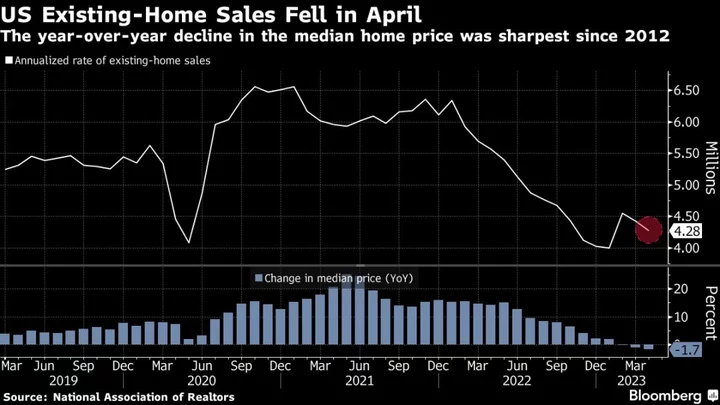

Sales of previously owned US homes fell in April, restrained by limited inventory and high mortgage rates, while the median selling price dropped by the most in 11 years.

Contract closings decreased 3.4% to a 4.28 million annualized pace, the slowest in three months, according to data released Thursday by the National Association of Realtors. The figure was in line with the median estimate in a Bloomberg survey of economists.

The median selling price fell 1.7% from a year earlier, to $388,800. The retreat was due to decreases in the West, the most expensive region, and the South.

“Home sales are bouncing back and forth but remain above recent cyclical lows,” Lawrence Yun, NAR’s chief economist, said in a statement. “The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand.”

While inventory picked up amid the spring selling season, elevated borrowing costs paired with limited listings are restraining sales. With mortgage rates about twice as high as they were at the end of 2021, many sellers are still reluctant to list their houses and some buyers are sidelined.

The number of homes for sale rose to 1.04 million, up 1% from a year ago. Still, inventory was nearly double that in April 2019. At the current sales pace, it would take 2.9 months to sell all the properties on the market. Realtors see anything below five months of supply as indicative of a tight market.

“Even in markets with lower prices, primarily the expensive West region, multiple-offer situations have returned in the spring buying season,” Yun said.

There are signs the housing market is beginning to stabilize. Homebuilder sentiment has been on the rise for the past five months as more buyers look to new construction in the low-inventory environment. Separate data this week showed single-family housing starts climbed to a four-month high in April.

Mortgage Rates

Still, elevated borrowing costs remain a key hurdle for many prospective buyers. Separate data out Wednesday showed mortgage rates rose to a two-month high last week.

And while some Federal Reserve officials have indicated they may pause their tightening campaign as soon as next month, how long rates will remain elevated is unclear.

Nearly three-fourths of homes sold were on the market for less than a month. Properties remained on the market for 22 days on average in April, down from 29 days in March.

Sales of single-family homes slid to an annualized 3.85 million pace. Existing condominium and co-op sales also edged lower.

Existing-home sales typically account for the vast majority of US housing and are calculated when a contract closes. Data on new-home sales, which make up the remainder, are based on contract signings, will be released next week.

--With assistance from Augusta Saraiva and Chris Middleton.